Japanese investment company Metaplanet issued $21 million in zero-interest bonds to Evo Fund, an investment firm based in the Cayman Islands. This follows just a day after announcing a separate $50 million raise, further accelerating its Bitcoin accumulation strategy.

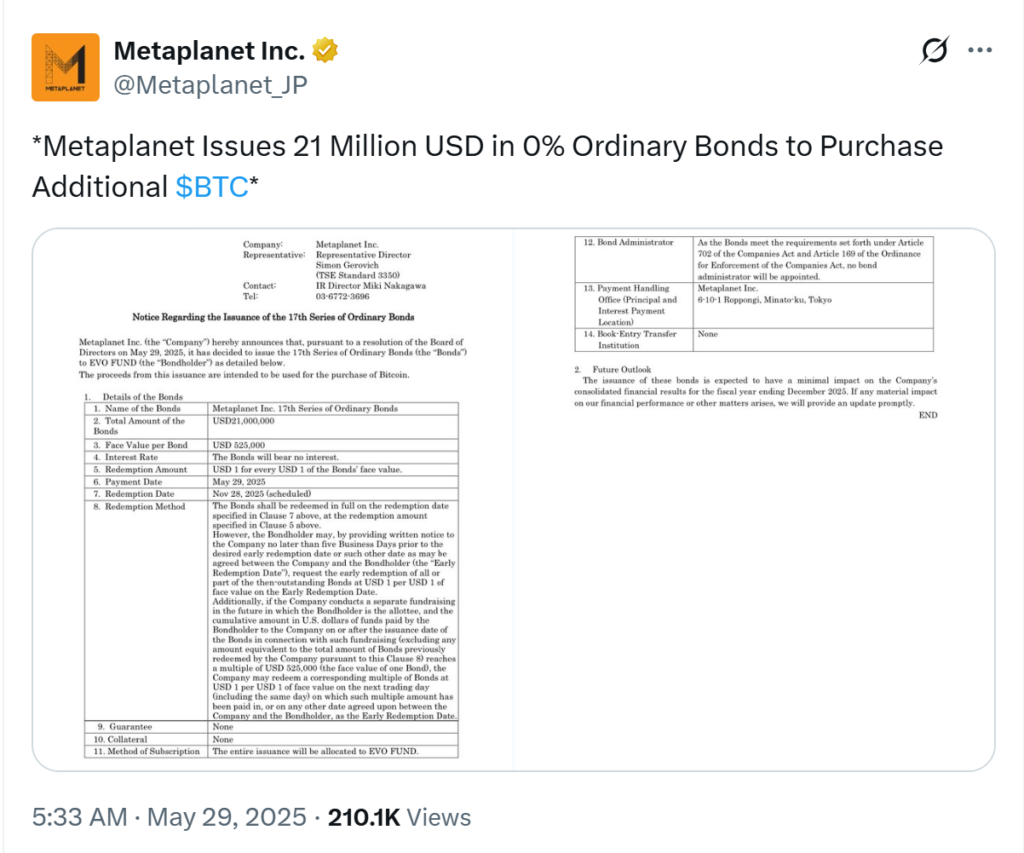

The 17th round of bonds was released on May. 29. Each bond is worth $525,000 and will reach maturity on Nov. 28, 2025. Unlike traditional debt instruments, these bonds don’t pay interest. That means Metaplanet to borrow money without owing anything extra.

Metaplanet’s bold $135M bet on Bitcoin

Evo Fund can redeem the bonds early by giving at least five business days’ notice. They can redeem all or part of the bonds, but any partial redemption must be in multiples of $525,000. Metaplanet might also trigger repayments linked to future fundraising rounds with the same investor, depending on the total payments made.

There’s no collateral or guarantee tied to the bonds, and no bond administrator has been appointed, as allowed under Japanese corporate law. The company has chosen its Tokyo office to manage the payments.

Metaplanet has consistently borrowed money to buy Bitcoin. They raised $25.9 million in February, $13.3 million in March, and another $25 million in early May.

The company’s aim is to hold 10,000 BTC by the end of 2025. With back-to-back fundraising this week, Metaplanet raised a total of $135.2 million this year.

Metaplanet announces US subsidiary

Metaplanet owns about 7,800 Bitcoins, ranking it 11th among the biggest corporate Bitcoin holders, according to BitcoinTreasuries.NET. Their Bitcoin stash is currently worth around $840 million, with an average purchase price of $91,340 per coin.

In March, the company added 696 BTC by exercising cash-secured put options and collecting premiums from selling those contracts. Then, just before the end of April, they bought another 145 BTC for $13.6 million.

On May. 1, Metaplanet announced the launching of a fully owned US subsidiary called Metaplanet Treasury in Florida. The company plans to raise up to $250 million to advance its Bitcoin strategy and access US capital markets.