Strategy bought thousands of BTC despite the recent decline in prices. The Nasdaq-listed company, formerly MicroStrategy, made the purchase after a brief pause. Co-founder Michael Saylor announced the buy on X and said the company had bought a lot more Bitcoin.

This is the first time Strategy has bought BTC since the rebrand and 2024 Q4 earnings release. The company is showing no signs of slowing down on Bitcoin, even as market watchers speculate on institutional adoption.

Strategy buys 7,633 BTC, now holds 478,740 BTC

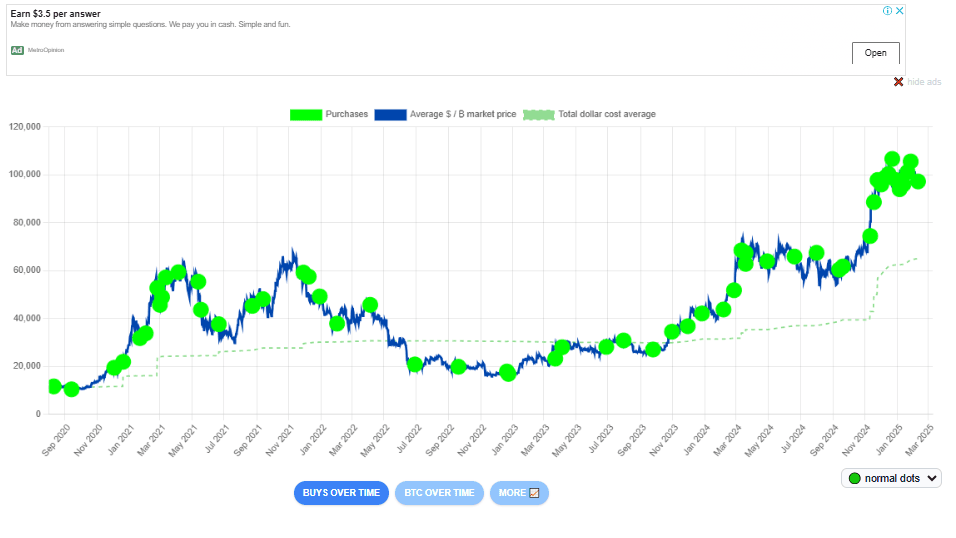

Strategy bought 7,633 BTC for $742.4 million at an average price of $97,255 per Bitcoin. According to its latest filing with the U.S. Securities and Exchange Commission (SEC), the company now holds 478,740 BTC worth $31.1 billion. At its current price of $97,500, the company’s Bitcoin is worth over $46.6 billion, up more than $15 billion.

Despite reporting a $670 million Bitcoin impairment loss in Q4 earnings, the company continued to buy more BTC. Shareholders recently approved a major expansion of its at-the-market (ATM) stock program, allowing Strategy to raise more money to buy more Bitcoin.

Rebrand means more Bitcoin

Last week, MicroStrategy rebranded to “Strategy” and dropped the “Micro” to align with its Bitcoin-first vision. The company also launched a new Bitcoin logo to emphasize its long-term accumulation plan. Saylor introduced the firm’s “21/21” vision to hold $42 billion in Bitcoin by 2027.

This rebrand is a big moment for Strategy as it reinforces its identity as the largest corporate Bitcoin holder. The company has been using equity sales to fund its BTC purchases, and the latest purchase was financed through stock and preferred stock offerings. A Feb. 5 public offering of 7.3 million shares of its 8% Series A Perpetual Strike Preferred Stock raised an additional $563 million to buy more Bitcoin.

Market Impact and Institutional Influence Strategy’s BTC buying is still impacting institutional sentiment and supply. The company’s accumulation has helped to stabilize the price and create a strong support range of $91,000 to $108,000.

Beyond corporates, Strategy’s approach is now influencing global companies, with Tokyo-based Metaplanet Inc. and Indian firm JetKing following in its footsteps. Market chatter is growing, and nation-states, particularly the US, may consider Bitcoin in the future. With institutional demand rising, some are predicting Bitcoin’s price will follow gold’s long-term trends.