Bitcoin has made a strong recovery, bouncing back to $63K after a recent 10% correction. This rebound follows a sharp one-day drop into the $60K range, marking one of the most significant pullbacks since the 2022 cycle lows.

Despite the typical lower weekend trading volumes, the market has demonstrated resilience, with the price stabilizing at $63.5K as the week concluded, according to a recent report from Glassnode.

It brings the correction into historical patterns seen in many previous bull markets, as drawdowns up to 26% from the local highs are common. However, demand-side resilience has been higher in the current recovery cycle, although difficult in recent months.

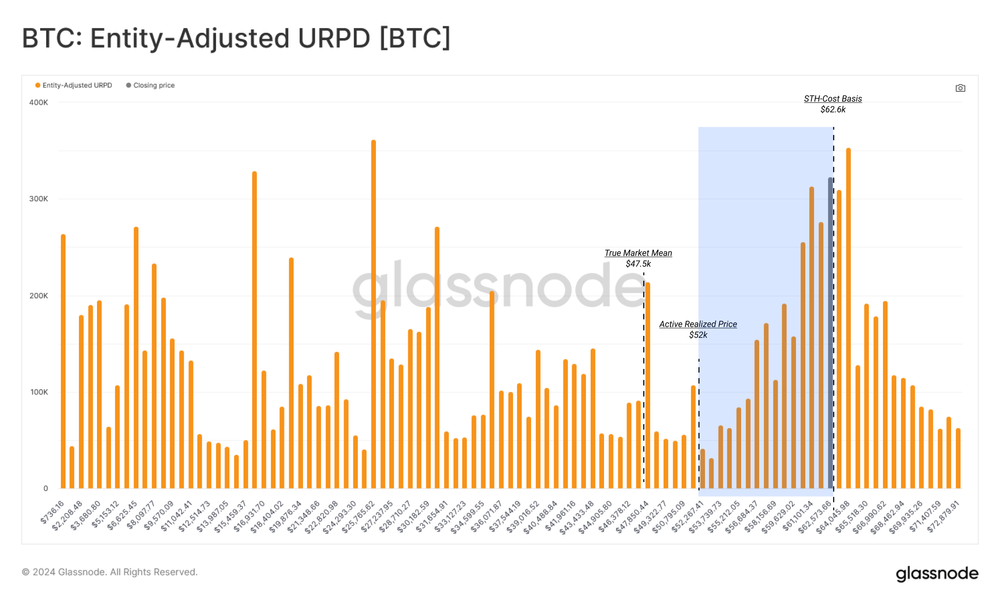

The on-chain analytics for Bitcoin’s present price above $62.5K reveal that it lies above the STS cost basis, indicating a constructive outlook. A slip below this would put selling pressure on new investors caught at higher prices.

Bitcoin holds above crucial market levels

Key longer-term markers include the True-Market Mean currently at $47K and Active Investor Price at $52.5K. Other than the brief drop below in early August, these have continued to be penetrating, reflecting overall market strength.

The URPD (Unspent Realized Price Distribution) shows Bitcoin is in a sensitive zone, with a significant portion of supply near current prices. This implies that small price movements could impact a large group of investors.

Meanwhile, speculative interest in the derivatives market is on the rise. A recent rally has forced a big chunk of short positioning to close. Although the use of leverage has come off its March highs, the renewed speculative interest suggests that potential volatility lies ahead.

However, recent Bitcoin price actions have pointed to a market that is ready to go up further. However, it remains vulnerable to volatility in case of changes in the traders’ positioning.

Related | Web3 gaming struggles: What’s holding gamers back?