Blockchain infrastructure company, Digital Asset, has raised $135 million from investors including Goldman Sachs and Citadel.

According to a Tuesday announcement, Digital Asset has raised $135 million in a strategic funding round. The investment round was led by DRW Venture Capital and Tradeweb Markets, with participation from major financial institutions.

The institutions include Goldman Sachs, Citadel Securities, BNP Paribas, and the Depository Trust & Clearing Corporation.

Crypto-focused backers included Paxos, Polychain Capital, and Circle Ventures. Digital Asset said the funding will help boost the adoption of institutional and decentralized finance on its Canton Network.

Canton network’s RWA expansion

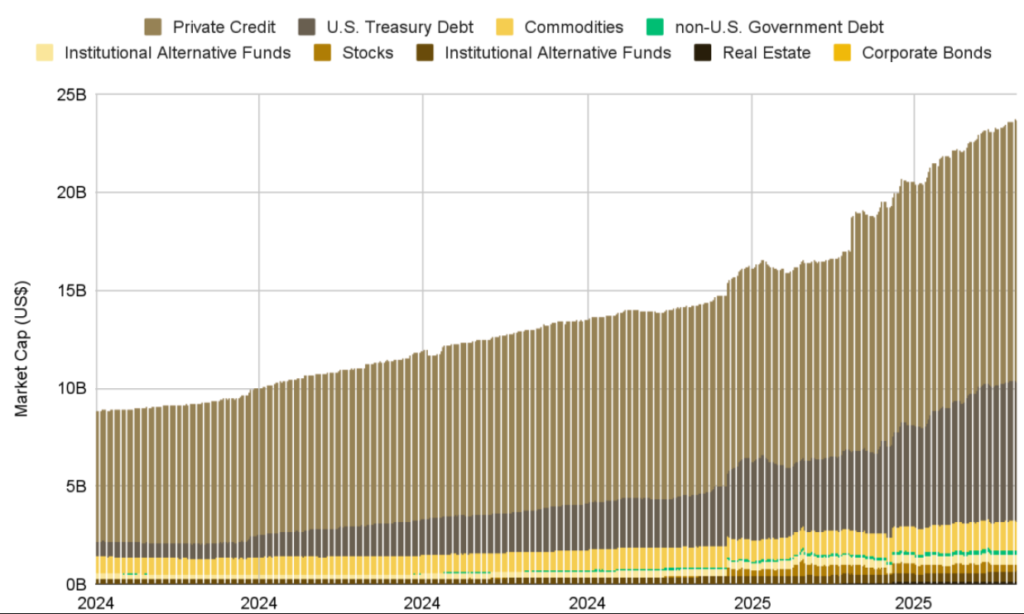

Canton Network is a public layer-1 blockchain that supports customizable privacy and meets institutional compliance standards. With the new funding, Digital Asset aims to expand billions of real-world assets (RWAs) onto the network.

Digital Asset and a group of companies, including Microsoft, Goldman Sachs, and Deloitte, introduced the Canton Network in May. 2023.

In Sept. 2024, Digital Asset and the Depository Trust & Clearing Corporation (DTCC) successfully completed their U.S. Treasury Collateral Network pilot on the Canton Network.

In early Oct. 2024, Digital Asset completed a major pilot project with Euroclear, the World Gold Council, and law firm Clifford Chance. As part of the initiative, gold and bonds, including Eurobonds and UK gilts, were turned into digital tokens on the Canton Network.

Institutions test Canton at scale

By mid-Mar. 2024, institutional investors had completed over 350 simulated transactions on the Canton Network. The trial used distributed ledger technology across areas like tokenized assets, fund registry, digital cash, repo, securities lending, and margin management.

The tests included 15 asset managers, 13 banks, four custodians, three exchanges, and Paxos. Digital Asset co-founder and CEO, Yuval Rooz, said:

Canton is already actively supporting numerous asset classes–from bonds to alternative funds–and this raise will accelerate onboarding even more real-world assets, finally making blockchain’s transformative promise an institutional-scale reality.