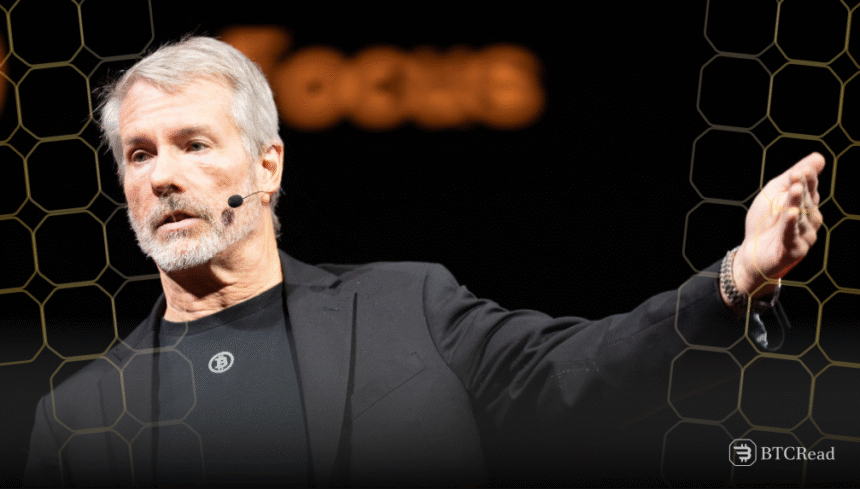

Michael Saylor, the executive chairman of Strategy (previously known as MicroStrategy), has again mentioned another Bitcoin purchase, demonstrating his continued dedication to it. The action reflects the company’s efforts to grow its huge Bitcoin stock and maintain its lead in digital assets.

Recent acquisition and the 21/21 plan

Between May 19 and May 25, 2025, Strategy purchased 4,020 additional Bitcoins and now holds a total of 580,250 BTC. At-the-market equity, debt, and preferred stock deals raised the money for the $427.1 million transaction. On average, a Bitcoin costs $69,979, which reflects careful and planned accumulation.

Moreover, as part of what they call the 21/21 Plan, this acquisition is expected to help raise a total of $42 billion for buying bitcoins. The project has caught the eye of organizations such as U.S. state pension funds and treasuries. It highlights that Strategy remains confident in its plan to focus on Bitcoin in the long term.

Saylor’s vision and market impact

Saylor supports Bitcoin, not just as part of business decisions. At the CPAC conservative conference, he recommended that the United States acquire at least 20% of all Bitcoin holdings. He thinks that by doing this, America would build more financial strength and take a leading role in the digital economy.

Furthermore, Investors have found the Strategy’s aggressive approach persuasive. The company’s stock has grown, finishing at $369.06 with a market capitalization of $80.59 billion. Therefore, this shows that investors are confident in the Strategy’s primary focus on treating Bitcoin as a major treasury asset.

Michael Saylor plans to accelerate Bitcoin by using it in his business and as a larger economic concept. The company’s firm financial plans, vast portfolio, and ongoing market interest help it stay at the forefront of the cryptocurrency world. As Saylor discusses further deals, Strategy’s actions indicate that it is prepared to lead rather than join the Bitcoin era.