Bitcoin bull market seems to be moving faster than usual, currently running about 100 days ahead of its typical four-year cycle, according to a recent report from CoinMarketCap. In their Q3 market report released on Oct. 3, CMC suggested that Bitcoin (BTC) might be on track to break away from its usual four-year pattern and could be entering a supercycle.

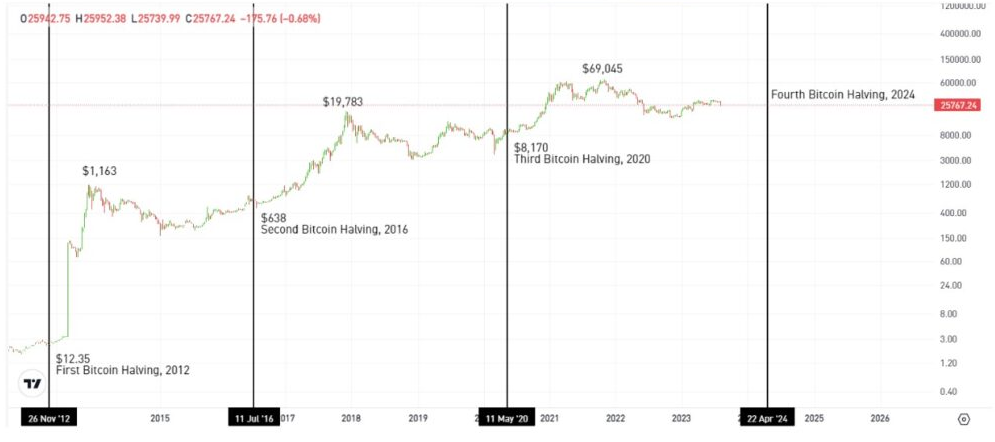

Meanwhile, this shift is driven by increasing institutional interest, the introduction of Bitcoin exchange-traded funds (ETFs), and evolving market trends. A crucial part of Bitcoin’s market behavior is its four-year cycle, heavily influenced by halving events. These events happen roughly every four years or after miners have mined 210,000 BTC blocks, reducing the rewards given to Bitcoin miners.

Bitcoin set for new highs post-halving

Bitcoin halvings have often impacted significant price surges, with bull markets typically reaching their peak around 518 to 546 days after the halving. According to CoinMarketCap, Bitcoin’s current price trends and the latest halving on Apr. 20, 2024, hint that we might see an all-time high for BTC much sooner than usual. Furthermore, Bitcoin’s current bull market is estimated to be about 40.66% through.

Experts believe Bitcoin might be moving away from its typical four-year cycle due to its rising connection with traditional assets like gold and tech stocks. Additionally, major institutional players like MicroStrategy and Semler Scientific are increasingly adopting Bitcoin, further supporting this shift. On Oct. 2, Forbes released an article titled “Why Bitcoin is Becoming a Part of Traditional Finance,” highlighting how Bitcoin is steadily gaining acceptance in mainstream financial systems.

In the report, CMC also listed the top five active sectors in the crypto space, with memecoins and Ethereum taking the lead. Despite a late rally in the third quarter, 16 sectors still experienced significant losses, with market caps dropping by at least 10%, some as much as 40%, according to CMC. The storage, lending, and privacy sectors experienced the hardest hits, posting declines of 39%, 37%, and 31%, respectively.

Related | Aptos Labs acquires HashPalette to strengthen Asian expansion