The frenzy surrounding meme coins is fading fast. Once the hottest trend in crypto, these speculative assets are losing steam. Traders are shifting back to Bitcoin, Ether, and Layer-1 coins. The shift signals a return to fundamentals and a departure from hype-driven speculation.

Crypto markets have seen these cycles before. The 2020 DeFi boom followed a similar trajectory. Early adopters made fortunes before the bubble burst. Memecoins now follow the same path. A handful of insiders profited, while latecomers held worthless tokens. The game is up, and traders are moving on.

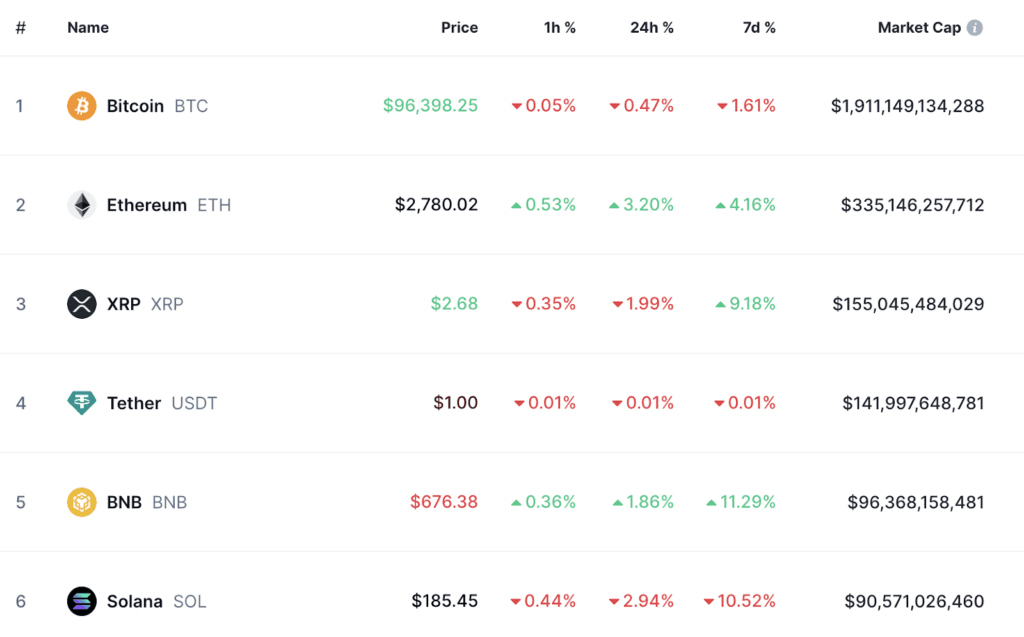

Bitcoin and L1s gain as hype-driven coins decline

Social sentiment confirms this shift. Crypto analytics firm Santiment reports a surge in discussions about Layer-1 projects. Memecoin chatter has dropped to a mere fraction of its former dominance. Investors are focusing on assets with real utility and staying power.

Market maturity plays a role in this evolution. Wild speculation tends to precede corrections. When hype fades, reality sets in. Traders now seek assets with tangible value. Bitcoin remains the market leader, while Ether and other Layer-1s gain traction. Stability and long-term growth are replacing quick gains and fleeting trends.

Even Binance Coin (BNB) is seeing renewed interest. Its market cap recently surpassed Solana, making it the fifth-largest cryptocurrency. BNB’s rise reflects the shift toward established ecosystems and away from unpredictable meme coins.

Not all meme coins have vanished. Some still make waves, like Broccoli (BROCCOLI), which is linked to Binance founder Changpeng Zhao’s dog. The novelty sparks curiosity, but seasoned traders see past the gimmick.

This market transition suggests healthier conditions ahead. Speculation drives volatility, but utility sustains value. Crypto is maturing, and the focus is shifting to assets built for the long haul. The memecoin era may not be over, but its dominance is waning. Fundamentals are back in the spotlight, and real projects are ready to shine.