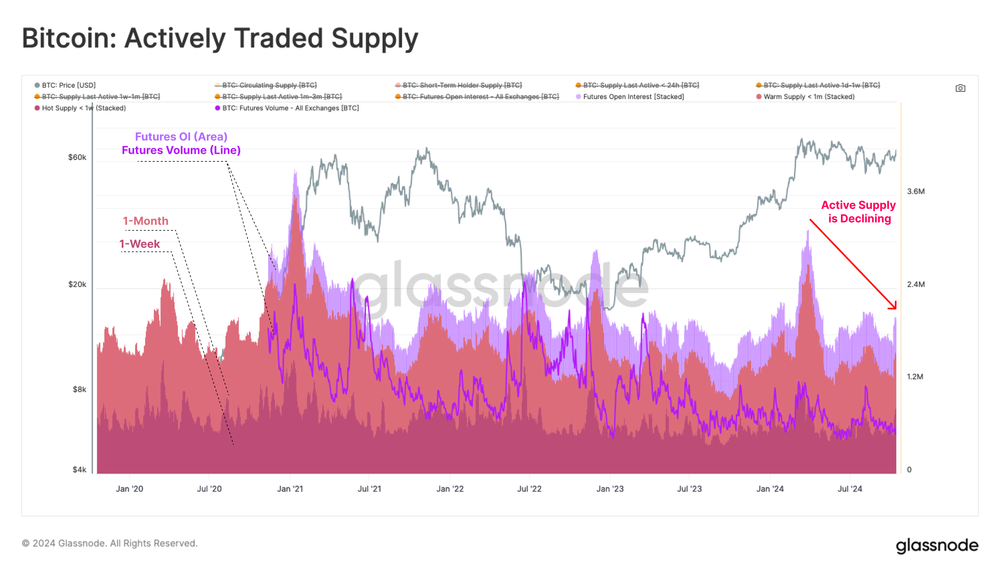

Bitcoin has been consolidating in a range for a period of no less than seven months which tells clearly about the mismatch between supply and demand. Today, we are observing clock low volumes both on the futures and on-chain markets. HODLers being the key holders, an uptick in the level of volatility can be expected soon.

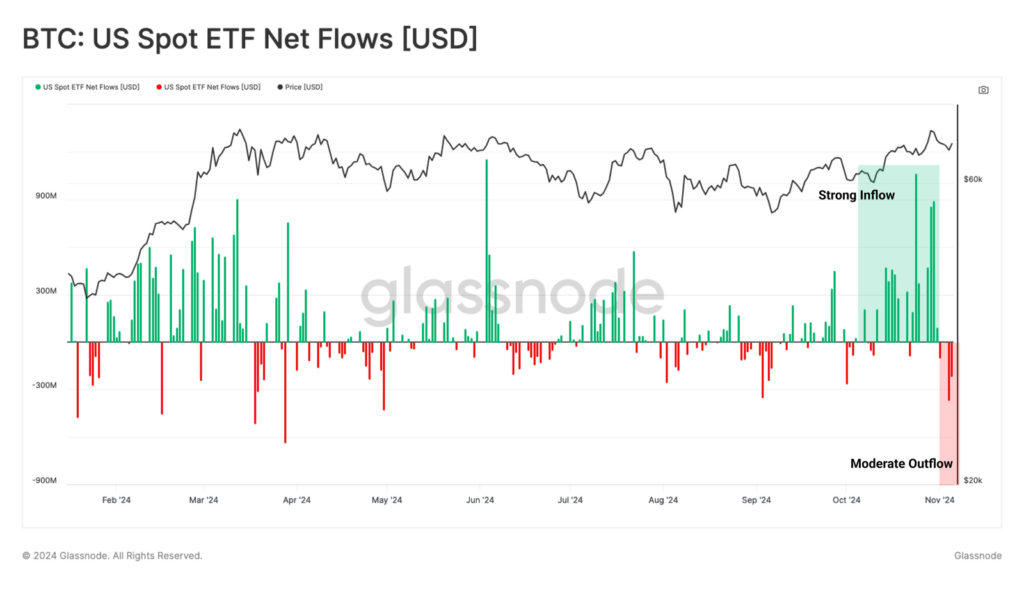

As per Glassnode, new capital inflows have decreased since March 2024, Bitcoin’s all-time high (ATH) of $73,000. Bitcoin’s peer-to-peer feature means there is no need for an intermediary to match buyers and sellers. In this way, the metrics of Realized Profit and Realized Loss would help point out new capital flowing in and out of the network.

At present, each day, Bitcoin gets around $730 million in new capital inflows, a significant reduction from the March peak of $2.97 billion. There was a clear increase in Realized Profit that occurred on Oct. 8. Nevertheless, this area didn’t show up in the Entity-Adjusted variant of the metric.

Bitcoin metrics impacted by internal WBTC transfer

This spike resulted from a large internal transfer by the Wrapped Bitcoin (WBTC) cluster as BitGo migrated its on-chain ownership structure. Glassnode’s clustering heuristics effectively identified this non-economical transaction, highlighting the advantages of entity-adjusted filtering.

From the buyers’ side, the Binary CDD model lists a low volume of transactions with long-term investors. This inactivity indicates that long-term investors are not doing much about the current price levels but staying within the range.

On the supply aspect of the market, it is obvious that supply is constrained. One example is a long-term increase in supply storage, meaning that HODLers do not sell. This is then, in turn, to a decrease in active supply, which means that fewer coins are being bought and sold at the current prices.

Furthermore, the top metric, “Warm Supply”, which is use for coins that have changed hands within a month, also reflects the mentioned phenomenon.

Although there are some new demands, they are still far from the level of March this year. The current market condition is cautious, with the new investors standing still. The possibility of a deep bear market in the near future is now less likely.

Related | Monochrome launches dual-access Ethereum ETF in Australia