Recently statistics shows that in the Bitcoin market there is an uncommon calmness with the investors almost holding their positions and the perpetual swap markets resetting. The past calmness was often observed before the increased volatility and this is confirmed by the Glassnode’s report.

The report mentions that the net capital inflows to Bitcoin are slowing down due to the balance between profit and loss. This phenomenon is an exception as 89% of the days typically have a larger inflow. The Realized Cap is currently at an all-time high of $619 billion.

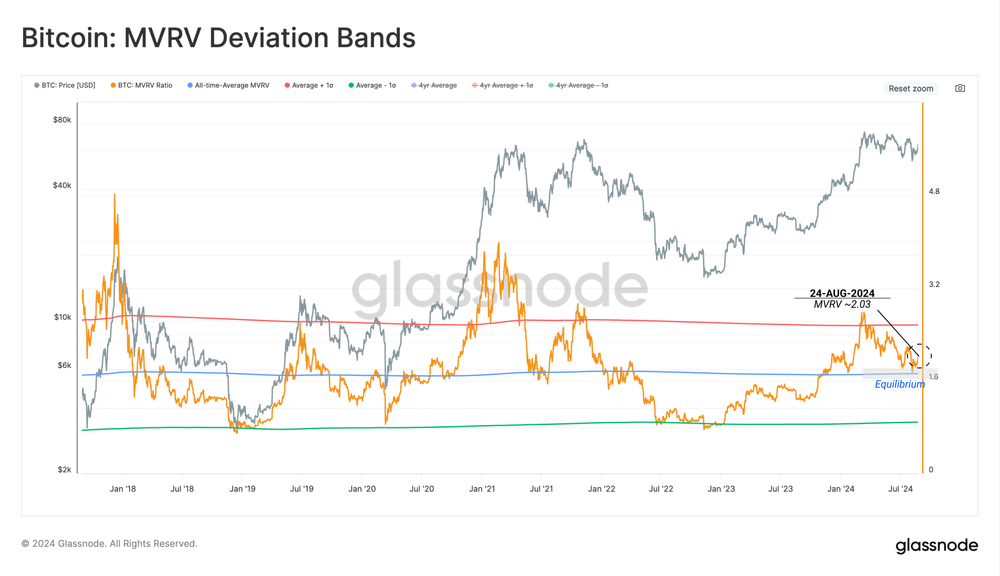

Profitability metrics for investors indicates a market reset. The MVRV Ratio has been hovering around the long-term average of 1.72 which it has tested. This level is mostly the border between bull and bear trends.

Still, it is the case that the percentage of profit in supply has gone back to its mean, in this way, it is repeat the patterns of late 2016, throughout the year 2019, and in the mid-2021 period’s sell-off.

Bitcoin Sell-Side risk ratio and profit/loss activity

The Sell-Side Risk Ratio has slid down to the lower band. It implies that the majority of on-chain transactions happen close to the break-even price. It is often the reason for the increase of volatility. Short-term profit and loss activities have decreased significantly, with the net realized profit/loss now at just $15 million per day, down from March’s $3.6 billion daily inflows.

Interestingly, a huge part of Bitcoin’s supply, about 12.5% or more, is kept in the 3-6 month age band. This is similar to what happened in mid-2021 and in the 2018 bear market. The last few weeks have recorded a rise in the loss-taking events in this group, similar to the major market inflection points.

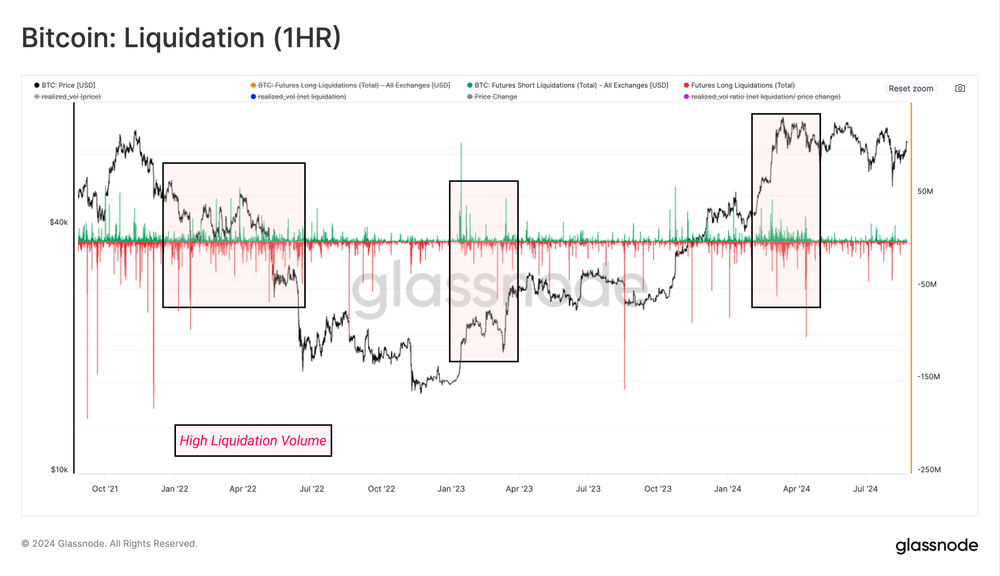

On the other hand, the perpetual swap markets indicate a similar trend of decreasing speculative appetite. Liquidation volumes have dramatically decreased since March’s all-time high, reflecting a tendency towards a spot-dominated market.

The link between price and liquidation volume volatility is getting closer to the levels that have not been seen since Feb. 2022, another sign of a reset in speculative interest.

Nevertheless, this cooling of speculative fervor extends beyond Bitcoin with many digital assets showing neutral funding rates. The spot markets may therefore be the major reason for the near-term price action and thus, a new market dynamics may come in.

Related | Indonesia considers Telegram ban over illegal content