Twenty One Capital brings forward an innovative method to redefine how businesses implement Bitcoin strategies. Jack Mallers launched Strike before founding Twenty One Capital, which arrives in the market backed by strong institutional support. Tether provided 23,950 BTC, together with SoftBank adding 10,500 more of the digital currency. Public listing became possible when Cantor Fitzgerald used a reverse merger with Cantor Equity Partners.

The firm earns such support because people strongly believe in its organizational objectives. Mallers’s leadership serves as the key foundation for the strategy. His previous accomplishments in Bitcoin adoption demonstrate expertise, which he now utilizes to make Bitcoin an indispensable asset for organizational treasury management systems. Traditional institutions and crypto-native thinkers from the firm pursue strategies to merge digital assets with mainstream finance through their collaborative efforts.

A capital-efficient model for Bitcoin investment

The initial startup of Twenty One Capital involves 42,000 Bitcoin, worth approximately $3.9 billion. The company will start trading on Nasdaq under the ticker symbol XXI. The firm’s future growth will be funded by $585 million acquired through convertible bonds and equity issues.

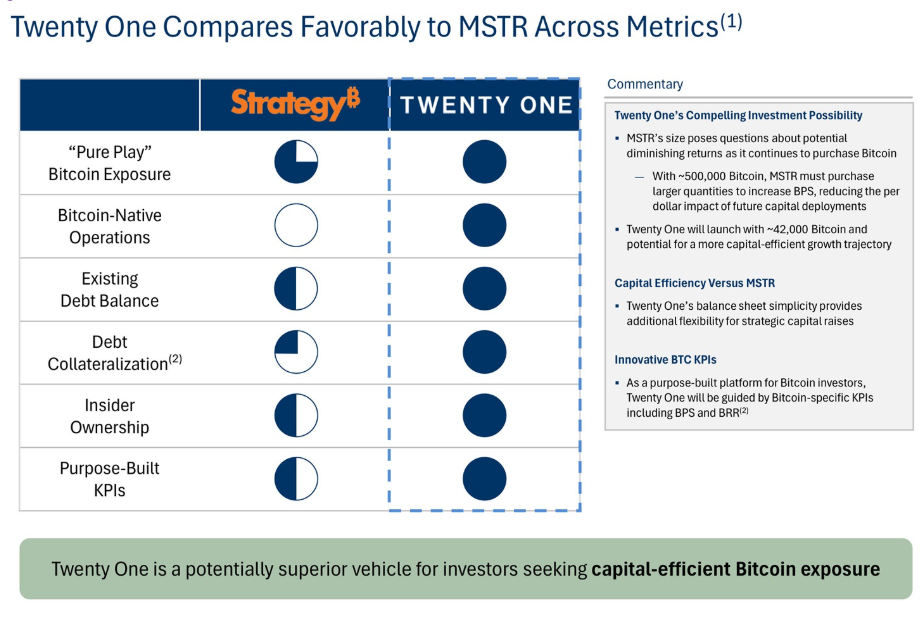

Twenty One Capital maintains a strategy that is different from that of MicroStrategy. It purchases Bitcoin using stock sales, while MicroStrategy decreases shareholder value through stock sales. By implementing this method, investors gain stronger exposure without suffering any equity dilution effects. The firm advances capital efficiency as its prioritized strategy to position itself as an investor-friendly choice among companies adopting Bitcoin.

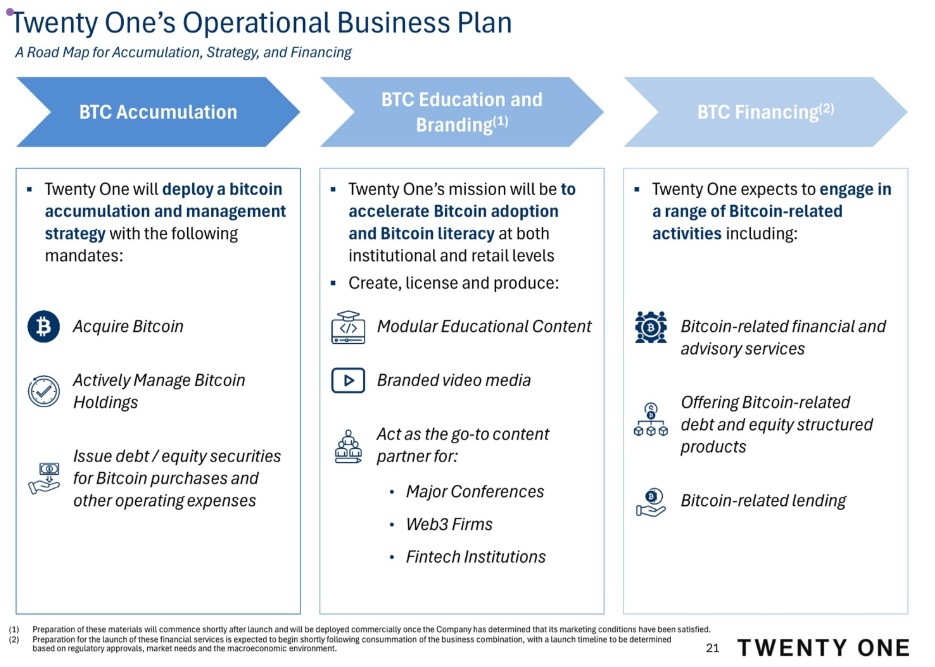

Beyond holding: building a Bitcoin ecosystem

Furthermore, Twenty One Capital extends beyond basic Bitcoin maintenance services. The upcoming Bitcoin-based products from Twenty One Capital will allow investors to access cryptocurrency while retaining ownership flexibility. Advisory services will offer clients help to understand Bitcoin’s long-term strategic value, while the lending platform will give liquidity access through Bitcoin-backed loans.

In addition, the firm will start educational programs that will develop Bitcoin knowledge for retail investors along with institutional investors. The company promotes Bitcoin integration for financial applications by combining various usage domains, including investments and loans, with educational programs. Twenty One Capital uses this complete strategy to handle Bitcoin and establish new directions in crypto finance.