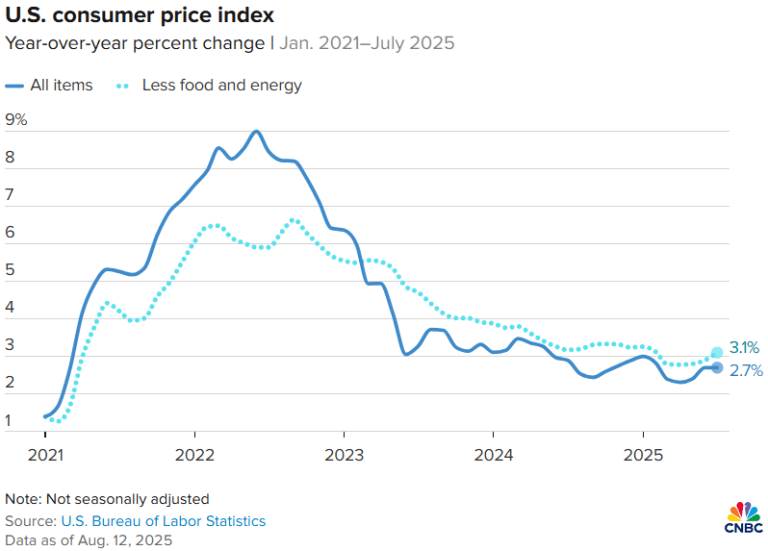

The latest consumer Bitcoin price index data from the U.S. Department of Labor Statistics created mixed signals for financial markets. Figures for July showed overall inflation slowing, but core inflation rising to a two-year high.

Traders struggled to interpret the split, and Bitcoin reacted with caution, holding steady near the $119,000 mark. The digital asset had surged to $122,000 over the weekend but gave up part of its gains as the market awaited clearer signals.

Annual inflation came in at 2.7%, slightly below the 2.8% forecast. Core inflation, which excludes food and energy prices, rose to 3.1%, higher than expected and the highest level since 2023. The jump in core prices fueled debate about the reasons behind the increase.

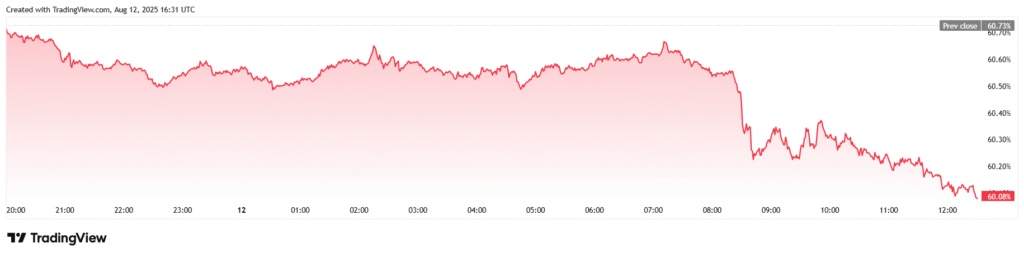

Crypto market sees shift away from Bitcoin dominance

Some observers pointed to the current tariff policies as a possible driver, while others dismissed any significant link between trade measures and inflation pressures. Bitcoin’s performance reflected this uncertainty.

At the time of reporting, the cryptocurrency traded at $119,898.64, showing a small 0.46% decline over the previous 24 hours but maintaining a 5.9% weekly gain. The price moved within a tight range of $118,159.03 to $120,193.39 since the previous day.

Trading volume slipped by 15.82% to $73.98 billion, and market capitalization edged down 0.71% to $2.38 trillion. Bitcoin’s share of the total crypto market fell to 60.08%, marking a 1.09% drop and signaling stronger relative gains from alternative coins.

Derivatives data also showed cooling momentum. Total bitcoin futures open interest on Coinglass declined 2.09% to $80.80 billion. Liquidations over the last 24 hours totaled $56.33 million, with the majority coming from long positions. Long traders absorbed losses of $43.83 million, while short sellers faced $12.50 million in liquidations.

Bitcoin holds steady amid mixed inflation signals

The shift suggested that bullish bets met resistance after the recent rally, prompting profit-taking and cautious positioning. The broader market remained watchful. The lower headline inflation figure hinted at easing price pressures, but the higher core reading signaled possible persistence in underlying costs.

Investors weighed how the Federal Reserve might interpret the data and whether interest rate policy could shift in response. For now, Bitcoin mirrored the indecision, moving sideways as traders awaited further economic cues.

If market sentiment stabilizes and core inflation fears ease, Bitcoin could attempt another push higher. If inflation concerns deepen, risk appetite may weaken, leading to further consolidation. In the current environment, volatility remains a constant companion for both crypto traders and traditional investors.