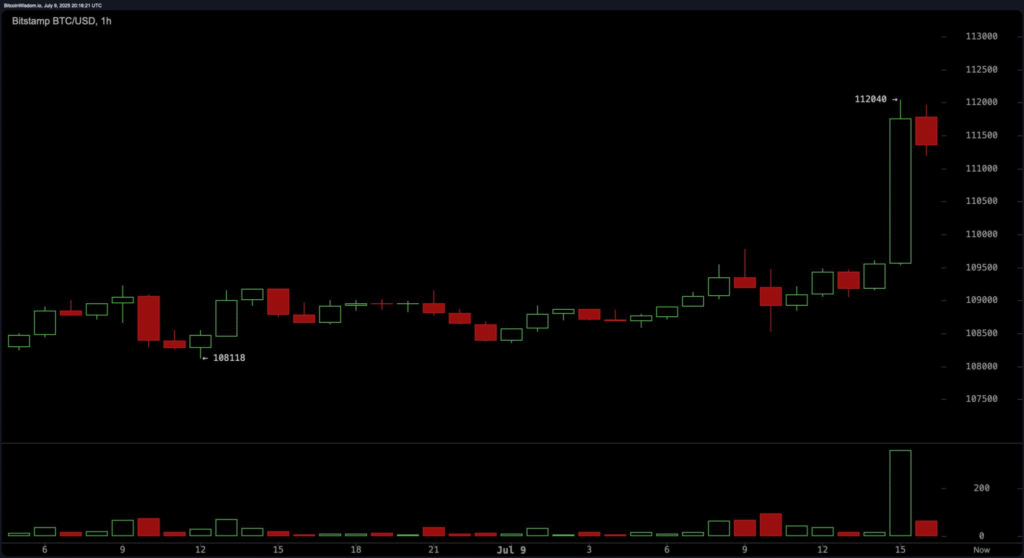

Bitcoin reached a new all-time high on Wednesday, pushing past the $112,000 mark. The move marked a sharp rise of 3% in just a single day. It topped out at $112,040 on the Bitstamp exchange before easing down slightly.

The sudden price spike pushed Bitcoin’s total market cap to $2.221 trillion. Traders exchanged over $28 billion worth of Bitcoin in 24 hours. This price movement gave the broader crypto market a lift. The overall digital asset market rose by 3.02%, taking total valuation to $3.47 trillion.

Derivatives markets see heavy losses

As prices moved higher, trading platforms saw heavy liquidations. The rally triggered $484.72 million in closed positions across major derivatives exchanges. A large part of this came from traders betting against Bitcoin.

Short sellers lost $223 million after the coin surged from the $109,000 level to its daily high. This rise surprised some traders who had expected a pullback. Instead, the bullish momentum pushed the price higher in a fast upward move. The market moved quickly, with several large orders executed within minutes.

Bitcoin surge draws attention

By late afternoon, Bitcoin’s price had cooled slightly. At 4:15 p.m. Eastern time, it was trading around $111,297. But despite the dip, the trend remains positive for bulls. This rally adds to Bitcoin’s already strong year. Investors continue to show interest in the asset as macro conditions shift. Market watchers point to growing institutional demand and optimism about digital assets.

With this new high, Bitcoin has cemented its position as the leading force in crypto markets. Other major coins also followed the trend, adding to the overall rise in the sector’s value. Volatility remains a key feature in crypto. Traders now watch closely to see if Bitcoin can hold above $110,000.

Some expect another push higher, while others warn of a possible correction. For now, Bitcoin holds near its peak, with volumes high and momentum strong. Markets remain alert as investors weigh their next moves in a fast-changing landscape.