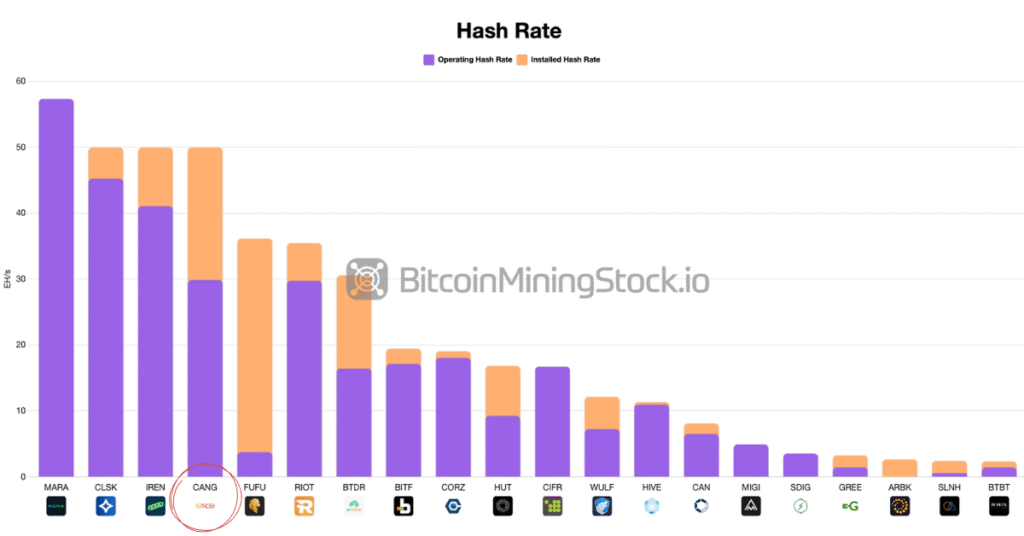

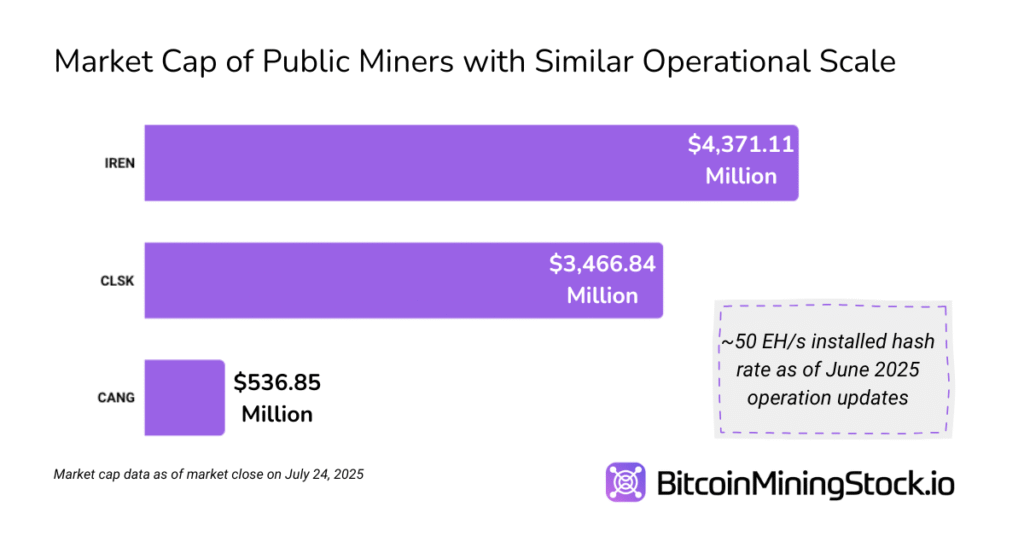

Cango has taken a sharp turn into the Bitcoin mining industry. The company now ranks as the fourth-largest publicly traded miner by hash rate. This move follows a major acquisition and a sudden leadership change. The shift has sparked speculation about whether Cango now acts as a proxy for Bitmain.

Bitmain is the biggest player in mining equipment. It supplies most of the equipment used across the industry. When one company is rapidly expanding into mining, one usually seeks Bitmain ties. In Cango’s case, there are several.

Bitcoin miner Cango brings in new leadership

Cango shifted the leadership group after the acquisition. Most new executives have working experience with Bitcoin mining and cryptocurrency finance. Two of them were formerly the chief executives at Antalpha, a company with publicly acknowledged associations with Bitmain. Such associations are not, however, evidence of ownership or control.

Antalpha is not connected with Bitmain, yet they both possess staff heritage as well as business direction. Enduring Wealth Capital Limited is the new majority faction of Cango. It holds the largest proportion of votes. There is limited information about this group as yet, and that continues to feed rumors about covert associations.

Nevertheless, existing records do not directly connect this investor to Bitmain. For the space, numerous businesses intersect. It is not unusual to find ex-Bitmain staff working with other mining companies. Bitmain’s influence is extensive because it created the majority of the mining equipment that is currently being utilized by other businesses.

Bitcoin mining ties don’t make Cango a proxy

That complicates the web of relationships but does not necessarily place it into jeopardy. Such cases as BitFuFu and Bitdeer outline the form of a true proxy. Both companies have direct investments, contracts, and shared leadership with Bitmain. These are clear and recordable relationships. There is not that kind of interlocking with Cango’s setup.

Cango’s pivot appears to be a common business model. Its massive hash rate and new leadership are characteristic of a heavy-mining model. Lines to previous Bitmain-related businesses may yield supply chain advantages but not necessarily guarantees of leadership. The mining industry is small and highly connected.

So long as Cango does things within acceptable industry norms, it’s difficult to call it a proxy. For the time being, it appears to be an aspiring miner with good connections, not a secret Bitmain arm. Nevertheless, it is best to monitor subsequent disclosures. If ownership or financial ties are altered, then the narrative will change.