Moscow Exchange (MOEX), Russia’s largest stock exchange, has started futures trading for BlackRock’s iShares Bitcoin Trust ETF (IBIT), as the fund moved into the world’s top 25 ETFs by assets under management (AUM).

According to an announcement, MOEX launched a new futures contract based on the IBIT index on June. 4. The new investment product is only available to accredited investors, and MOEX plans to start qualification testing from June. 23.

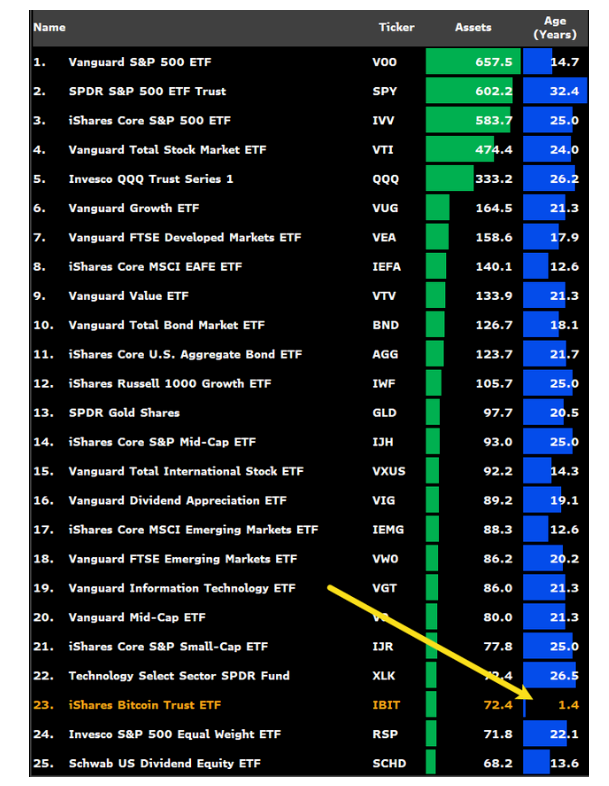

The launch comes as IBIT joins the list of the top 25 ETFs globally by assets, with $72.4 billion under management, according to Bloomberg’s senior ETF analyst Eric Balchunas.

Crypto investment options expand in Russia

Moscow Exchange’s IBIT futures trading debut is the latest crypto investment product launched in Russia since the Bank of Russia allowed financial institutions to offer crypto products to qualified investors in May.

Following approval, major local banks like Sber and T-Bank (formerly Tinkoff Bank) have started offering investment products linked to cryptocurrencies like Bitcoin.

Despite this growth, the Russian central bank is still cautious about direct crypto investments and continues to advise regular people against involving in digital asset markets.

Russian IBIT futures fail to impress retail investors

Since IBIT ETF futures are only available to accredited investors, many regular investors aren’t impressed by the latest crypto developments in Russia.

“Not actual ETFs from the US, just copies. They don’t affect the crypto market at all,” one annoyed observer commented on the DeCenter channel on Telegram.

Another commentator suggested they’d rather trade cryptocurrencies directly on exchanges like Binance than use crypto investment products on MOEX.

According to official MOEX data, 36.9 million people had brokerage accounts as of May. Last month, at least 3.6 million people traded on the MOEX stock market, including 315,000 qualified private investors.

BlackRock’s IBIT has continued growing rapidly since it launched in Jan. 2024. By June. 3, the ETF had already made it into the global top 25 list based on assets under management, something it achieved in just over a year.