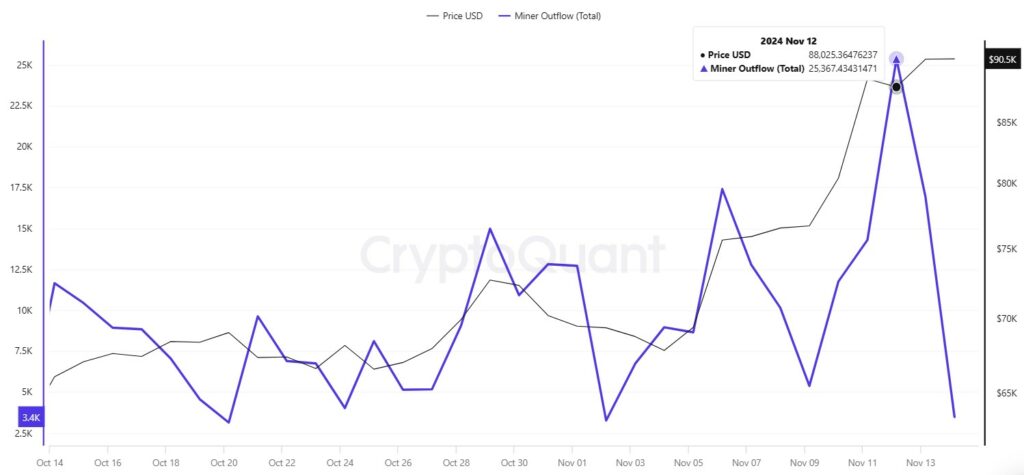

Bitcoin miners are transferring large amounts of their holdings out of wallets as the cryptocurrency’s price surges to new highs. According to data from CryptoQuant, about 25,367 Bitcoin left mining pool wallets on Nov. 12, when BTC hit $88,025. This outflow was valued at around $2.2 billion. Bitcoin miner outflows calculate the amount of BTC leaving mining pool wallets, covering transactions from all miners.

According to onchain analyst Avocado_onchain, miners usually cash out more when the market is strong. This strategy helps them prepare for the next Bitcoin halving, which will reduce their mining rewards by half. The analyst pointed out that Bitcoin miners often prepare for a potential price dip whenever BTC hits new highs, which could explain the recent increase in BTC outflows.

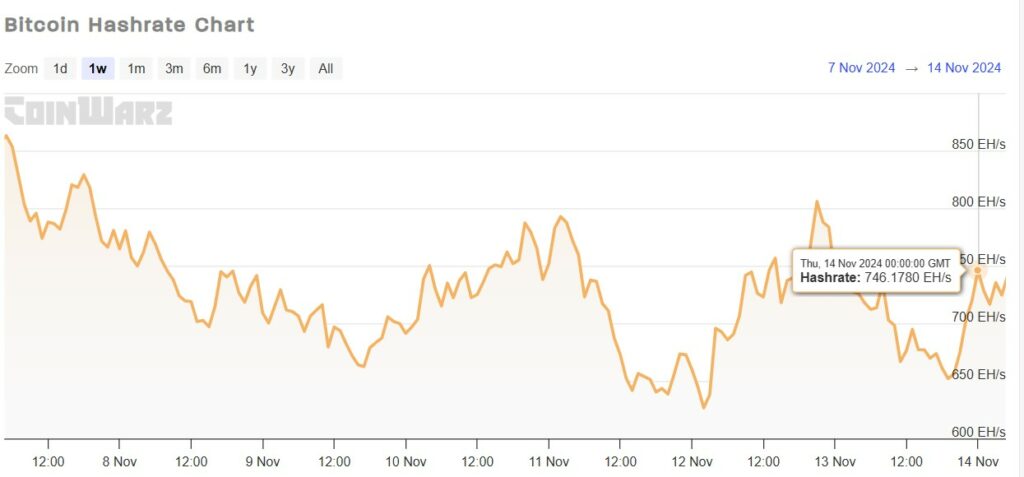

However, Avocado noted that while some early selling has started, the overall volume of BTC sold suggests there’s still “plenty of room for growth in this cycle.” Moreover, the analyst highlighted Bitcoin’s strong hashrate and rising mining difficulty as signs of growing miner participation, which could support further price increases for BTC.

Bitcoin eyes $100K amid miner transfers

CryptoQuant pointed out that a rise in Bitcoin miner outflows doesn’t automatically mean miners sell their BTC. Miners often move their assets to external addresses for different reasons. These transfers could mean sending funds to exchanges, possibly planning to sell, or simply making internal wallet moves.

Meanwhile, Bitget Research’s chief analyst Ryan Lee highlighted that November has historically delivered the strongest returns for BTC. Lee believes that if this trend holds, BTC could hit $100,000 before the month wraps up. Bitfinex analysts also said that Donald Trump’s recent win in the presidential race will likely boost crypto adoption in the United States, potentially pushing BTC past $100,000 in the coming months.