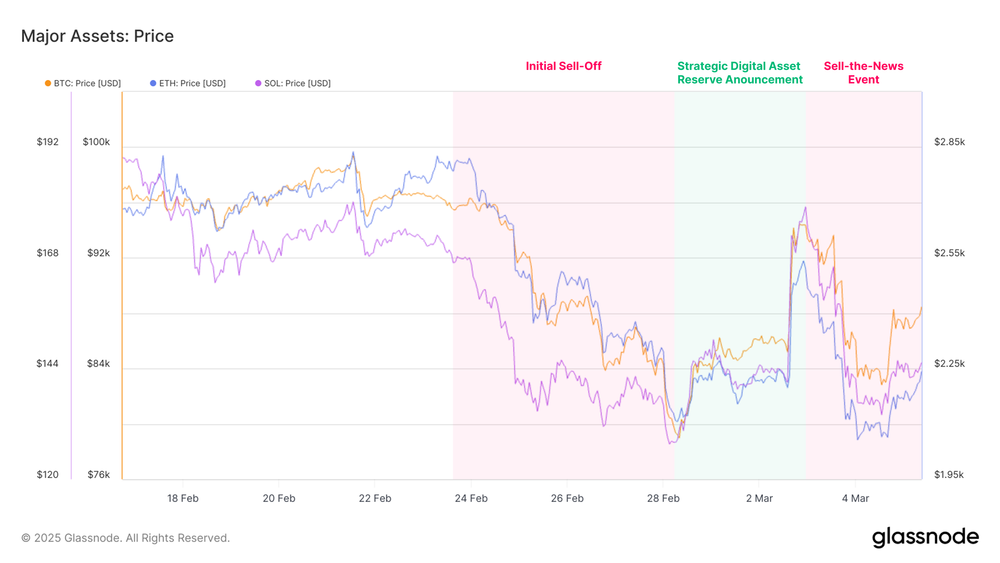

The crypto market has faced sharp price swings, driven by heavy selling and an uncertain economic outlook. Over the weekend, President Trump announced plans for a US Strategic Crypto Reserve, including Bitcoin, Ethereum, Solana, Cardano, and XRP.

As per the latest report by Glassnode, prices surged briefly but quickly reversed, turning into a “sell-the-news” event. Bitcoin remained more stable due to its size and liquidity, but Ethereum and Solana dropped over 50% from their highs.

Bitcoin dips below $86K, investors face losses

Volatility spiked, with Bitcoin’s one-week and two-week realized volatility exceeding 80%. On-chain data showed Bitcoin dipped below $86K, a level with little prior trading activity. Between Feb.26 and March 3, over 150,000 BTC ($14.2 billion) were acquired in this price zone. Investors holding coins above $90K now face losses, raising concerns about potential sell-offs.

The Realized Supply Density metric revealed that investor profitability changed significantly due to price drops. Supply concentrated around the current price saw extreme volatility, signaling sharp sentiment shifts.

Despite Bitcoin’s relative strength, the recent decline marked its second-largest weekly drop of this cycle at -13.9%. The worst weekly drop was in Aug. 2024 due to the yen-carry-trade unwind.

Investors have been offloading coins aggressively. Since mid-January, all wallet sizes have contributed to sell-side pressure. Many sold at a loss, with Realized Loss reaching $818 million per day this week. The only larger daily loss came on Aug. 5, 2024, at $1.34 billion.

Short-Term Holder SOPR, a key metric for new demand, posted its second-largest negative print of the cycle, indicating severe losses for new investors. Market sentiment remains fragile.

Key price levels to watch

Bitcoin’s price structure highlights key levels. The market broke out at $70K in Nov. 2024, surged past $80K, then consolidated near $90K. The Short-Term Holder cost basis sits at $92K, with the upper and lower bands at $130K and $71K. Bitcoin recently dipped below this level, now trading between $92K and $71K.

The Active Realized Price, considered a key bull/bear market threshold, stands at $70K. This aligns with other cost-basis metrics, marking it as a crucial support level. If Bitcoin loses momentum, $71K becomes a key area for bulls to defend. The market remains highly volatile, with investors closely watching these levels for signs of recovery or further losses.