Bitcoin has just reached an impressive milestone, surpassing the $100,000 mark, a significant psychological achievement for the cryptocurrency market. For traders, especially those who have held onto their positions through thick and thin, this is validation.

Whale accumulation has been strong, as explained by Santiment, and now it is led by institutional players and big investors. But here is where retail traders’ excitement and overemotional reaction is the only hindrance for Bitcoin.

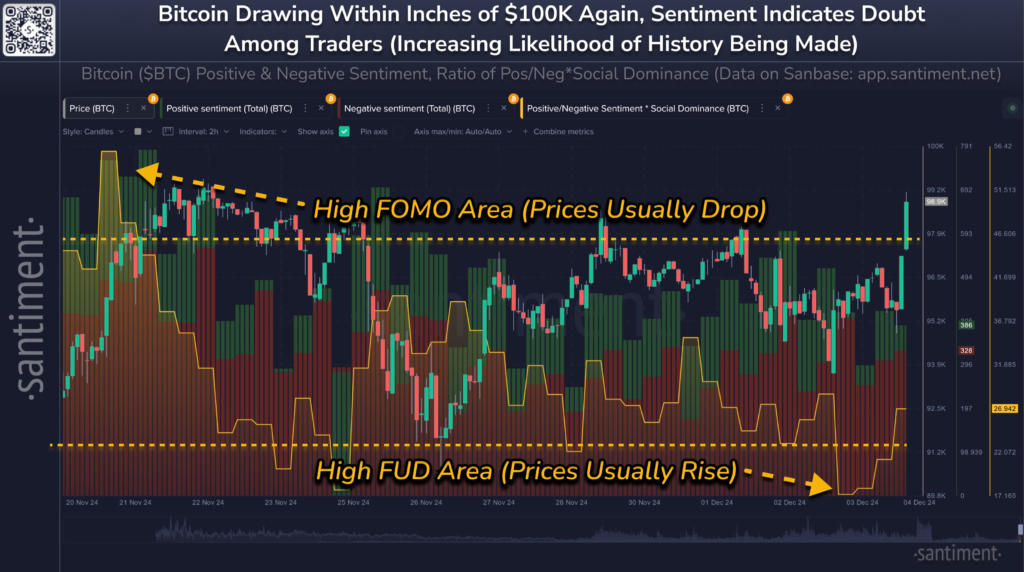

December started with many market participants doubting. Commentaries on social media have grown more skeptical, and some of them predict a major retracement after such an extraordinary growth of the sector in November.

While general opinion might still be tilted in the ratio of positive to negative comments through platforms such as Twitter, for example, the overall tone across participants seems to be one of hesitation. Oddly enough, history shows many more times when the market ends up doing exactly the opposite of what the majority think it will do.

This is the way it usually works: when the crowd is pessimistic, it often is a precursor to a reversal or continuation of the rally. This bearish outlook can be a bullish sign, which led Bitcoin to cross into six-figure territory, provided large investors don’t stop accumulating.

What’s next for Bitcoin after breaking $100K?

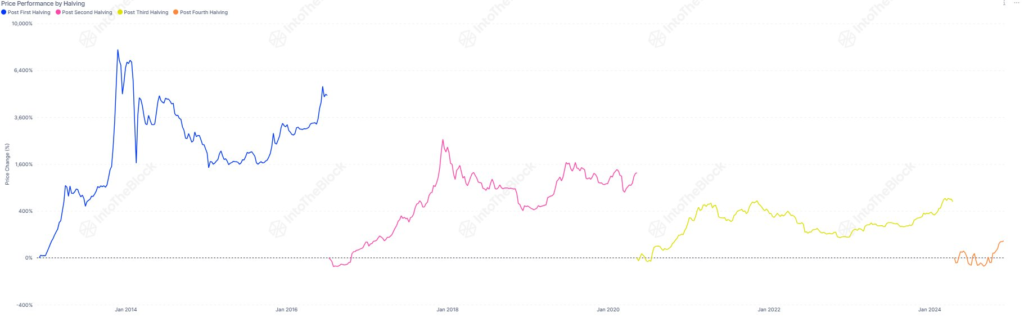

IntoTheBlock data shows that the price of Bitcoin has officially broken the $100,000 barrier. The only question now is, where to next? With the supply of Bitcoin fixed, as well as institutional interest of the cryptocurrency increasing, many would say the sky’s the limit. However, looking at previous market cycles puts things into perspective, at least a little.

Each of these events has been followed by a surge in price, although returns have gradually diminished with each cycle. In 2013, Bitcoin surged 7900%. The 2017 cycle resulted in a 2560% return, and by 2021, that number dropped to 594%. This pattern suggests that while Bitcoin’s price could continue to rise, the returns won’t be as exponential as they were in the early years.

While the $1 million per Bitcoin mark has never left some enthusiasts’ sights, the precedent set by past cycles and capital requirements puts a 100-200% return from the halving price more in line, placing Bitcoin’s peak in a range of $130,000 to $190,000.

Related | BNB hits record High, surges past $793 as network activity grows