Bitcoin maintains its position above the critical $100k mark, buoyed by a steady influx of capital. Long-Term Holders (LTHs) are seizing this opportunity, pushing profit realization to a new high of $2.1 billion per day.

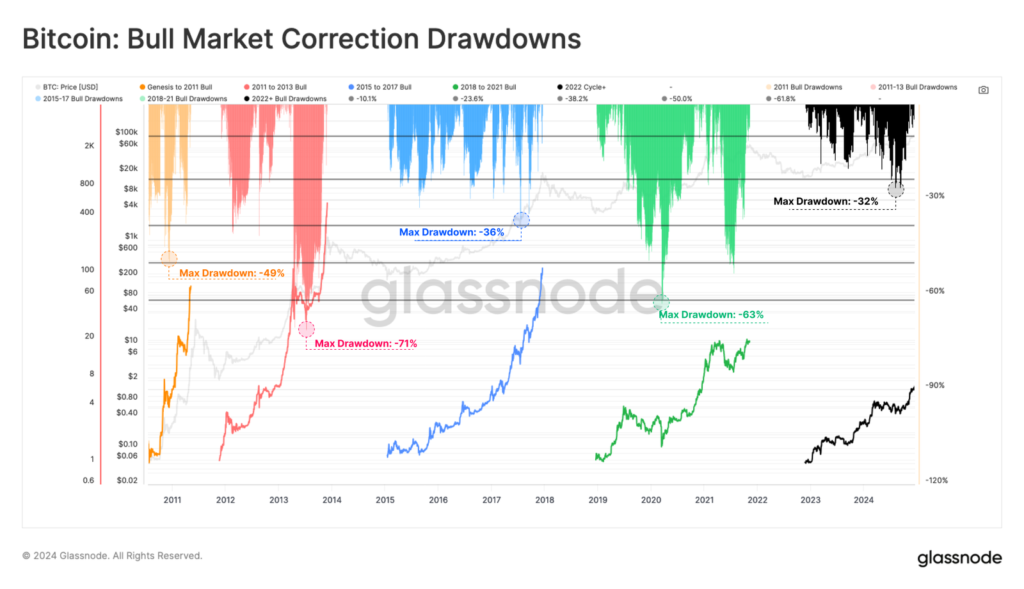

According to the latest report from Glassnode, as 2024 progresses, Bitcoin continues its exceptional run with over 150% year-to-date returns, a trend resembling the 2015-2018 and 2018-2021 cycles.

Bitcoin market shows less volatility

While this market has the largest market cap and thus requires increasingly large capital to move, it has actually been less volatile in the past few cycles. By far, the largest drawdown in this recovery cycle was -32% at the beginning of Aug. 2024, while most other drawdown periods stay below -25%, showcasing stability from increased institutional appetites and spot ETF issuers.

The moments of extremity, especially in Aug. 2023 and Sept. 2024, were particularly challenging to the strength of the market. During these periods, the Short-Term Holders, normally thought of as representative of fresh market demand, were holding coins at a loss.

However, the magnitude of these unrealized losses was not as huge as in previous downturns. This could mean that, though on paper, many STHs were losing, they were not facing deep losses typical of more fragile markets.

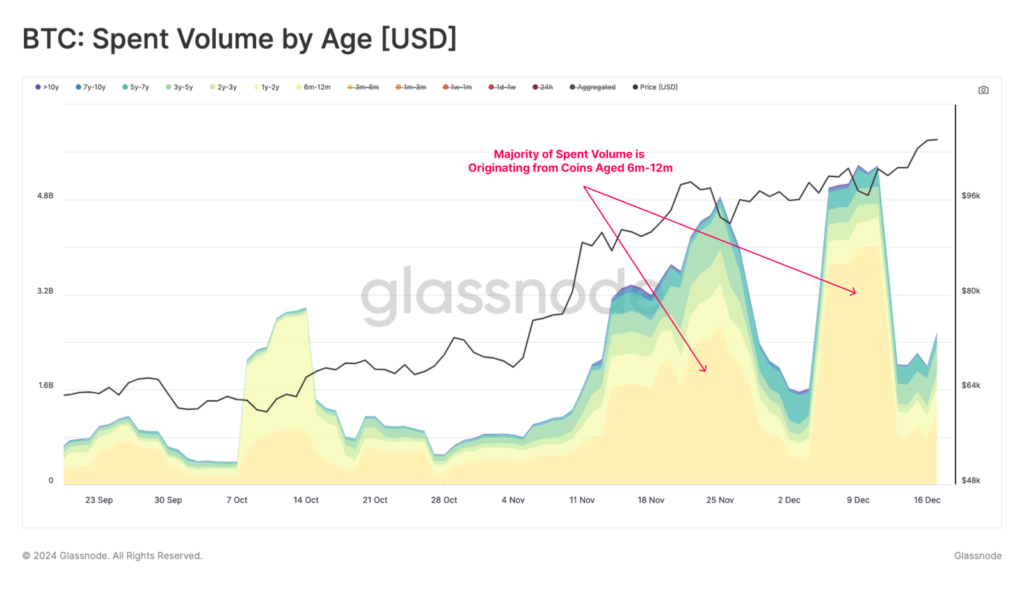

On the demand side, every time Bitcoin reaches new highs in price, LTHs actively distribute the coins. This sell-side pressure has been surpassed compared to previous cycles, with the market still absorbing these large volumes without a breakdown. The $2.1 billion in daily realized profits from LTHs signal strong demand and fresh capital entering the market.

Bitcoin’s new investor demand remains strong

But, in the case of the distribution of wealth between old and new investors, this is still well below euphoric levels reached at the tops of previous cycles. It’s far from a saturated market in speculators, so more growth might be in store.

The long-term sell-side pressure comes mainly from coins held for 6 to 12 months, many of which have been acquired this year. Older coins, including those held for more than three years, stay mainly unspotted.

Furthermore, the unrealized profit portion of the AVIV Ratio implies a strong market that has not yet reached overheating. With more profit left to be realized, Bitcoin could keep going upwards before its peak.

Related | Bloomberg analyst predicts Crypto ETF surge in 2025