The real estate industry may be on the verge of a major shift as a new report projects that over $4 trillion worth of real estate could be tokenized on blockchain networks by 2035. This move could give investors broader access to property ownership and new investment opportunities.

Tokenization, built on blockchain technology, transforms physical and financial assets into digital representations. Investors can buy these in small portions through secure digital platforms.

This process could help real estate organizations reduce operational inefficiencies and high administrative costs while increasing participation from retail investors. Since the first tokenized real estate deals eight years ago, the technology has opened new investment paths through fractional ownership.

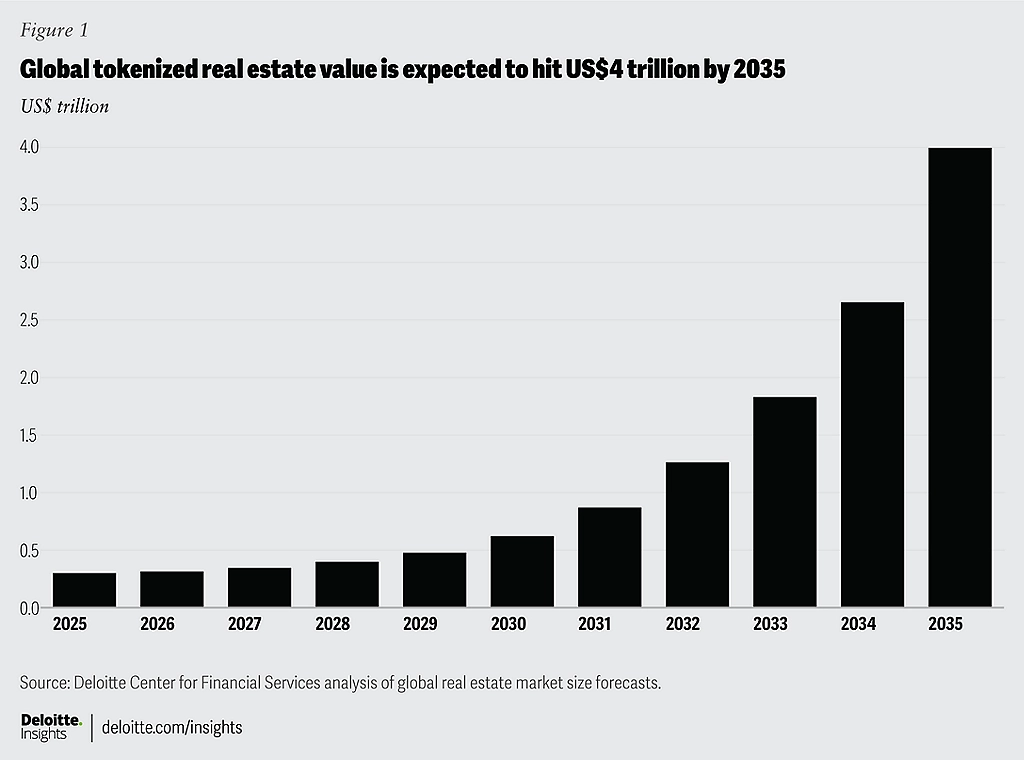

Analysts predict this technology could spark trillions of dollars in economic growth within the sector over the next decade. The Deloitte Center for Financial Services forecasts a rise from less than $300 billion in 2024 to $4 trillion by 2035, with a 27% compound annual growth rate.

Tokenized real estate funds offer strong potential

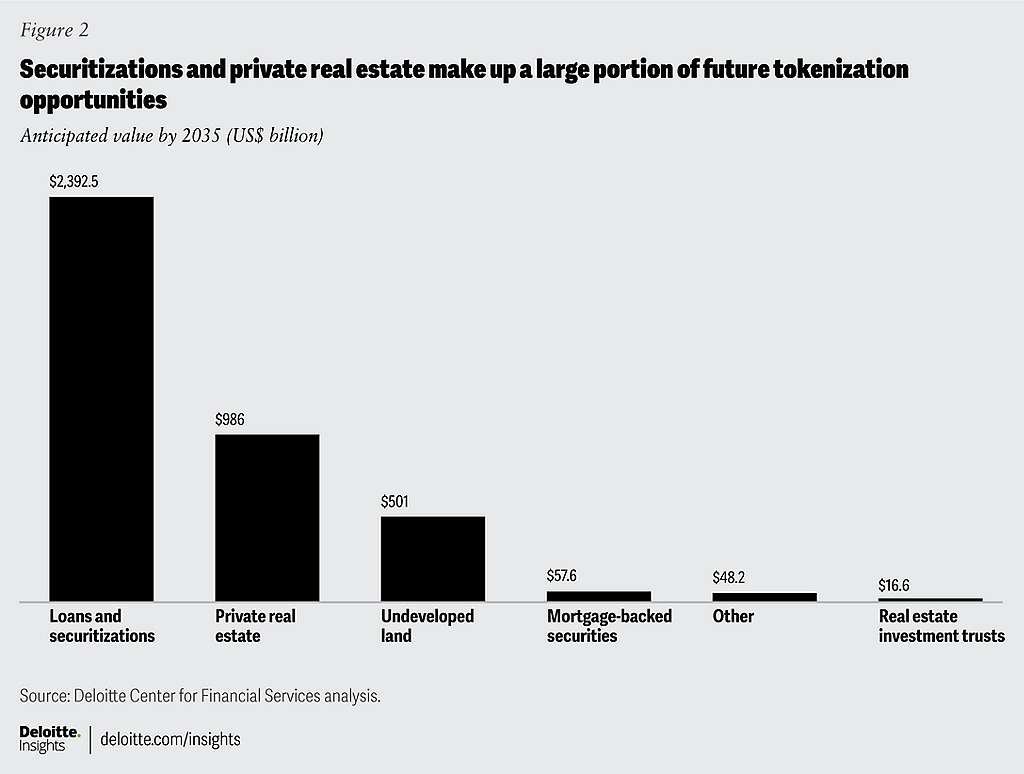

Three major components of this forecast include tokenized private real estate funds, tokenized ownership of loans and securitizations, and tokenized ownership of undeveloped or under-construction properties.

Among these, tokenized loans and securitizations are expected to lead, reaching $2.39 trillion by 2035. Tokenized private funds could grow to $1 trillion, and undeveloped land and projects may account for $50 billion.

Real estate funds seem to fit well with tokenization models. Blockchain-based platforms could streamline fund issuance, asset servicing, and secondary market trading.

This could reduce intermediaries and create faster, more efficient operations. Existing funds may either tokenize current structures or create new blockchain-based funds using agreements between lenders and borrowers.

Blockchain revives interest in securitized loans

Tokenization also promises more personalized investments. Investors could select tokens based on sustainability scores or location preferences, such as proximity to airports. New systems could enforce compliance, capital calls, and distributions automatically through coded rules embedded in the tokens.

Securitized loans are also attracting attention despite past financial crises. Blockchain-backed securities are showing faster reporting times and cost savings. Companies like Redwood Trust and Figure Technologies have already demonstrated notable improvements in loan securitization and cost reductions through blockchain use.

In addition, tokenization is fueling financing solutions for infrastructure and residential projects. Deals like the $300 million Project Champfleury in Canada and a $1 billion global data center fund in India show the potential scale of new tokenized developments.

Growing marketplaces and exchanges for tokenized assets could further accelerate adoption, providing real-time transparency and liquidity for investors.