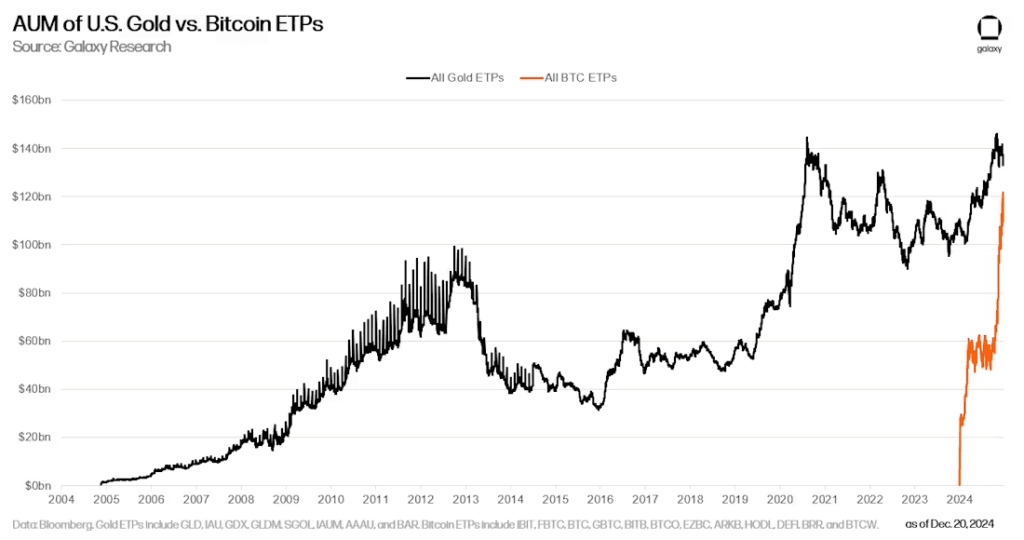

2024 became a defining year for Bitcoin, marked by groundbreaking developments and soaring adoption. Spot-based Bitcoin ETPs launched in the U.S., drawing over $36 billion in net inflows. This cohort of ETPs emerged as the most successful launch in history.

Major players such as Millennium, Tudor, and D.E. Shaw took positions and joined the likes of SWIB. These ETPs now sit 19% below the combined AUM of US physical gold ETPs.

For most of the year, BTC’s price was indecisive, moving in ranges for 237 days. The election of Donald Trump and the rise of Bitcoin ETPs drove market sentiment. According to Galaxy Research, a stellar year ahead is expected for 2025.

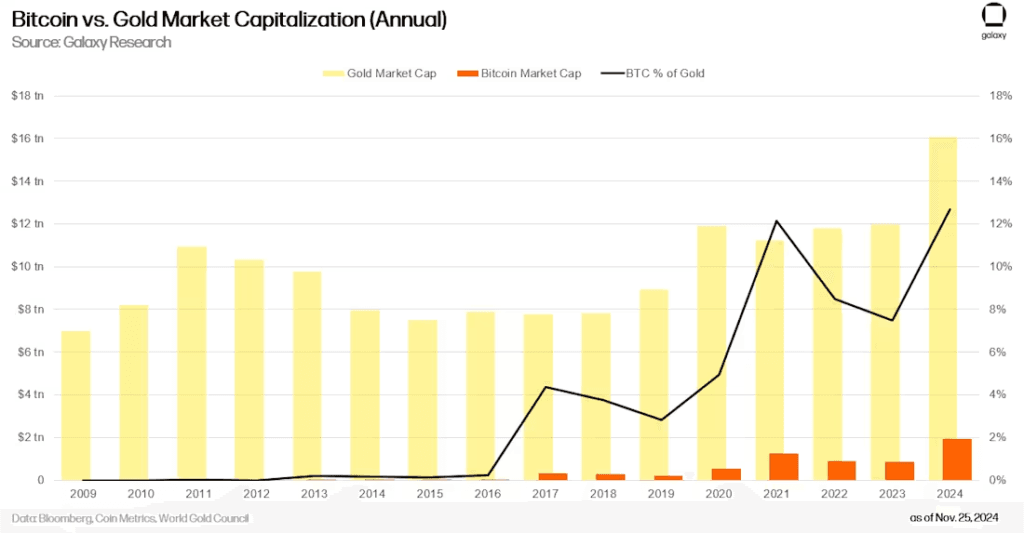

In the first half of 2025, it is expected that Bitcoin will break $150,000 and reach a value of at least $185,000. It’s going to be institutional and corporate adoption that will lead the way in 2025 to the leading position. By 2025, Bitcoin may reach 20% of the market capitalization of gold.

The cumulative AuM of US-based spot Bitcoin ETPs will surpass $250 billion by 2025. Adoption on the wealth management platforms will increase substantially; some will even offer 2% or higher Bitcoin allocations, which will also be a significant driver of money inflows into those vehicles.

Corporate and national Bitcoin adoption to accelerate

Corporate and national adoption is also in the pipeline. Five Nasdaq 100 companies and five countries might declare BTC holdings or inclusions into sovereign wealth funds. This will further pinpoint the growing relevance of BTC in the space of diversification and trade strategies.

This could also be the signal of BTC Core developers’ unrestricted consensus on protocol upgrades. Development with opcodes like OP_CTV and OP_CAT could enable the next excitement in Bitcoin, significantly enhancing transaction programmability.

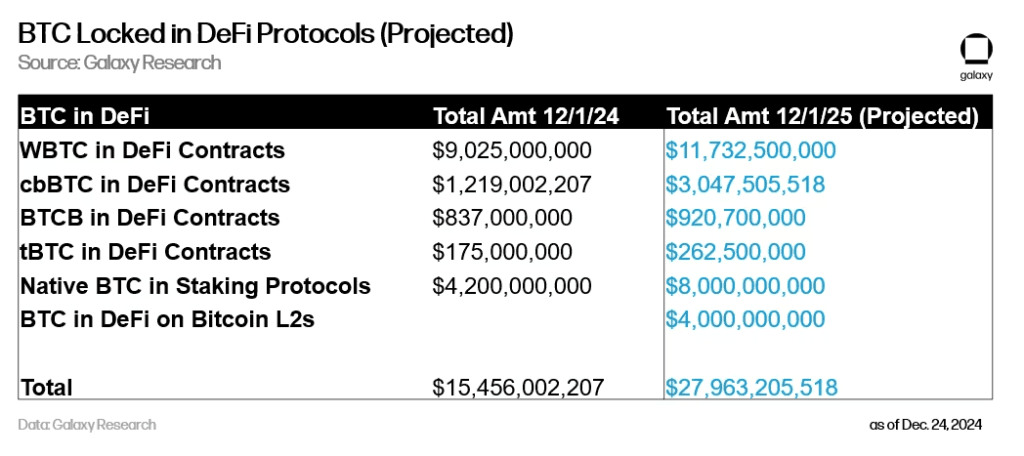

It is now inevitable that Bitcoin’s DeFi has exponential growth about to occur very soon. These are conservatively doubling DeFi and Staking for any value locked due to growing adoptions on solutions such as Bitcoin Layer 2 and legacy platforms like Babylon.

With the shift of Bitcoin miners to high-performance computing and AI partnerships, the pace of development within the ecosystem has accelerated. By 2025, BTC is sure to turn out to be one of the global financial powers.