The BNB Chain network’s NFT market saw impressive growth in Q3, with trading volumes surging by 283%. The daily average jumped to $600,400, up from $156,900 in Q2. Despite this boost, the number of buyers dropped 53%, showing that whales drove the recovery, not smaller traders.

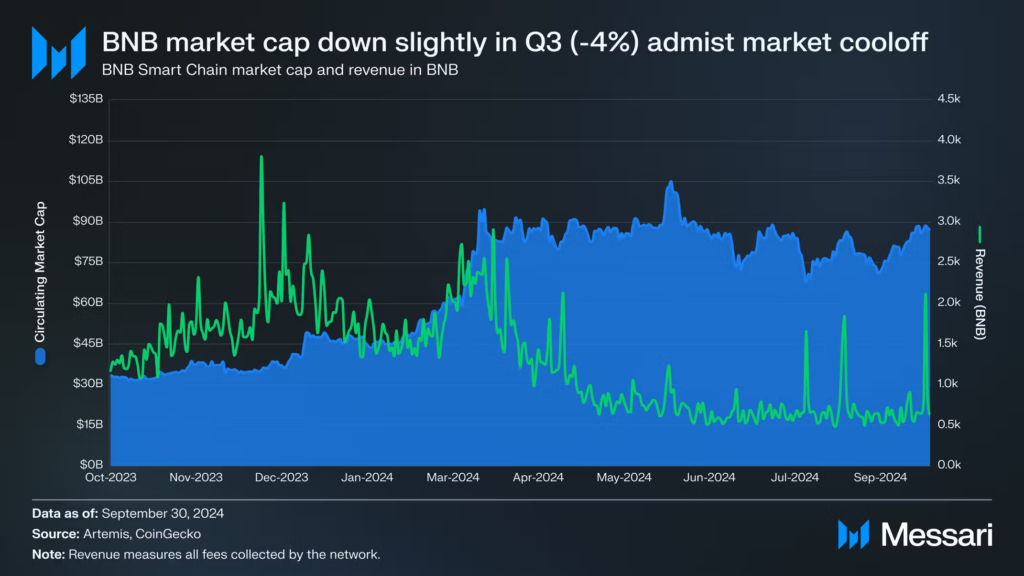

As per Messari’s report, while NFTs surged, BNB’s market cap decreased slightly by 4% QoQ, finishing Q3 at $82.79 billion. BNB trailed behind Ethereum (ETH) and Bitcoin (BTC) in market capitalization but slightly outperformed Bitcoin in terms of price stability.

Revenue for the network saw a decline, down 28% from $48.4 million in Q2 to $34.9 million. The biggest drop came from DeFi-related fees, which fell by 27%, though wallet-to-wallet transactions rose by 53%.

BNB’s deflationary supply mechanism continued, burning 1.6 million BNB in Q3, reducing the circulating supply to 145.9 million. This contributed to an annualized deflation rate of 4.5%, a 14% increase in QoQ.

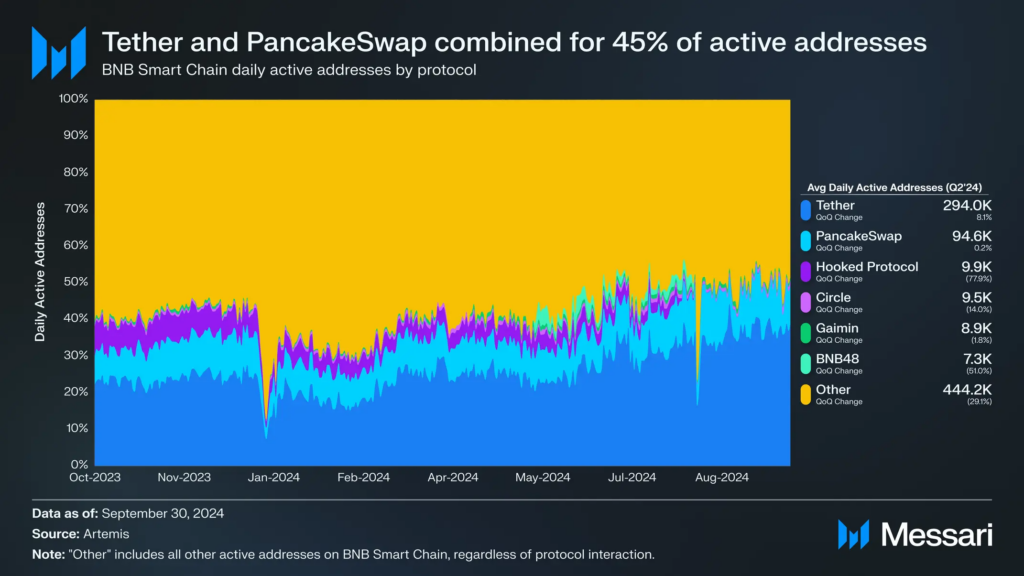

Tether and PancakeSwap lead BNB Chain transactions

On-chain activity slowed in Q3, with daily transactions dipping 8% and active addresses falling 19%. Tether (USDT) led transactions, accounting for nearly 20% of all activity, while PancakeSwap’s daily transactions fell by 14%.

BNB’s staked tokens rose by 7%, with a total of 32.4 million BNB staked, placing the network in the top three for dollar value staked. Meanwhile, DeFi protocols like Venus Finance saw growth, while PancakeSwap’s TVL dropped.

BNB Smart Chain’s Q3 developments signal a maturing ecosystem, though challenges like a drop in DEX volume and stablecoin market cap persist. Moving forward, innovations like the Gas-Free Carnival aim to boost adoption and transaction volume.

Related | DOGE eyes $0.18: A bullish signal for 10X returns?