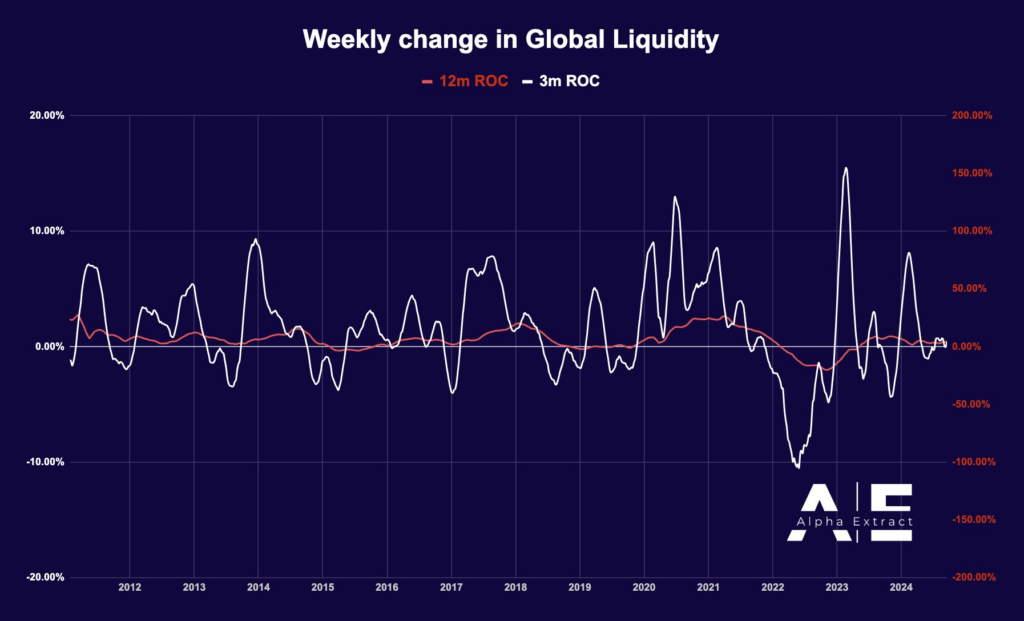

A significant surge in liquidity is pointing toward a bullish run for Bitcoin, according to crypto expert Alpha Extract. The liquidity index saw an impressive boost of $2.26 trillion last week, indicating favorable conditions for Bitcoin’s performance.

In a post on X, Alpha Extract noted the surge marked a 1.76% increase, pushing liquidity levels beyond the 2023 all-time high (ATH). They explained that the rally Bitcoin has experienced recently wasn’t unexpected: “It’s been perfectly in step with our liquidity measure, just as we anticipated.” .

This increase in Bitcoin’s value is mainly due to China’s rapid growth in lending and the U.S. Federal Reserve providing more money. This shows that Bitcoin’s price is closely connected to global liquidity levels.

The expert said the European Central Bank’s recent 0.25% rate cut shows global central banks are getting ready to lower rates more. If the U.S. Federal Reserve cuts rates by 0.5% this week, Alpha Extract predicts the ECB may do the same in October. This would increase the global money supply as China tries to fight deflation.

September could mark a bullish shift for Bitcoin

Meanwhile, analyst Michaël van de Poppe commented on the upcoming FOMC meeting. He predicted faster-than-expected interest rate cuts. This is due to worsening labor markets and the economy. He suggested Bitcoin and gold as key assets in the current situation.

Looking forward, Alpha Extract’s chart shows September may see Bitcoin rise. Even bigger moves are likely in the coming months. Their Global Liquidity (GL) Index has stabilized. However, Bitcoin’s liquidity is increasing. This means Bitcoin is ready to rise. “The connection is undeniable,” they said. Bitcoin has always followed increases in liquidity.

This trend of interest rate cuts and extra money from central banks across the world may help Bitcoin keep rising. This supports Bitcoin as an important asset in financial markets.

Related | BaseBros DeFi pulls rug with unverified smart contract