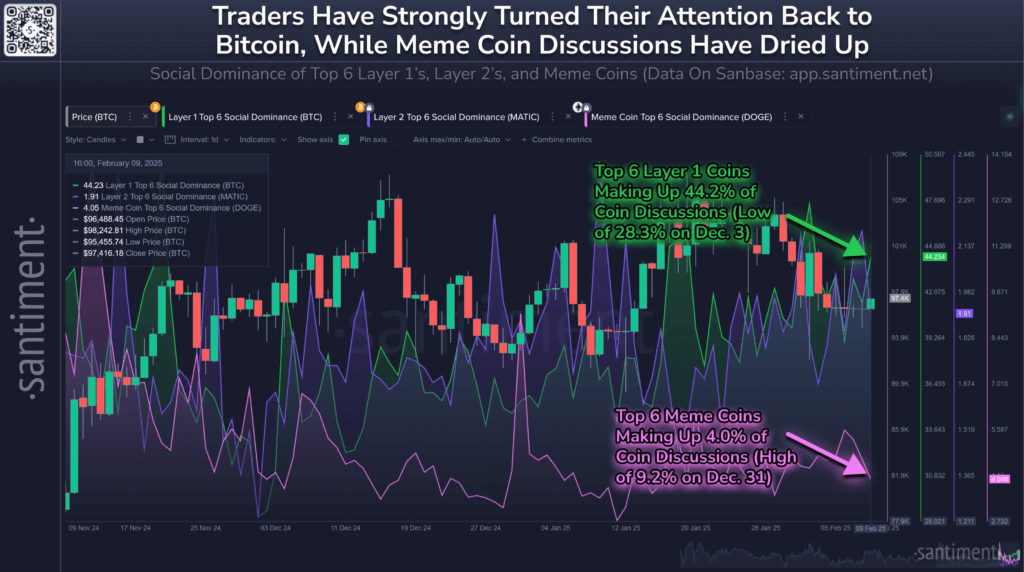

Crypto markets are shifting, and the signs point to a more stable cycle. Traders are turning away from speculative meme coins, focusing instead on Bitcoin, Ethereum, and other Layer 1 assets.

Data from on-chain analytics platforms confirm this trend. Discussions surrounding major Layer 1 blockchains now make up a significant share of crypto conversations, while meme coin chatter declines.

Hype and viral trends often fuel meme coin surges. These assets attract speculative traders looking for quick profits rather than long-term value. When markets center around meme coins, excessive greed usually follows. Price swings become unpredictable, and corrections hit hard. A market dominated by fundamentals is healthier, with fewer extreme fluctuations.

Bitcoin and Layer 1 blockchain provide the foundation for decentralized finance, smart contracts, and network security. Increased attention to these assets suggests traders are making more informed decisions. The shift to Layer 1 signals a more sustainable environment, focusing on innovation and real-world applications instead of speculative frenzies.

Price surges in meme coins often precede downturns. Investors chasing short-term gains create bubbles that eventually burst. As traders move back to established assets, volatility eases. The current cooling-off period reflects a more mature phase in the market. While meme coins will likely have future rallies, their influence is fading for now.

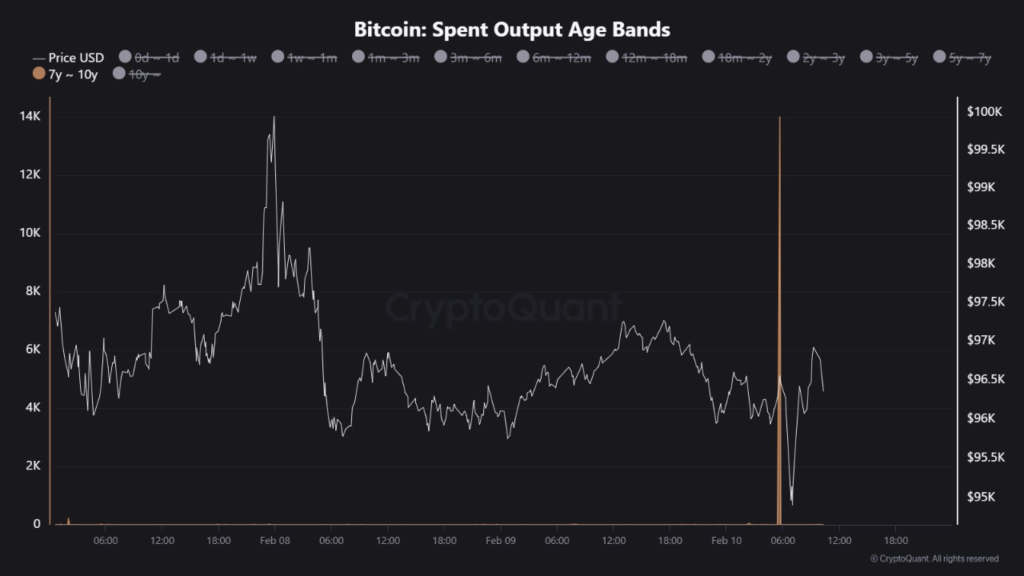

Bitcoin movement and market implications

Another development is the movement of old Bitcoin holdings. On Feb. 10, 14,000 Bitcoins, dormant for years, started moving. Despite the large volume, no transfers to exchanges occurred. This suggests no immediate plans to sell. Market reactions to such movements vary. Past instances have not always led to price drops. Tracking historical data provides a clearer picture of potential effects.

The acquisition price of these coins remains low. Holders may choose to sell if market conditions favor profits. However, long-term investors often wait for strategic opportunities. Their decisions could shape Bitcoin’s price trajectory in the coming months.