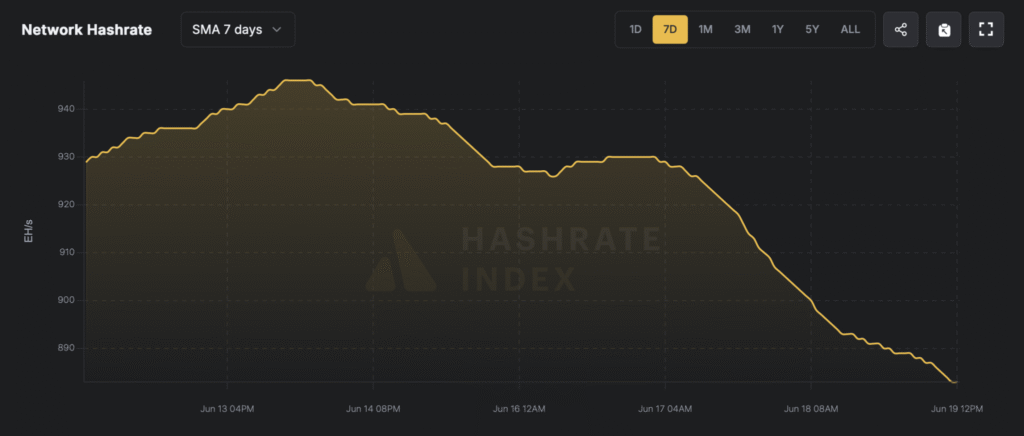

Miners are feeling the heat. Bitcoin’s price climbed slightly past $104,000 on Thursday afternoon. But behind that, the network’s power is slipping. The total hashrate dropped from a record 946 EH/s over the weekend to 880 EH/s by June 19. That’s a fall of 66 EH/s in just a few days.

This drop means nearly 66,000 petahash per second vanished. The decline follows a small shift in mining difficulty. Six days ago, the network adjusted difficulty at block 901152. That change only reduced the challenge by 0.45%. It was not enough to ease the load on miners.

Bitcoin network nears difficulty cut

With the hashrate lower, block times have slowed. Miners now take an average of 10 minutes and 31 seconds to find a block. If this pace holds, the network could reduce difficulty by around 5.05% on June 28. But the number may still change before then.

At the same time, mining profits continue to shrink. Bitcoin’s recent dip in value has cut into earnings. The hashprice, which shows how much money a miner earns per petahash, fell by 4.37% in the last month. On May 19, a single PH/s earned about $54.91. Now, it earns just $52.51.

These changes reflect a tough balance. Bitcoin’s system keeps block times steady with difficulty shifts. But as price swings and hashrate fluctuates, miners find themselves stuck in a cycle. Power up, earn less. Power down, miss rewards.

Mining margins shrink as hashrate drops

This environment tests even large operations. They must weigh cost, timing, and hardware limits. When prices go down and block intervals stretch, margins shrink. That’s the harsh math of crypto mining. The current trends point to a cooling period. Fewer miners are online.

Profits grow thinner. And if Bitcoin’s price doesn’t rise fast, more machines may shut down. The market shows just how tightly price, hashrate, and profit connect. One slips, and the others follow. This is not new for the mining world. But each cycle hits harder as the network matures.

More capital flows through, and more precision is needed. Miners now face a season of waiting, for relief from falling rewards or a rebound in Bitcoin’s price. Until then, the numbers tell the story. And the story spells pressure.