Bybit suffered a massive $1.48 billion hack, causing panic in the crypto market. Bitcoin dropped 20% below its all-time high, and new investors faced big losses. The attack, one of the largest in history, drained 403,996 ETH from Bybit’s cold wallet.

Bybit CEO Ben Zhou said hackers tricked signers into approving a bad transaction. Despite the breach, Bybit assured users that other wallets were safe, and withdrawals were working.

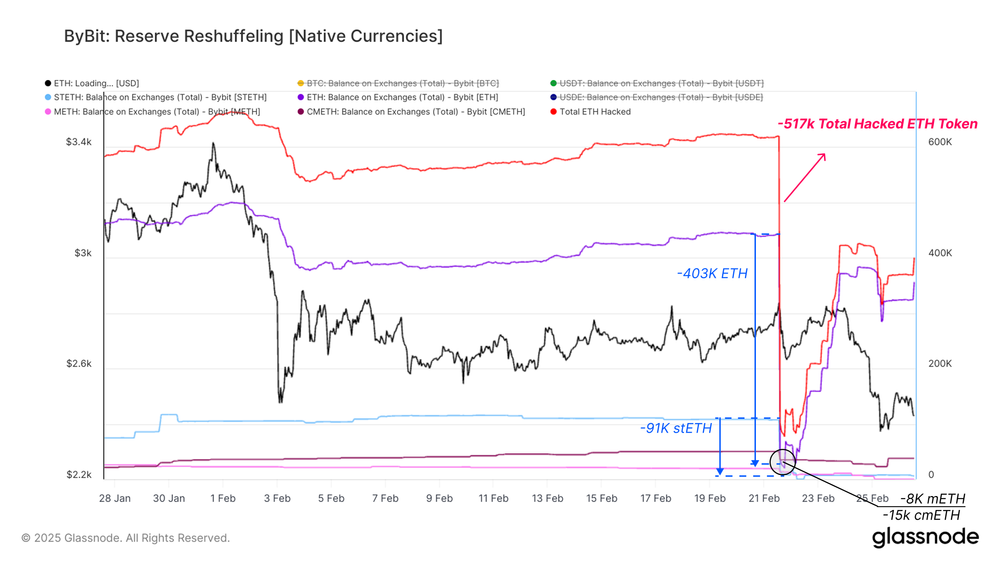

According to the Glassnode report, the hacker stole more than just Ethereum. Losses included 91,076 stETH, 8,000 mETH, and 15,000 cmETH. The attack shook investor confidence, leading to a market sell-off.

By Feb. 24, Bybit saw heavy withdrawals. Bitcoin reserves dropped by 21,248 BTC, and USDT outflows reached $1.76 billion. USDE lost $217.47 million. Bybit’s total reserves fell from $10.8 billion to $6.5 billion, showing a $4.3 billion loss.

Ethereum reserves later recovered to $1.19 billion, but ETH prices fell to $2,490. Another $117 million outflow followed, showing weak investor trust.

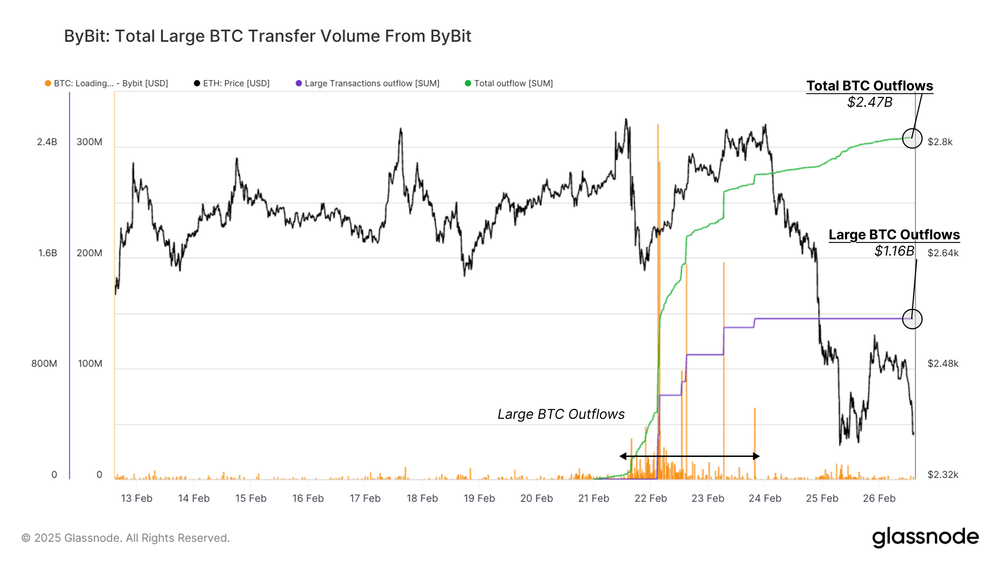

Bitcoin and USDT outflows reach billions

By Feb. 26, Bybit received $1.58 billion in Ethereum deposits, mostly from just eight big transactions. This suggested Bybit was restoring funds through internal transfers or institutional deposits. Meanwhile, Bitcoin outflows reached $2.47 billion, with nearly half leaving in five large transactions. USDT outflows hit $2.25 billion, with 38.1% moving through eight major withdrawals.

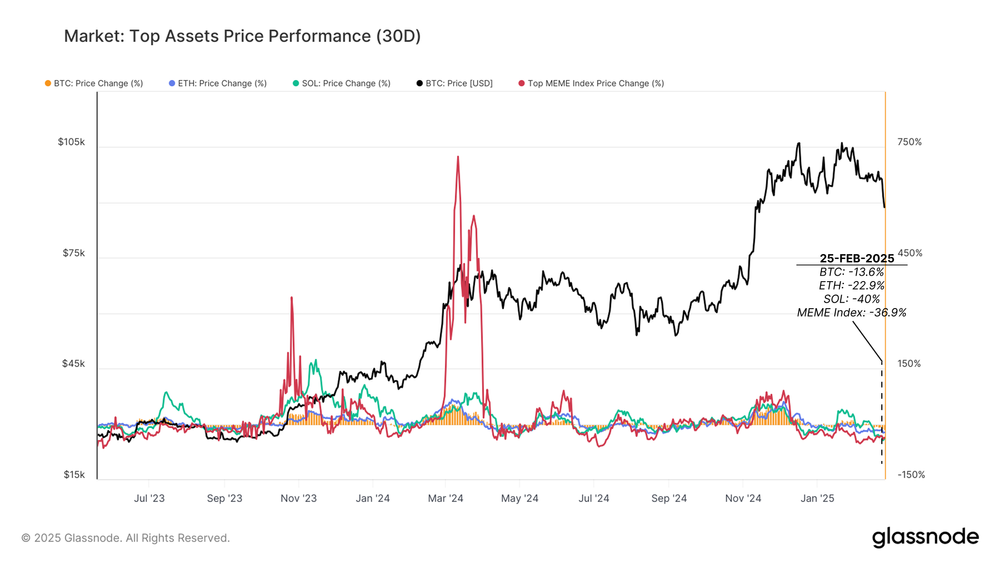

The hack sent a shock in the market. Bitcoin fell 13.6% in a single month, Ethereum 22.9%, and Solana 40%. The 36.9% fall in meme coins mirrored investor fear. Bitcoin entered a zone with a lack of liquidity, increasing risks. The short-term holders (STH) suffered as Bitcoin fell short by 5% from its breakeven level, sending new investors into distress.

Increased investor sales at a loss saw STH-SOPR fall short of its quarterly mean. Historically, that signaled a short-term market bounce, but due to the lack of underlying demand, a continuing decline in prices is a high-risk possibility.