Bitcoin has outpaced Google’s parent company, Alphabet, to become the world’s fifth most valuable asset. As of Apr. 23, Bitcoin’s market cap hit an impressive $1.87 trillion, surpassing Alphabet’s $1.859 trillion valuation. Now, only gold, Apple, Microsoft, and Nvidia stand ahead of it in terms of market capitalization.

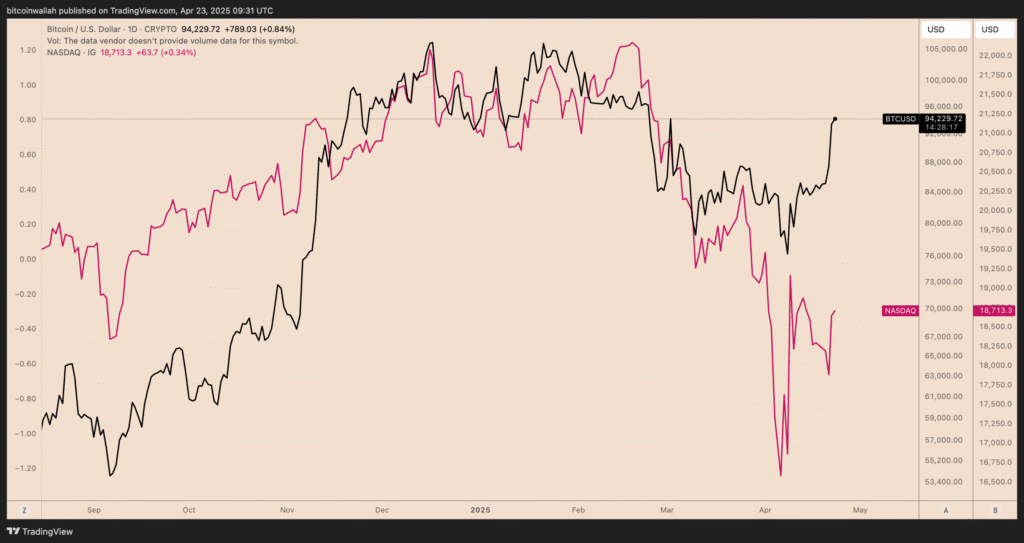

Bitcoin’s recent outperformance compared to Alphabet aligns with its ongoing shift away from its usual connection to US tech stocks, particularly noticeable in April when Bitcoin jumped 15%, even though the Nasdaq 100 only saw a 4.5% increase during the same time. This decoupling followed months of letdowns for crypto traders hoping for a stronger post-election rally.

Bitcoin surpasses two Teslas in value

Despite April’s gain, Bitcoin’s price is still 16% lower than its all-time high of $109,000 from January, when Trump was re-inaugurated as US president. Trump’s recent criticism of Federal Reserve Chair Jerome Powell and his executive order to make a Strategic Bitcoin Reserve (SBR), which is approaching its 60-day review, have sparked renewed investor interest in crypto. K33 head researcher Vetle Lunde said,

Chatter questioning Fed independence is having positive spillover effects on BTC.

Macro analyst Fejau highlighted that as capital flows out of US assets, Bitcoin could benefit. He explained that since countries can’t impose tariffs on BTC, it offers a way to diversify portfolios. Additionally, Fejau said that Bitcoin provides high volatility potential without the current risks tied to US tech stocks.

Alphabet is struggling with challenges like stricter regulations, antitrust issues, and a drop in digital ad revenue. On top of that, the rise of AI-driven competitors and lower growth projections have made people question whether Google can maintain its long-term dominance.

To put Bitcoin’s $1.87 trillion valuation into perspective, it’s now worth more than two Tesla firms. The EV giant famously added Bitcoin to its balance sheet back in early 2021 when it was priced around $33,500. It is now sitting on roughly 180% gains worth over $1 billion.