Bitcoin price surge to an all-time high (ATH) has spotlighted strong buying momentum fueled by institutional interest and a rush of spot demand. Over 95% of Bitcoin’s circulating supply now holds profitable positions, reflecting broad market confidence in this rally.

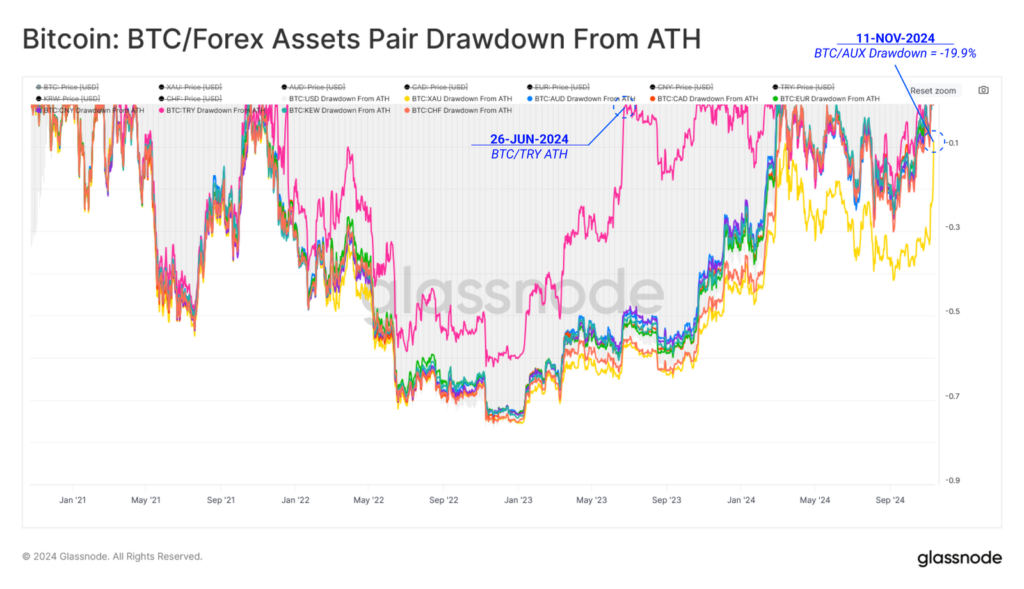

Recent U.S. election results have supported this upward momentum, with a reported crypto-friendly stance from the Trump administration adding to optimism. Glassnode’s data shows Bitcoin’s price broke ATH levels against nearly all major fiat currencies by Nov. 6, except the BTC-Gold pair, which remains 19.9% below its ATH despite Bitcoin reaching $88.6K.

Historical data suggests presidential elections shape Bitcoin’s price dynamics. Following the 2024 election, Bitcoin’s realized capital saw a modest increase, but the price has climbed 27.9%, showing a measured response compared to prior cycles. The market anticipates further crypto policy shifts that may continue affecting Bitcoin’s price.

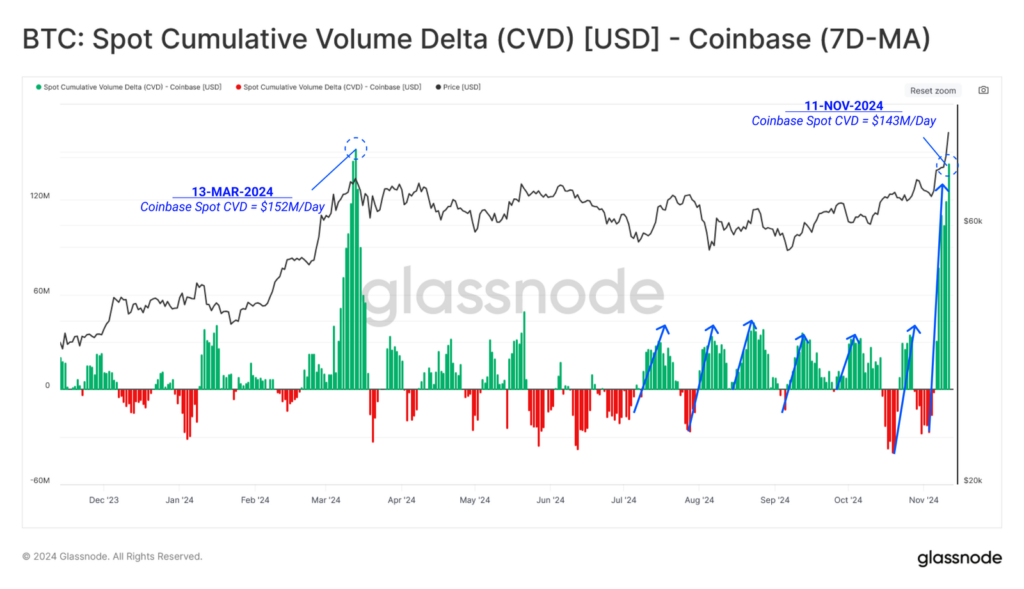

Spot demand drives Bitcoin rally on Coinbase

The latest weekly candle marks Bitcoin’s largest recorded gain, a striking $11.6K jump that exceeded previous weekly gains. Coinbase’s Cumulative Volume Delta (CVD) surged to $143M, indicating strong buyer demand. Since July, each rally has shown a similar increase, reinforcing the dominance of spot market buying in this cycle.

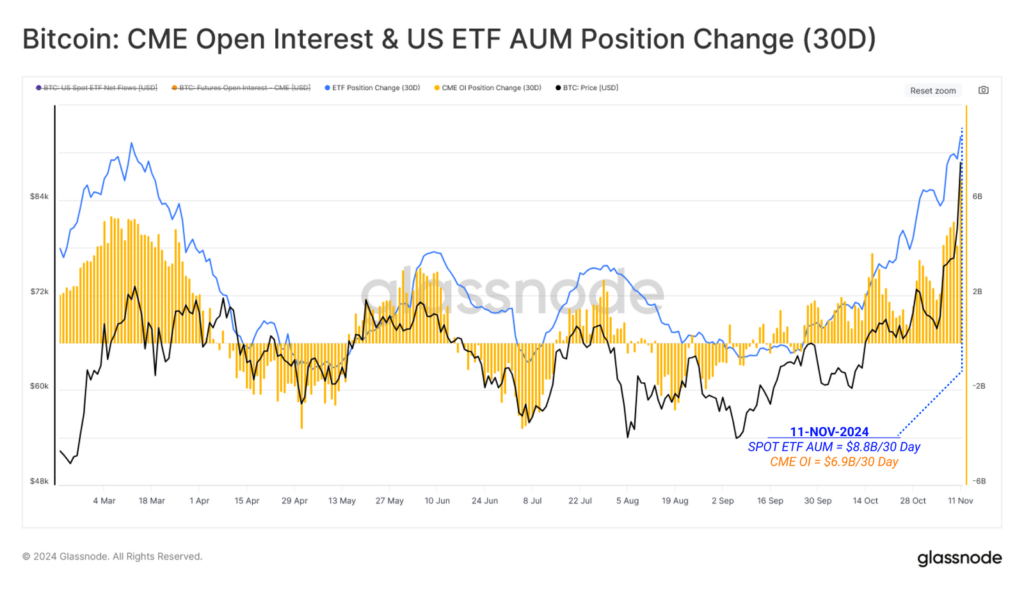

ETF demand has also spiked, with $6.8 billion added to AUM over the last 30 days. This surpasses CME futures open interest growth, underscoring a preference for direct Bitcoin exposure through spot ETFs. While perpetual futures premiums are rising, they trail March highs, confirming spot-driven demand as the primary rally force.

With this ATH, Bitcoin’s supply is nearly all in profit. Similar euphoric phases previously lasted around 22 days before corrections began. Realized profits have reached $20.4 billion, yet they remain under historical highs, leaving room for continued growth.