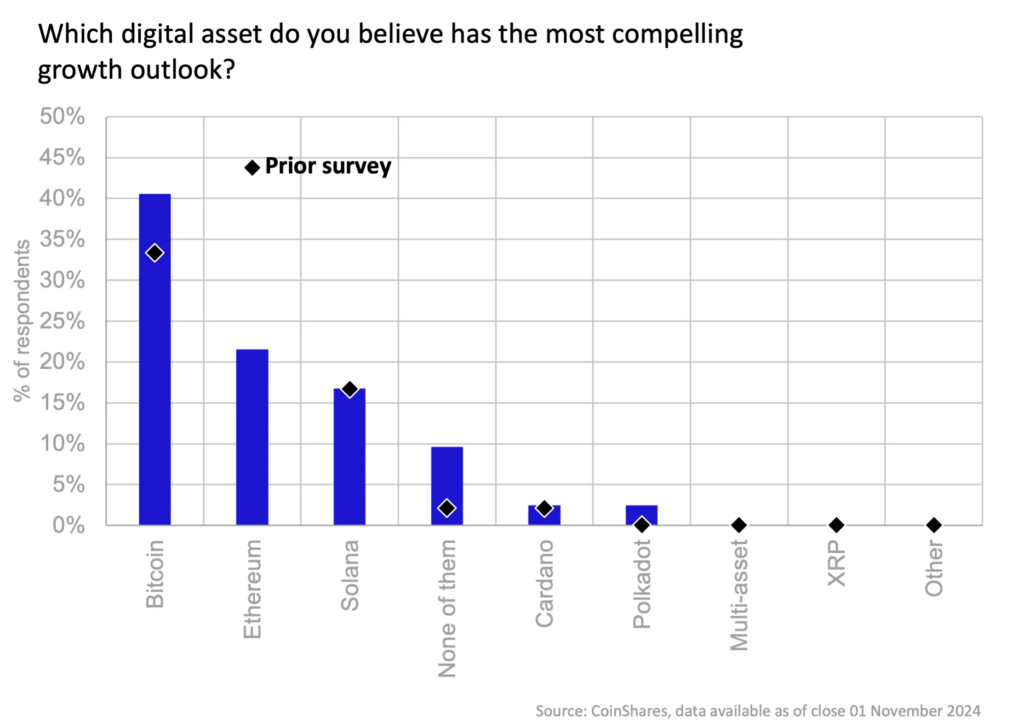

CoinShares’ October Fund Manager Survey shows Bitcoin is still leading among other digital assets. The survey highlights increased allocations to Bitcoin, which saw a 7% rise in sentiment since July. Bitcoin now holds nearly double the positive outlook compared to other assets.

As per the report, Ethereum’s sentiment hit its lowest point since 2021, with enthusiasm halving. Solana maintained steady support at 9.5% of responses. Notably, 10% of respondents saw no digital asset with a compelling growth outlook.

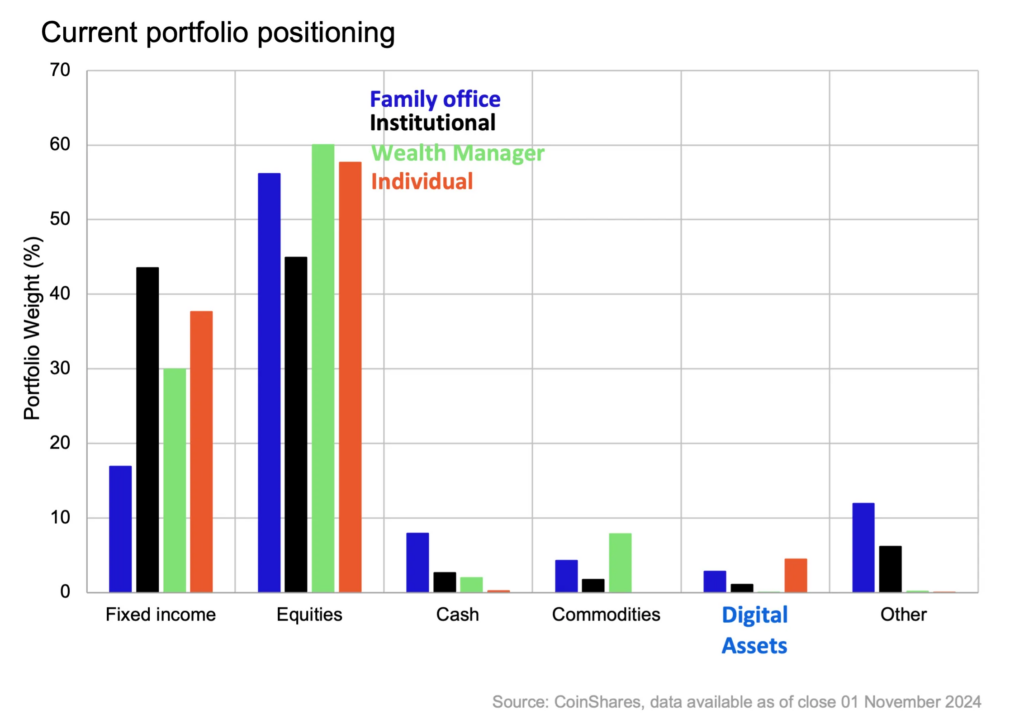

The weighting of digital assets in portfolios dropped from 1.7% to 1%. This reflects a shift to fixed income as inflation cools. Institutional managers still view the asset class as lacking fundamentals. However, hedge funds and family offices hold the most significant digital asset exposure.

Bitcoin allocation sees a notable rise

Of the assets, only Bitcoin presented a measurable hike of ownership, up 5% more survey participants. Despite poor sentiment, Ethereum’s allocations remained pretty much the same. Solana’s favourable sentiment also failed to turn into bigger positions. Altcoins are left with minimal allocations.

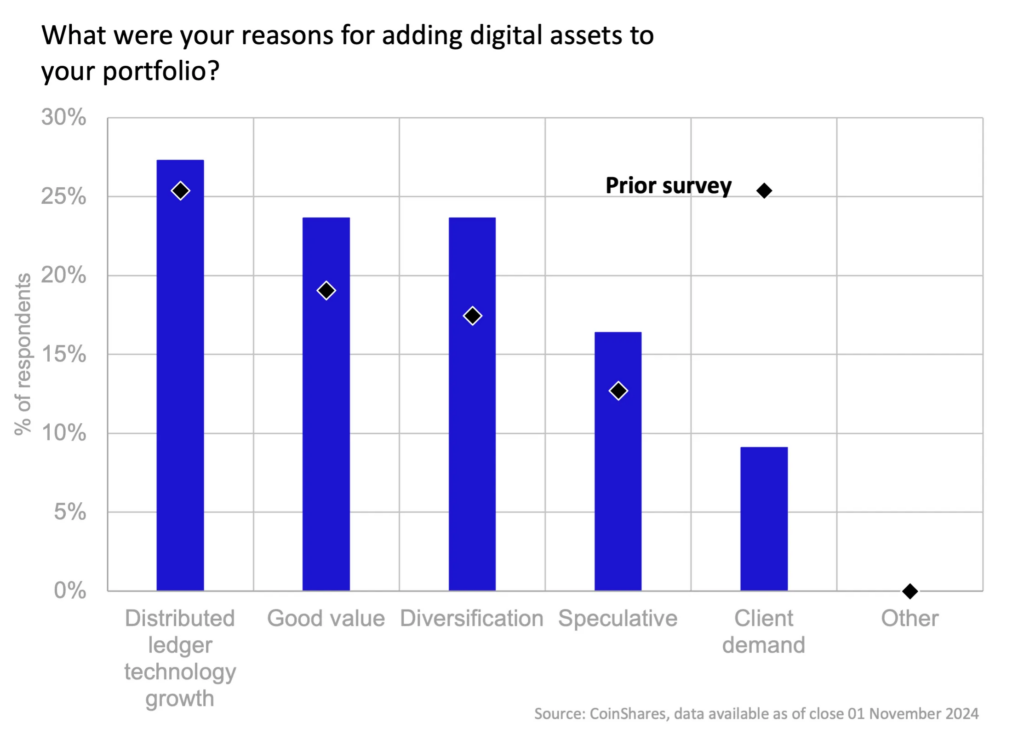

Exposure to distributed ledger technology continues to be the number one driver to investing in digital assets for the second year in a row. The recent price increases have not scared off investors; instead, more consider digital assets to be a value opportunity and value the diversification benefits.

Client demand seems to be losing momentum, which could come from the fact that the investment platforms are now easier to access. Even though there have been some recent U.S. ETF approvals, the fact of regulation remaining as the main barrier for investors is still there.

Greater accessibility is a very big concern, as reflected in this. Other issues, such as corporate restrictions and basic doubts, have turned out to be less.

Regulation and political risks are still the major causes of anxiety for people who are already invested, even though Bitcoin and Ethereum ETPs have made some progress. Both of these concerns, protocol design and hash power concentration, have been relegated to less significant issues now.

The U.S. Federal Reserve’s policy division is very evident, with a decrease in the number of undecided opinions after the 50 basic points rate cut in September.

Related | Cardano’s 490 SATS Target: Analyst Faces Severe Backlash