Solana token, SOL, shot up by 35% between Nov. 5 and Nov. 11, hitting $222, its highest point since Dec. 2021. This spike has traders buzzing about whether SOL might reach its all-time high of $260 again, especially as Bitcoin recently crossed $89,500, fueled by steady support from institutional investors and hopes for clearer regulations in the U.S.

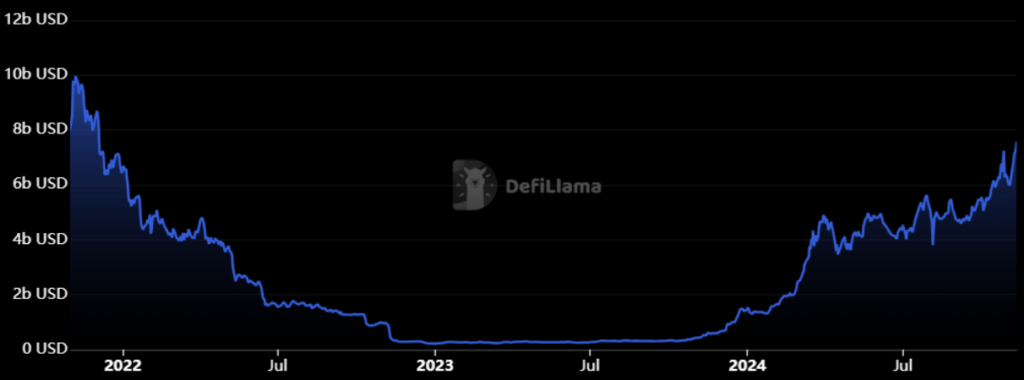

Solana has been outshining the wider altcoin market, which grew by 33% over a recent six-day period ending on Oct. 11. This surge in SOL’s value is partly driven by investor confidence, thanks to the growing activity in Solana’s smart contracts, as seen in the rising total value locked (TVL) on the network.

Solana’s total value locked (TVL) surged to $7.6 billion as of Nov. 10, reaching its highest level since Dec. 2021. Major decentralized applications (DApps) such as Jito, Raydium, Drift, and Binance’s liquid staking played a key role in driving a 36% increase in deposits.

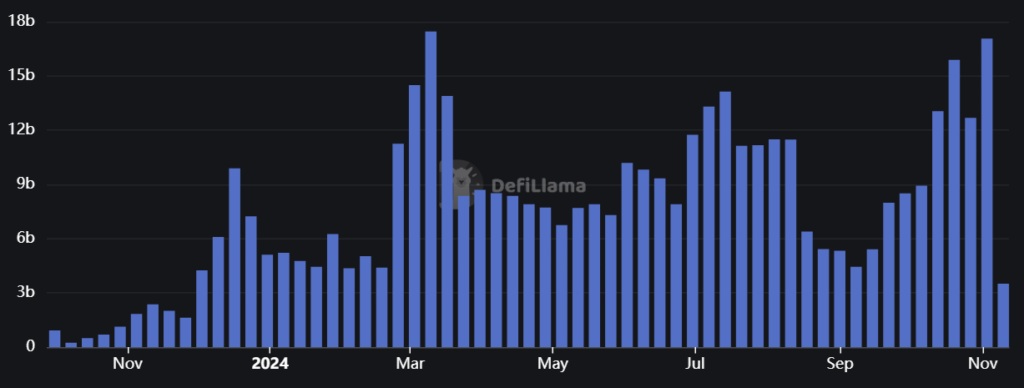

Solana outpaces Ethereum in DEX volume

Some valid concerns have been raised about Solana’s reliance on memecoins, such as Dogwifhat (WIF), Bonk (BONK), and Popcat (POPCAT), all of which have crossed the $1.5 billion market cap mark. Decentralized token launch platforms like Pump.fun have significantly boosted the trading volumes on Solana’s decentralized exchanges (DEX).

Solana saw a significant jump in weekly DEX volumes, reaching $17.1 billion on Nov. 2. This is the highest figure since Mar. 2024 and accounts for a 26% market share, even surpassing Ethereum, the top blockchain for decentralized apps (DApps). Additionally, Solana generated $88.2 million in monthly fees, a crucial amount for boosting the network’s security.

In comparison, the Ethereum network, with a total value locked (TVL) over seven times greater than Solana’s, generated $131.6 million in fees in just one month. Similarly, Tron, another blockchain focused on scalability, brought in $49.1 million in fees over the same period. These figures don’t account for additional ecosystem earnings, such as the $100.2 million from Jito and $83 million from Raydium.

Relying only on TVL (Total Value Locked) and fees to evaluate platforms can be misleading, as not every decentralized app (DApp) requires high volumes to be impactful. However, these factors are important for fostering adoption, attracting new users, and creating a foundation for long-term growth. This, in turn, drives the demand for SOL accumulation and usage.