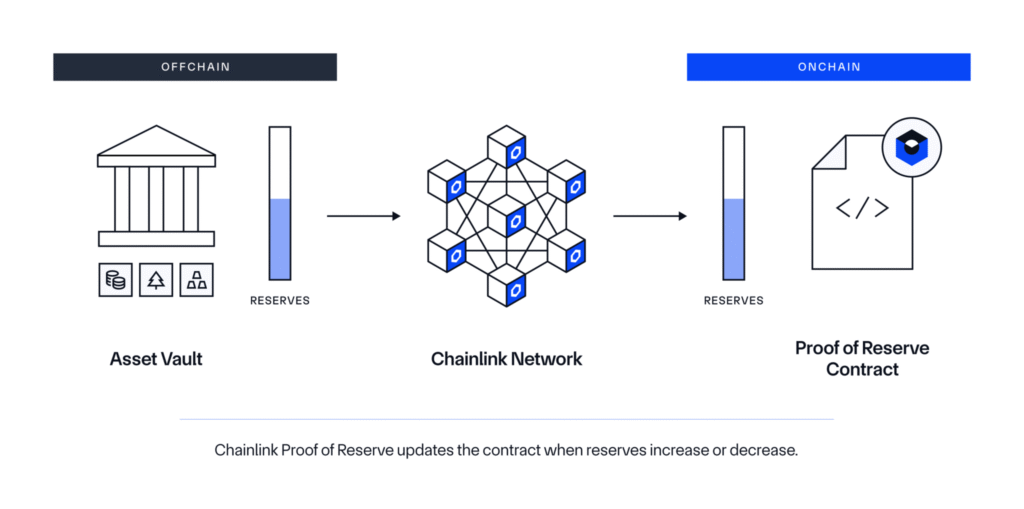

The shift of financial assets onto blockchain networks is gaining speed. Tokenized treasuries, stablecoins, and digital assets are moving trillions on-chain. In this evolving landscape, Chainlink plays a critical role by providing the real-time data infrastructure needed for constant visibility in the new financial environment.

Old strategies are obsolete. Reserve proof is essential. Quarterly checks and confirmations are how traditional audits are conducted. That approach is outdated for a real-time environment like blockchains. Proof of reserves is a superior approach.

It lets everyone, not just auditors, verify that real assets back every token. But not every solution provides genuine proof. Some only look trustworthy. Without strict standards, unfounded confidence can cause failure. To serve users and markets well, every system has to abide by a set of essential principles.

Proof must put data on public blockchains. It places information in an open state, allowing access. Users, authorities, and programmers are all capable of verifying the same facts. It avoids relying on private disclosures or assurances.

Chainlink tools must prove real-world readiness

Systems must deliver real-time reserve updates. Delaying updates creates large gaps that let bad actors exploit the system or cause asset losses. Real-time data closes those gaps and enables constant monitoring. Developers must protect the data using cryptographic techniques.

Independent actors must sign each reserve update. They verify the timing and content of the reported information. Once signed, no one can alter the update. Only independent players can authenticate the reserves, and they must have no affiliation with the companies they audit.

They need to obtain their information from trusted third-party sources and not from the issuer. The methodology underlying them must also demonstrate value. They must operate in actual financial systems and not in test beds. These systems have to be reliable, stable, and tested to operate in real-world stress.

Stablecoins and wrapped assets count too

Issuers must provide proof for each token they claim is backed. It is insufficient to test Bitcoin or Ethereum. Stablecoins, tokenized assets, and wrapped assets must pass the same test. All issuers and custodians must demonstrate reserves.

Whether they are holding money or issuing digital claims against money, they have to provide evidence. Nobody must work in the dark. With more digital finance developing, improved tools will ensue. Secure Mint ties token issuance to reserves.

Proof of Composition reveals what is inside reserves. Proof of Solvency establishes that companies can pay all debt. Trust is built on truth. And in a finance world where code is everything, only proof provides truth.