The crypto market experienced a massive rebound last week, with products focusing on Bitcoin attracting more than $500 million in new capital. The surge has come after Federal Reserve Chair Jerome Powell’s statements at the Jackson Hole Symposium, which pointed to possible interest rate cuts in September.

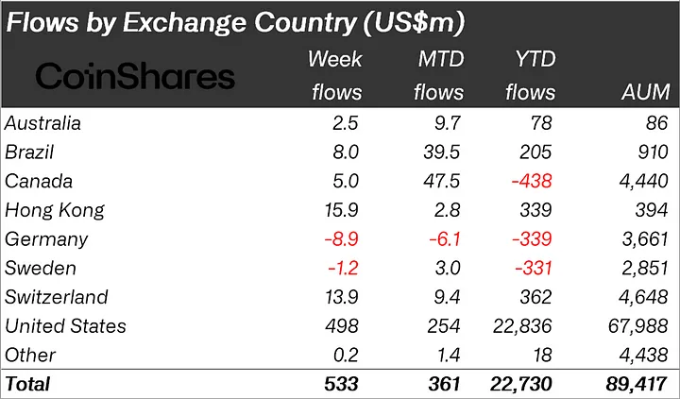

As per the latest CoinShares report, digital asset investment products had a total inflow of $533 million in the last week. This is the biggest entry in five weeks, even though trading volumes were not very high, at $9 billion.

The United States dominated regional inflows, accounting for $498 million. Hong Kong and Switzerland also saw notable interest, with inflows of $16 million and $14 million, respectively. Germany bucked the trend, experiencing minor outflows of $9 million.

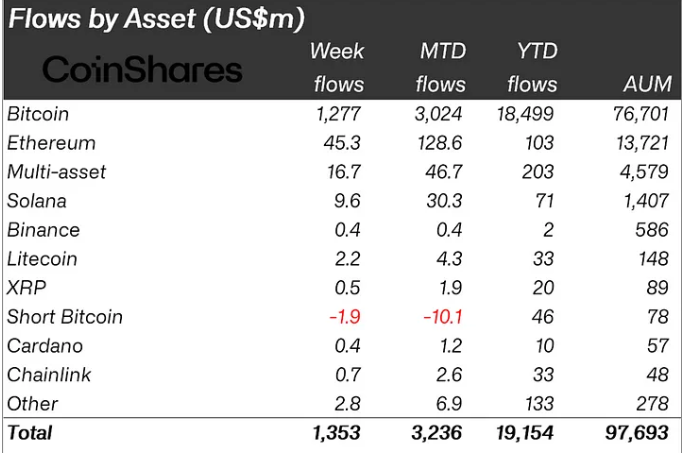

The majority of these inflows were recorded on Friday. This synchronization demonstrates Bitcoin’s high sensitivity to interest rates. Nonetheless, Ethereum was in the opposite direction, with outflows of $36 million.

The inflow of new Ethereum ETF products was one of the reasons for the change. These ETFs have gained $3.1 billion within a month after their launch. On the other hand, $2.5 billion in outflows from the Grayscale Ethereum Trust have somewhat counterbalanced this increase.

Bitcoin’s market dominance hits 40-month high

Meanwhile, Bitcoin’s market dominance has reached a 40-month high, according to data from CryptoQuant. The leading cryptocurrency now commands a 78.5% share of the total crypto market cap, significantly outpacing Ethereum.

This Bitcoin’s capital increase set out in late 2022, propelled by rumors of the Bitcoin ETF’s launch. The Bitcoin ETF official approval and launch have further pushed this trend. Although the Ethereum ETFs have been approved, they have not generated the same level of excitement or inflows.

The present scenario is in sharp contrast to the previous crypto market cycles which included ICOs and a 2021 bull run when altcoins managed to attract Bitcoin. Some experts in the industry believe that it is a necessity for Ethereum and other altcoins to find a significant reason to be able to regain lost ground in the upcoming months.

Related | Australian regulator secures victory against Kraken Bit Trade