Bitcoin has surged to a new all-time high (ATH) of $76.4k on Nov. 6 in response to the US Presidential Election. The price broke past $73.7k, rallying toward uncharted territory. This new ATH signals a shift in investor sentiment, nearing a state of euphoria.

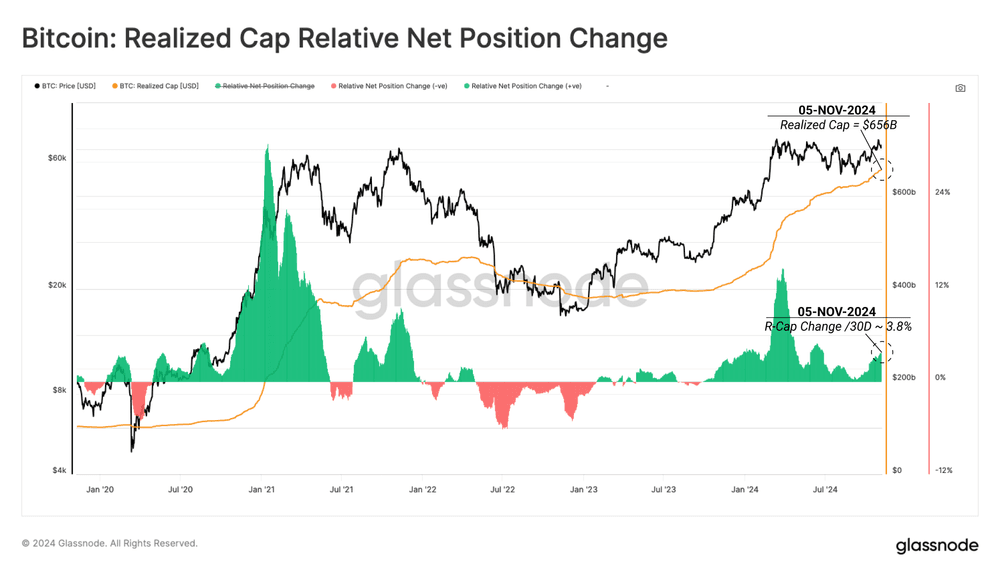

According to Glassnode weekly on-chain report, capital inflows are rising, marking a strong demand for Bitcoin. Since September, net inflows have surged, with the Realized Cap climbing 3.8% over the past 30 days, reaching a new ATH of $656B.

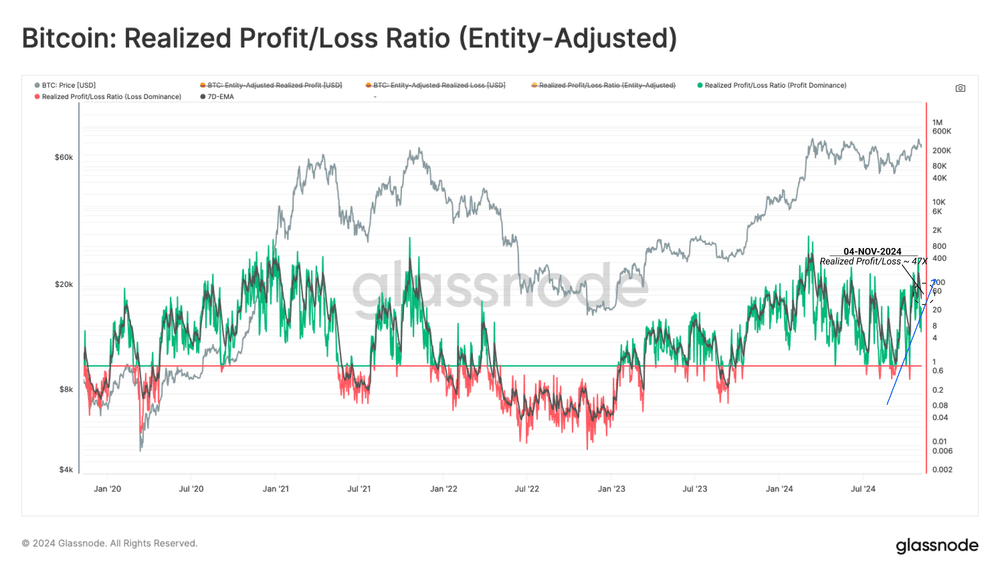

In total, $2.5B has flowed into the market in the past month, pushing profit-taking volumes to over $635M per day. However, the market dynamics are shifting. Bitcoin is now in a profit-dominant phase, with profit volumes outpacing losses by a staggering 47x. This suggests the market is entering a new cycle of demand.

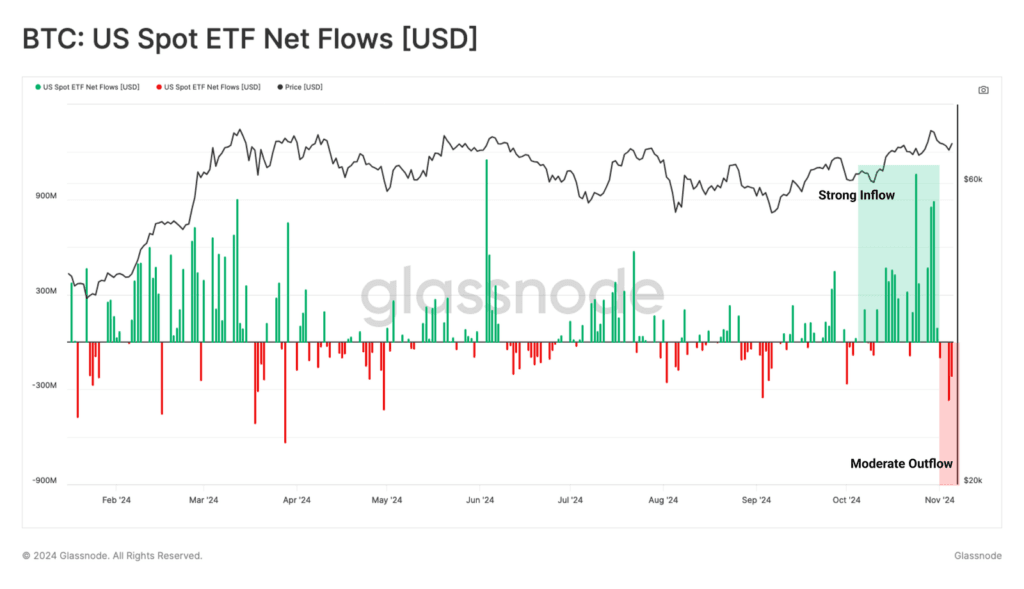

Bitcoin ETFs see outflows amid election

While Bitcoin ETFs saw significant inflows earlier in the month, recent outflows have been noted as investors de-risk ahead of the election. However, with Bitcoin’s price rise, these ETFs could see fresh momentum.

Volatility is likely to remain high. This is reflected in options markets, where open interest has reached $ 25.2B, second only to the ATH set in March. Institutional investors are increasingly dominant, with sophisticated strategies at the front.

The balance of the put and call contracts shows two clear expectations of big market moves, at least in both directions. Additionally, implied volatility (IV) has surged, most of all short-term options, which is a common sign of increased uncertainty.

The VRP currently stands at an extreme 27.9%, indicating that investors are preparing for large price swings. That said, Bitcoin’s price action and market dynamics suggest a turbulent road ahead, with investors positioning for both upside and downside risks.

Related | Tether shifts $2B USDt to Ethereum in major cross-chain swap