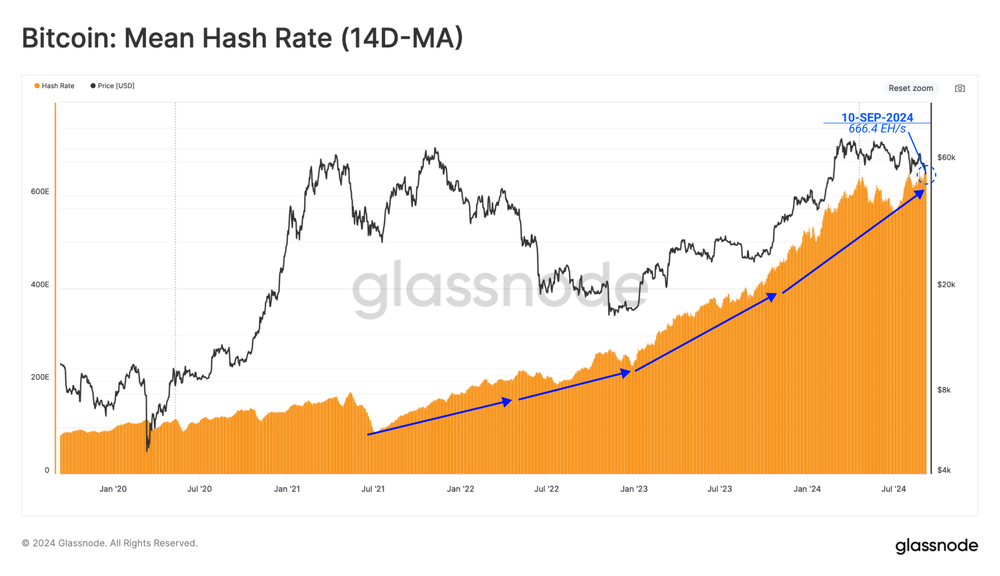

Bitcoin mining has hit record levels of competitiveness, with the network hash rate approaching all-time highs. However, investor activity on exchanges has declined significantly in recent weeks, according to new data from blockchain analytics firm Glassnode.

As per the report, the Bitcoin hash rate has recently reached 666.4 EH/s, almost its peak, as miners are still deploying new ASIC hardware, although the market is uncertain. This is a consequence of mining difficulty being just shy of a record, with the land currently needing about 338000 exahash on average to mine a block.

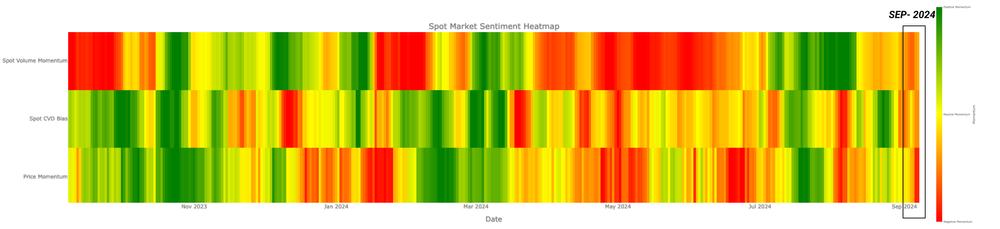

Miners generally tend to be optimistic about Bitcoin in the long run, but short-term investors are much more tentatively optimistic. On-chain settlement volume was nearing yearly averages, while Centralized exchanges had lesser inflows and outflows. Additionally, spot trade volumes have dropped for the last quarter.

Glassnode researchers said:

This underscores a decline in investor demand and less trading by speculators within the current price range.

The information illustrates a market gradually moving to a low-risk area compared to previous months. Reducing selling pressure and gently decreasing prices imply that the market is more likely to be impacted by unforeseen factors. This could initiate a breakout in either direction.

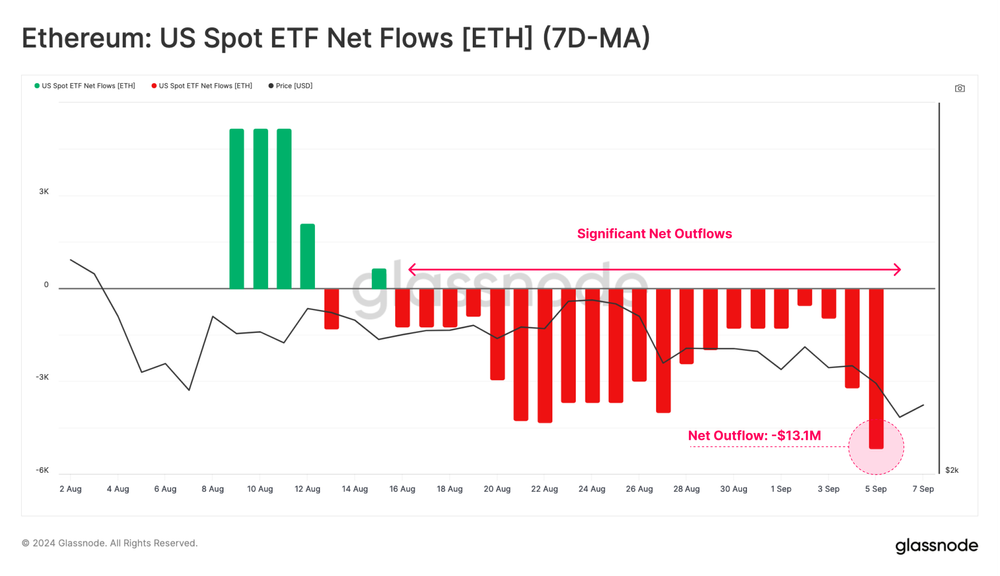

Ethereum ETFs struggling compared to Bitcoin

At the same time, Ethereum ETFs, which have been recently launched, have been in a slow manner. When compared to their Bitcoin counterparts, Bitcoin ETFs have encountered some outflows recently whereas Ethereum products have consistently net negative flows since the launch in August.

The relative effect of ETFs on market dynamics also varies greatly between the two dominant cryptocurrencies. Bitcoin ETF flows account for up to 8% of Bitcoin’s spot volume, whereas Ethereum ETF flows only account for 1%. However, the past weeks may have been fundamental in defining Bitcoin’s future, with decreased trading activity and mixed signals in Bitcoin on-chain metrics.

Related | From Dogecoin to Pepe: Unpredictable world of memecoins