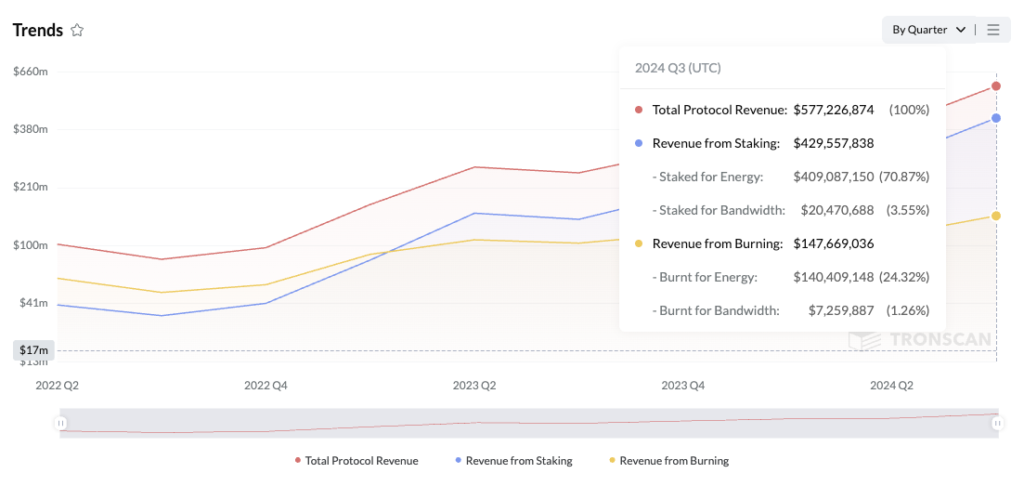

Tron Network achieved an impressive milestone in Q3, generating $577 million in revenue, surpassing well-known blockchains like Bitcoin and Ethereum in quarterly earnings. According to data from Tronscan, 74% of Tron’s revenue came from staking activities, while the remaining 26% was from token burns. Tron founder Justin Sun shared these figures in an Oct. 2 post on X (formerly Twitter).

Tron’s impressive quarterly performance was driven by increased stablecoin activity on the network and a recent move into the memecoin market. Data from Token Terminal shows that Tron’s total fees and revenue surpassed those of bigger networks like Bitcoin and Ethereum, which reported quarterly earnings of about $56.3 million and $256 million, respectively.

Tron dominates stablecoin market

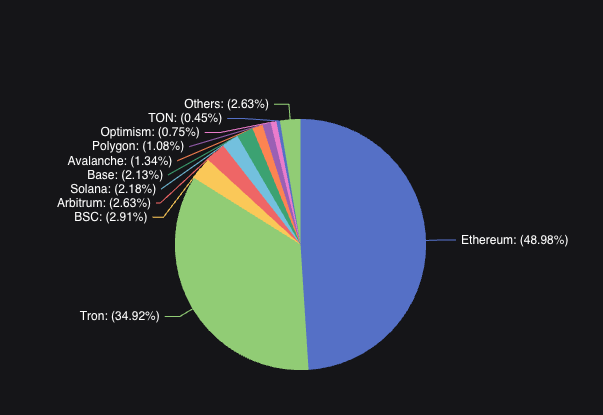

Different blockchain networks generate income in various ways, often involving a mix of fees and other technical methods. So, comparing them based solely on revenue or fees might not give the full picture of their total income. Currently, Tron is the second-largest blockchain for stablecoins after Ethereum, holding about 35% of the $172 billion stablecoin market, according to DefiLlama.

Tron has become a go-to network for users in emerging markets like South America and Africa, where inflation and unstable local currencies push people to seek more stable options, such as Tether, a US Dollar-pegged stablecoin. Additionally, Tether makes up 98.3% of all stablecoin deposits and activity on the Tron network.

SunPump, a knockoff of the Solana-based memecoin platform pump.fun, raked in $1 million in just 11 days after launching. Since its debut on Aug. 9, it has pulled in a total of $5.4 million. Meanwhile, Tron had a record-breaking day on Aug. 21, generating over $5.4 million in revenue within 24 hours. According to data from DefiLlama, this surge came right after Tether injected $1 billion worth of USDT into the ecosystem on Aug. 20.

Related | Bitwise files for XRP ETF amid Ripple’s legal battles