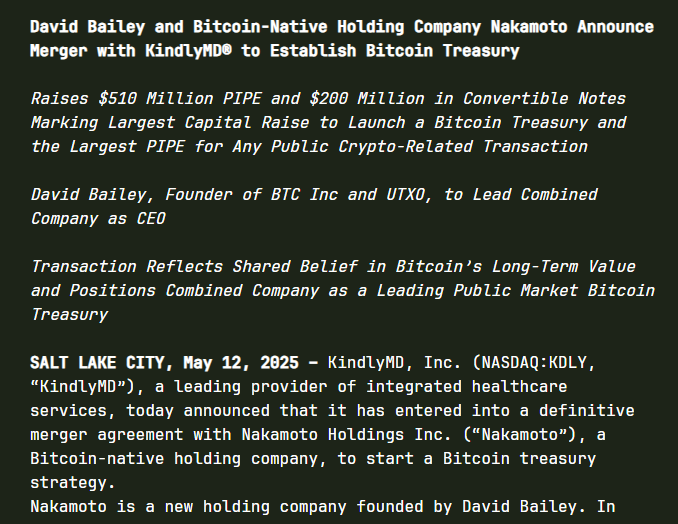

Nakamoto Holdings has combined forces with KindlyMD to create the native treasury ecosystem for Bitcoin. David Bailey founded Nakamoto Holdings to bring Bitcoin to traditional finance. The merger intends to facilitate the establishment of a global network through which companies can legally have Bitcoin on their balance sheets without any back cover.

Merging Bitcoin with corporate finance

The firm wants to develop a Bitcoin-first financial system. It will provide equity, debt, preferred shares, and new hybrid securities directly linked to Bitcoin. Such instruments will be listed on the world’s leading stock exchanges. Therefore, the strategy will make Bitcoin-linked investment options more accessible to institutional and retail investors.

Essential to the strategy is developing a network of firms focused on Bitcoin. These include media services, advisory, and financial services. Furthermore, the ecosystem will stimulate Bitcoin’s growth and promote the use of the digital currency in various sectors.

Backed by $710 million in new capital

The company collected $710 million to finance the merger and future development, including $510 million from a private equity placement at $1.12 per share. Investors obtained common stock and pre-funded warrants in KindlyMD.

Another $200 million was from selling secured convertible notes that will mature in 2028. These funds will be used to purchase Bitcoin and develop ecosystems. The model reflects tactics pursued by firms such as MicroStrategy. The company will use debt and equity to boost the number of Bitcoins held per share.

Building trust through compliance

The new entity will provide exposure to Bitcoin using a fully compliant mechanism. This guarantees investor confidence and is legal. The firm intends to list its Bitcoin-based instruments in leading exchanges to increase accessibility and liquidity.

KindlyMD will continue trading on Nasdaq under “KDLY” until the rebranding is complete. The boards of both firms approved the deal, which now awaits shareholder approval. The combined company will also inherit partnerships with BTC Inc., the publisher of Bitcoin Magazine, and the Bitcoin Conference. These ties will help strengthen the company’s reach and credibility in the Bitcoin space.