Binance will delist several stablecoins in the European Economic Area (EEA). This move aligns with the Markets in Crypto-Assets Regulation (MiCA). The affected stablecoins include USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG. MiCA-compliant stablecoins like USDC and EURI remain available.

Users should convert non-compliant stablecoins to USDC, EURI, or EUR. Custody services for non-compliant stablecoins will continue, and withdrawals and deposits of these assets will remain possible.

Binance promotions to encourage conversion

Binance offers promotions to encourage conversion, including zero fees and higher yields. Spot trading for non-compliant pairs will cease on March 31, 2025. Pending orders will be canceled within 48 hours.

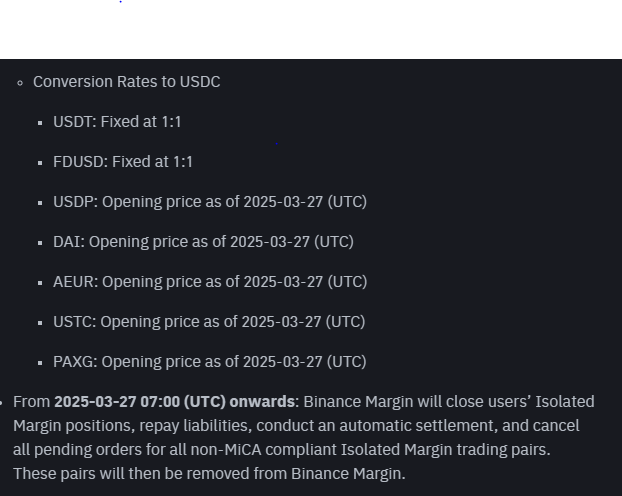

Margin trading will end on March 27, 2025. Binance will automatically convert the remaining non-compliant stablecoins to USDC. Users should convert their holdings before the deadline to avoid liquidation risks.

The company urges users to transfer non-compliant stablecoins in Earn products, collateral, and loans to MiCA-compliant options before March 31, 2025. After this date, non-compliant stablecoins will only be sellable via Binance Convert.

Binance trading bots service termination

Trading Bots for unauthorized stablecoins will stop on March 31, 2025. Users should cancel their bots to avoid potential losses. Regulated stablecoins like USDC will not face restrictions.

Banking Circle S.A. Users who issue EURI can redeem EURI at par value for EUR. Circle Internet Financial Europe SAS issues USDC. Holders can redeem USDC at any time at par value. Binance may change or cancel this announcement without notice.

Investing in digital assets carries risks. Prices can fluctuate, and investors may lose money. Binance does not offer financial advice and accepts no liability for investment losses. Users should assess their risk tolerance before investing.