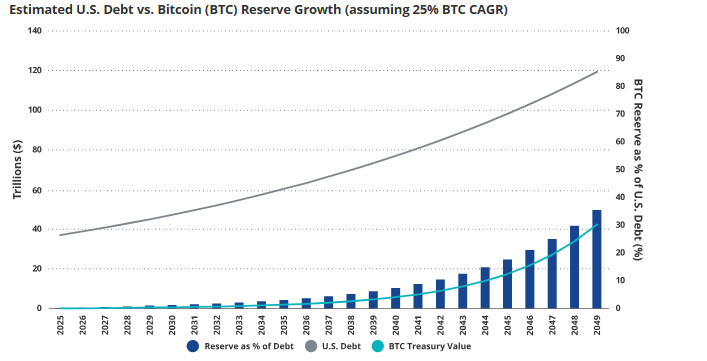

VanEck’s latest report paints an ambitious picture for Bitcoin potential in reshaping the U.S. financial landscape. It suggests that adopting Bitcoin as a strategic reserve asset could slash national debt by 36% by 2050.

If Bitcoin continues to grow at a yearly growth rate of 25%, its price will reach a mindboggling $42 million by 2049. VanEck recommends that the U.S. government stop selling the seized Bitcoins and start buying more Bitcoins using the ESF.

Market sentiment is very bullish after Bitcoin’s breakout above $100,000 on Dec. 5th and its high of $108,000 on Dec. 17th. Institutional adoption is on the rise, along with altcoin activity and a growing crypto-AI space. While there are potential retracements of as much as 40%, the long-term outlook for 2025 is one of further growth.

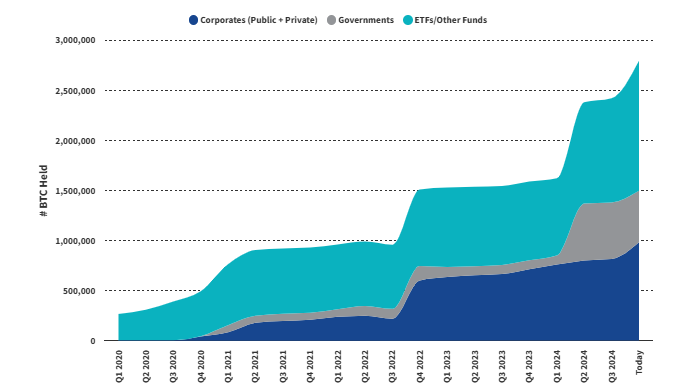

Institutional treasuries are also accelerating BTC adoption. MicroStrategy’s inclusion in the Nasdaq-100 is a milestone, indirectly exposing ETFs and funds to its vast Bitcoin reserves.

Sovereign interest reflects corporate momentum, and President-elect Donald Trump has emphasized Bitcoin’s role in U.S. dominance across AI, energy, and finance. State-level adoption is heating up. Pennsylvania has proposed allocating 10% of its $7 billion rainy-day reserve to BTC. Other states, like Florida, Alabama, Texas, Ohio, and Wisconsin, are also showing strong interest in strategic reserves.

National Bitcoin strategy: Trump and the BITCOIN Act

On the national stage, Trump doubled down on the BITCOIN Act, promising a national Bitcoin reserve. The U.S. Financial Accounting Standards Board added further corporate adoption, allowing companies to value Bitcoin at current market prices starting in 2025.

That means BRICS countries are making their way to advance BTC strategies globally to decrease dependence on the U.S. dollar. Russia, Brazil, and China are making major moves in mining, legislation, and the allocation of reserves. Other players also include Suriname, the UK, Poland, Japan, and Australia, which are integrating BTC into their financial systems.

Institutional accumulation remains strong, with public companies and ETFs holding close to 985,000 BTC. The United States has the opportunity to avoid mistakes such as that of Germany, which was seen to sell off some of its BTC some time ago and thereby incurred considerable opportunity costs.

With the BITCOIN Act in place, for example, the U.S. Treasury might acquire as many as 1 million BTCs until 2029. By 2049, that could cover up to 35% of the national debt, offsetting liabilities totalling $42 trillion. Bitcoin’s emerging function as a strategic asset, in turn, portends a sea change for global finance.