The number of domestic crypto asset investors has surged following the US presidential election, with clear data revealing the growth. Market enthusiasm grew after President-elect Donald Trump’s pledge to support the virtual asset industry.

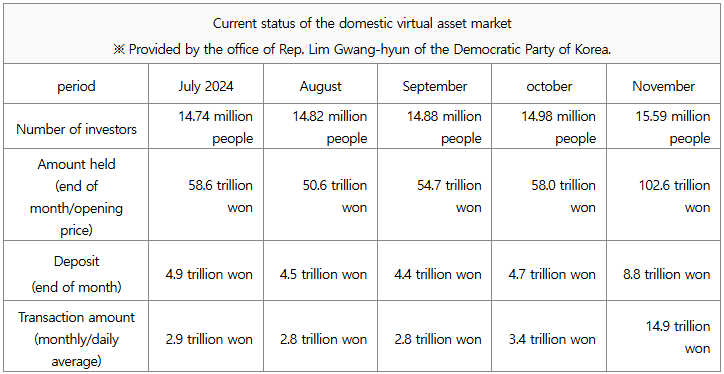

Data provided to Rep. by the Bank of Korea indicates that by the end of November, domestic virtual asset investors totaled 15. 59 million, according to Lim Gwang-hyun. In comparison to October, this represents a 610000 increase.

These numbers include accounts from the top five local exchanges: GOPAX, Korbit, Coinone, Bithumb, and Upbit. In this count, duplicate accounts from different exchanges were included. As a result of this increase, more than 30% of South Koreans, or roughly 51. 23 million people are now crypto investors.

Official information on investor numbers is provided by the Bank of Korea’s data, which was collected under the Virtual Asset User Protection Act, which went into effect in July. The number of investors increased by about 100000 per month between July and October.

When Bitcoin’s price surged from 105 million won at the end of October to 135.8 million won by the end of November the trend picked up speed. The total value of domestic virtual asset holdings reached 102. 6 trillion won by the end of the month.

Crypto deposits on exchanges hit new highs

By November, per-person holdings had increased from an average of 3.87 million won in October to 6.58 million won. This pattern was reflected in exchange deposits, which are money that is pending investment.

By November, they had increased from 4.7 trillion won in October to 8.8 trillion won. With daily averages hitting 14. 9 trillion won in November, trading volume skyrocketed. The KOSPI and KOSDAQ markets in South Korea saw daily trading volumes of 9. 92 trillion won and 6. 97 trillion won, respectively, during the same time period, but this amount exceeded those figures.

Rep. Lim emphasized how urgently the government must take strong action to guarantee stability and user protection in this quickly growing market. He emphasized the need for sensible regulations to protect investor interests and foster the expansion of the industry.