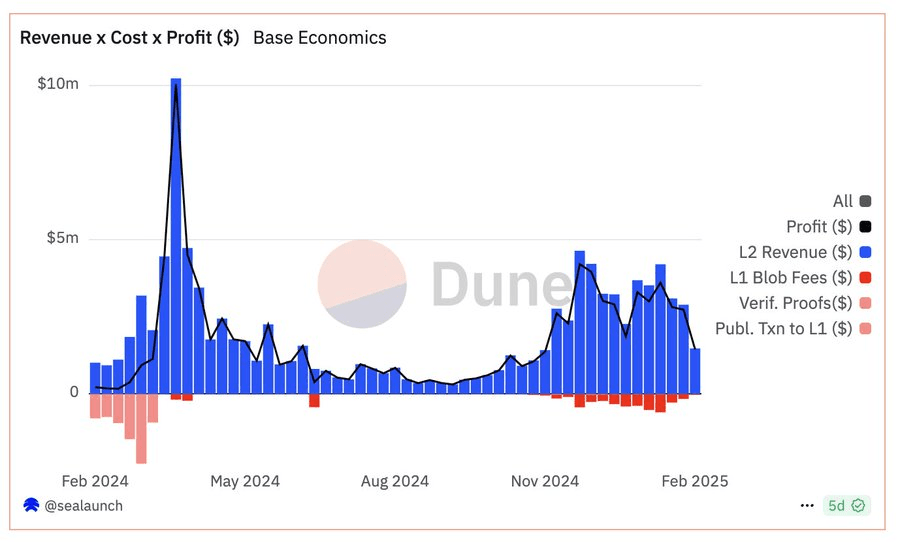

The Ethereum layer-2 ecosystem is facing serious tension. The debate over whether L2 networks truly support ETH’s long-term value is heating up. Many believe these networks profit heavily while giving little back to Ethereum’s economic foundation. The discussion has turned into a battle of claims and counterclaims among key figures in the space.

At the core of the issue is Ethereum’s design. The network handed off key parts of its infrastructure, MEV, congestion pricing, and execution, to L2s. In return, it kept lower-value roles like settlement and data availability. This has created an economic imbalance where L2s make huge profits but contribute only a small fraction, sometimes as little as 1% back to ETH.

Vitalik Buterin’s proposal for Ethereum support

To compensate, Ethereum advocates pushing the idea that L2s expand ETH’s reach. They argue that Ether’s monetary premium, like Bitcoin’s, matters more than revenue. However, this economic structure has led to friction. Some L2s hold large amounts of ETH, while others sell it off.

Debates rage over which networks are truly “ETH aligned.” Vitalik Buterin suggested a solution: encourage L2s to support Ethereum by burning fees, staking ETH, or donating to public goods. However, no technical enforcement exists.

Instead, Ethereum relies on social pressure, pushing L2s to contribute more voluntarily. Those who refuse are called out for not supporting the network. The result is constant infighting about which L2s are most aligned.

This debate, however, ignores a bigger issue. L2s are businesses. They optimize for profit, not Ethereum’s economic health. It isn’t their responsibility to fix Ethereum’s revenue problems. Ethereum’s decision to offload value to L2s created this situation. Expecting L2s to give back revenue without incentives is wishful thinking.

The conflict will escalate when L2s start accepting stablecoins for gas fees. Right now, that idea is taboo. Ethereum proponents insist that ETH must remain the primary gas token. But if one major L2 allows stablecoins for gas, others will follow.

The improvement in user experience is too significant to ignore. Networks will convert a small portion of stablecoin revenue into ETH for settlement while keeping the rest in stablecoins. This change could further weaken ETH’s role in L2 economies.

Solving these issues requires action at the center of Ethereum. First, L1 scaling must be accelerated via gas limit increases, EVM optimizations, and increased blobspace. Second, native rollups must be prioritized to regain MEV and congestion gas income.

Third, the discussion must begin with integrating third-party rollups into native Ethereum infrastructure. These changes may restore balance, but without them, the economic ills of Ether will persist.