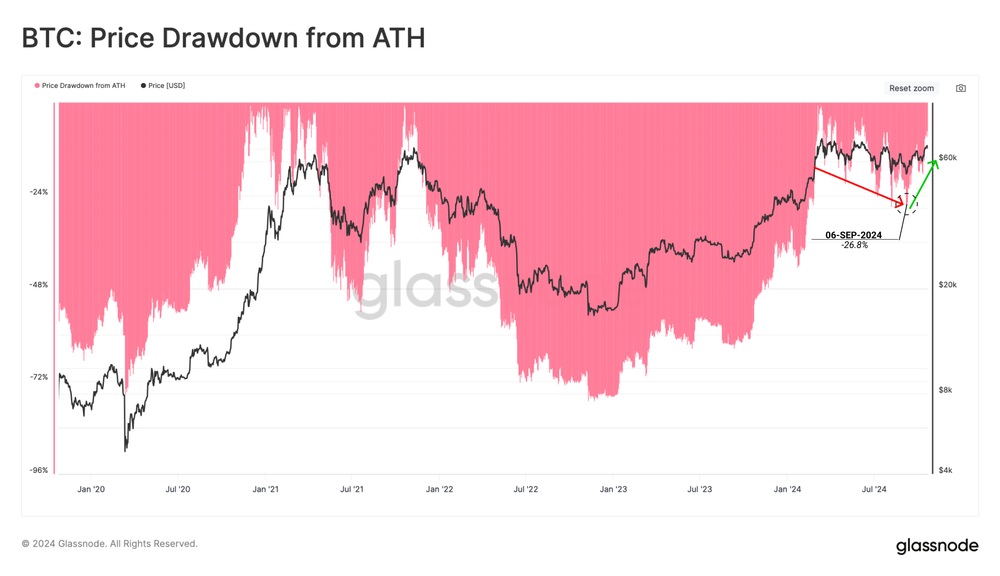

Bitcoin spot price continues to rise, reaching $69,000, just 6.8% below its all-time high (ATH). This increase marks one of the first signs of positive momentum since late June.

According to a report from Glassnode, the market has seen a surge this week, bringing the price closer to the $73,000 ATH established in March. After seven months of fluctuating conditions, this rally brings relief to investors.

Recent price action has broken through key technical levels, notably the 200-DMA and the 111-DMA, which Bitcoin traders often watch. The 365-day SMA has acted as a significant support level, particularly during market corrections, reinforcing the uptrend.

Fibonacci retracement levels show that the spot price remains confined between the ATH and the -23.6% region. This range-bound behavior is unusual for Bitcoin, which typically experiences either new highs or sharper declines. Investors are intrigued by this prolonged consolidation phase.

On-chain metrics reveal robust net capital inflows into Bitcoin, increasing by $21.8 billion over the past month. This surge has pushed the Realized Cap to a new ATH of over $646 billion, indicating rising liquidity and solid support for the current price increase.

Bitcoin AVIV ratio reflects strong investor profitability

Besides, the AVIV Ratio, reflecting investor profitability, has stayed above its historical mean. That would indicate active investors have a strong cost basis and that more upside is possible so long as the price momentum continues.

The growth of the Bitcoin derivatives market also reached new highs. The combined open interest of perpetual and fixed-term futures reached an ATH at $32.9 billion, a sign of increased leverage in the market.

The CME Group’s fixed-term futures contracts have gained much attention from institutional investors, which caused the open interest to increase to $11.3 billion. Regarding the latest development, the trading volume was still below the ATH in March, even though there had been a growth in the volume of the previous daily trading.

Cash-and-carry strategies are attracting institutional traders, with returns on investment set at about 9.6%. The trend will probably be as the Fed gets ready for more rate cuts are anticipated, enhancing market liquidity.

Related | XRPL snap unlocks XRP Ledger for 30M MetaMask users