Twenty states within the United States presented legislative bills on Feb. 14th to set up Bitcoin reserves. The proposed measures would deliver $23 billion to the Bitcoin market, which would translate into 247,000 BTC if implemented. The growing institutional viewpoint on digital assets and their capability to enhance financial plans at the state level forms the basis of this development.

State-level investment initiatives

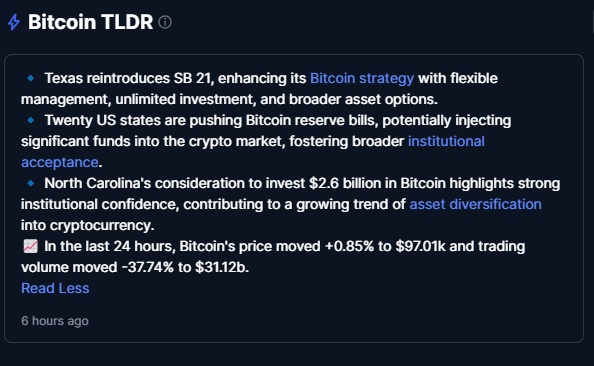

The suggested law includes different state-based investment vehicles, such as reserve funds alongside pension plans. Crypto investment plans have gained state-level support through budget surpluses, stabilization funds, and land fund proposals. The state of Oklahoma plans to dedicate 10 percent of its $14.7 billion resources to Bitcoin purchases, which would result in acquiring more than 15,000 BTC.

Oklahoma, Massachusetts, and Texas represent three states that have initiated Bitcoin investment plans. Oklahoma state officials plan to distribute 10% of its $14.7 billion funding to acquire more than 15 thousand Bitcoins. The “Rainy Day” fund of Massachusetts, of $8.8 billion, seeks to allocate resources to Bitcoin investments to achieve portfolio diversity. Texas intends to dedicate at least 1% of its unreserved revenue toward crypto investments. The state also demonstrates a rising interest in Bitcoin for its financial plans.

Legislative Challenges and Uncertainties

The passing probability of these bills remains uncertain. States like Pennsylvania, Wyoming, and North Dakota have already rejected them. The evaluation of Bitcoin demand comes to $23 billion due to state pension funds and projected Bitcoin investments being omitted from consideration.

Multiple American states currently display interest in enhancing their investment asset diversity by including Bitcoin and similar digital currencies. Different states have introduced bills about digital currencies, yet their outcomes remain uncertain. Such a potential $23 billion investment into the crypto market would produce major price modifications coupled with market fluctuations.

Various us states are considering using their reserves to transform financial operations. This is caused by institutions continuing to invest heavily in digital currency. The current legislative process dealing with crypto market investments shows states are evolving their financial strategies, but the final outcomes remain unknown.