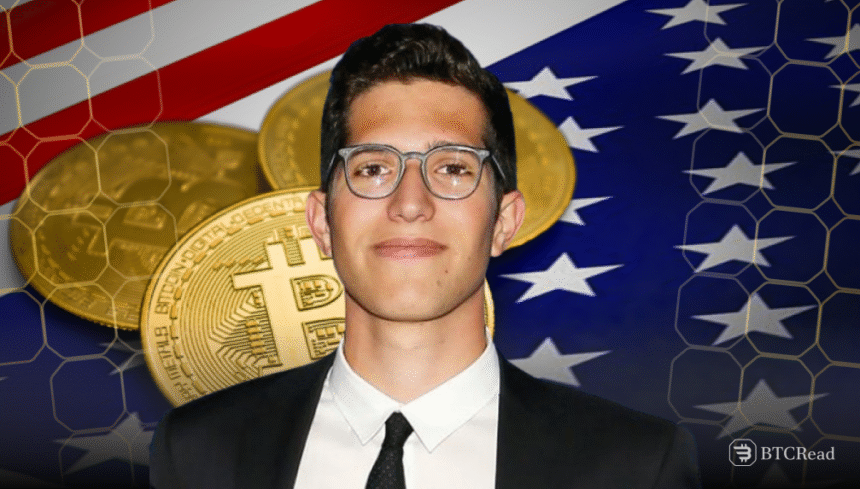

Brandon Lutnick, chairman of Cantor Fitzgerald and U.S. Commerce Secretary Howard Lutnick’s son, is leading a $3 billion investment in Bitcoin.

It is a massive effort involving headline players SoftBank, Bitfinex, and Tether, and at a time when there is renewed optimism in the cryptocurrency market under President Trump’s regime.

Lutnick is launching a new firm, 21 Capital, with Cantor Equity Partners. The latter had raised $200 million in January. Now, that money and a huge $3 billion investment in Bitcoin by its backers will be channeled to create a crypto titan.

According to the reports, Tether will provide $1.5 billion in Bitcoin, SoftBank will contribute $900 million, and Bitfinex will contribute a further $600 million.

Additionally, the aim is to copy the playbook of MicroStrategy, which made itself a titan of Bitcoin by buying digital assets aggressively.

MicroStrategy, a former traditional software company, now owns dozens of billions of dollars’ worth of Bitcoin. Its shift has been rewarded with a $91 billion market capitalization.

Lutnick plans to do the same by scaling up quickly through his special purpose acquisition company. However, he aims to turn it into a publicly listed alternative backed by top investors.

Bitcoin stockpiling builds crypto powerhouses

However, the vehicle will also raise a $350 million convertible bond and a further $200 million in a private equity placement to top up the war chest. Funds raised will be directly invested in the purchase of Bitcoin.

The invested Bitcoin will ultimately be exchanged for shares in 21 Capital worth $10 each. The strategy pegs the value of Bitcoin at a lofty $85,000 a coin, slightly below where it has just peaked at $106,000 after Trump won the election. It now trades at around $92,000.

The deal is expected to be announced soon. However, insiders caution that the figures could change and the venture might still fall apart.

Tether and Bitfinex have a regulatory history that makes the situation more complicated, and both companies concluded probes in 2021. Despite this, the pro-crypto attitude of the Trump administration presents a tailwind.

Nonetheless, Cantor Fitzgerald has already gained from its involvement by advising Tether on a $775 million investment. The firm guided Tether in funding the conservative video platform Rumble.