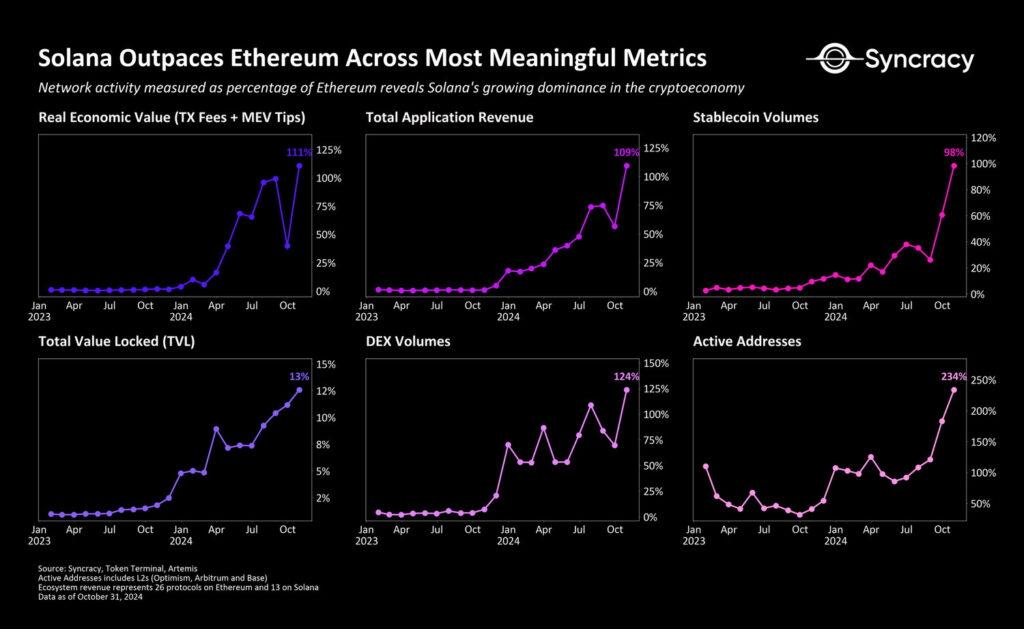

Solana is rapidly closing the gap with Ethereum in key metrics, showing a clear rise in market share in 2024. A report by Syncracy Capital, released on Nov. 12, reveals that Solana now competes with Ethereum across almost every major economic indicator.

In Q4 of 2023, Syncracy published a thesis on Solana, highlighting its potential despite being valued at just 13% of Ethereum’s market cap. At that time, Solana’s prospects were based on scalability, design, and developer interest.

However, the data now paints a clearer picture. Since the collapse of FTX and the rise of Bitcoin ETFs, Solana’s blockchain has seen a surge in activity. Its fast transactions, low costs, and mobile accessibility have made it the go-to for retail trading, DePIN, and payments.

Revenue from Solana applications surpasses Ethereum

Today, SOL trades at 33% of Ethereum’s valuation, up 18 times from its bear market low. As more users and applications flock to Solana, the network’s growing ecosystem is becoming a driving force. The on-chain economy is thriving, with SOL generating more revenue from applications than Ethereum for the first time.

Meanwhile, the platform’s DePIN sector is also gaining momentum. Projects like Hivemapper and Helium, backed by Solana, show the real value of decentralized networks. With such innovations, along with the general rise of the application ecosystem on Solana, they hint at one thing: that the blockchain is more than just a competitor to Ethereum.

Nevertheless, Solana is well-placed to gain ground as one of the largest participants in the crypto economy. Ethereum might still stay ahead in many ways, but nobody can neglect its rise. This gap in market capitalization and on-chain assets is more likely to shrink further when SOL advances its technical and decentralization roadmap.

Related | Italy plans tax overhaul for crypto, proposes 28% rate