Coinbase is on track for a major earnings boost. Digital asset researcher Coin Metrics predicts the crypto exchange will report $2 billion in revenue for Q4 2024. If accurate, this marks a 109% year-over-year increase and a 65% rise from the previous quarter. The official earnings report is set for release on Feb 13.

The surge comes amid renewed optimism in the crypto sector. Donald Trump’s election victory helped fuel the rally, bringing heightened activity across both retail and institutional markets. Coinbase, the only major publicly traded crypto exchange in the U.S., is in a prime position to capitalize on this momentum. With expectations of a friendlier regulatory climate and a potential wave of crypto IPOs, competition is heating up.

Analysts expect Coinbase to outperform revenue forecasts

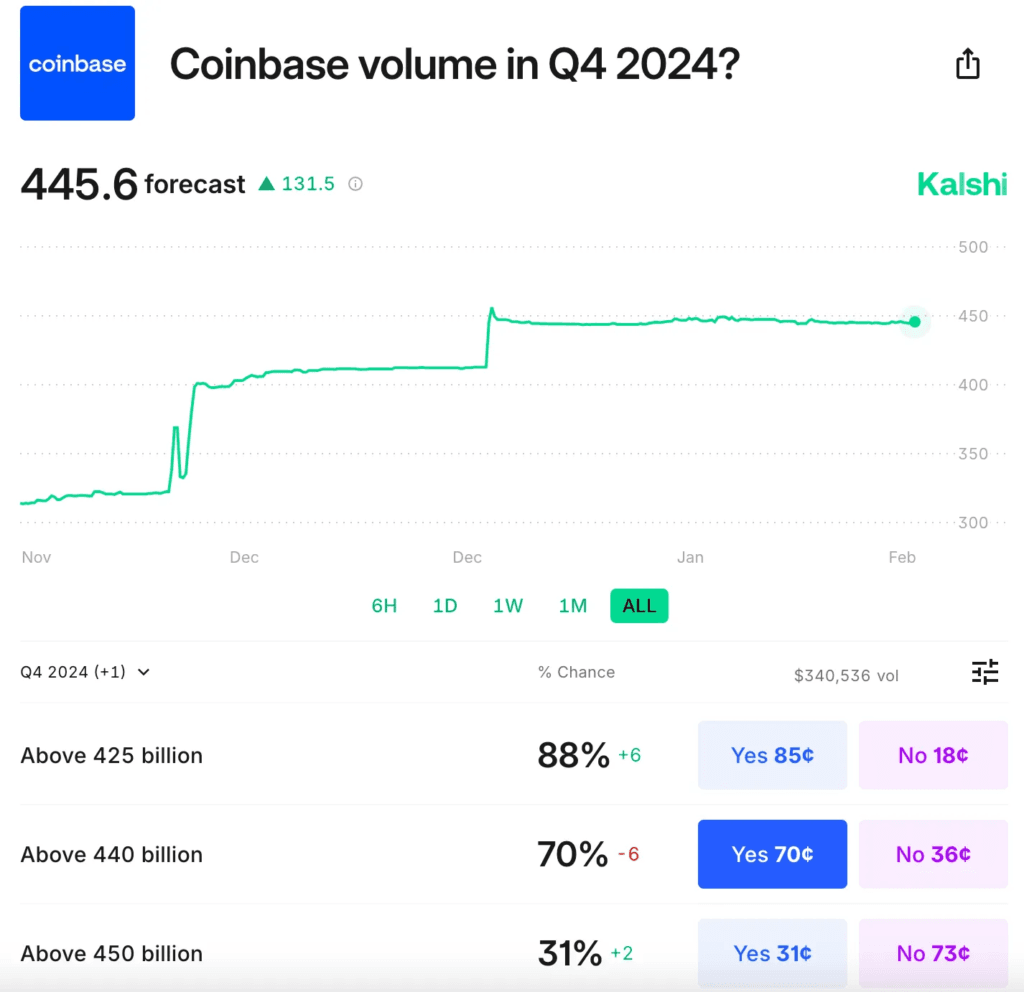

Analysts forecast revenue at $1.59 billion, but Coin Metrics believes Coinbase will surpass that figure. Transaction revenue remains a key driver, supported by increased consumer and institutional trading. Quarterly trading volume is projected at $440 billion, up 140% from Q3. Consumer trading should contribute $1.3 billion, while institutional trading is expected to generate $102 million.

Coinbase’s Layer-2 network, Base, is also adding to its bottom line. Base generated $26.36 million in revenue in Q4, with profit margins of 45% to 100%. Rising settlement costs eroded profitability later in the quarter, but overall, the network is a good revenue source.

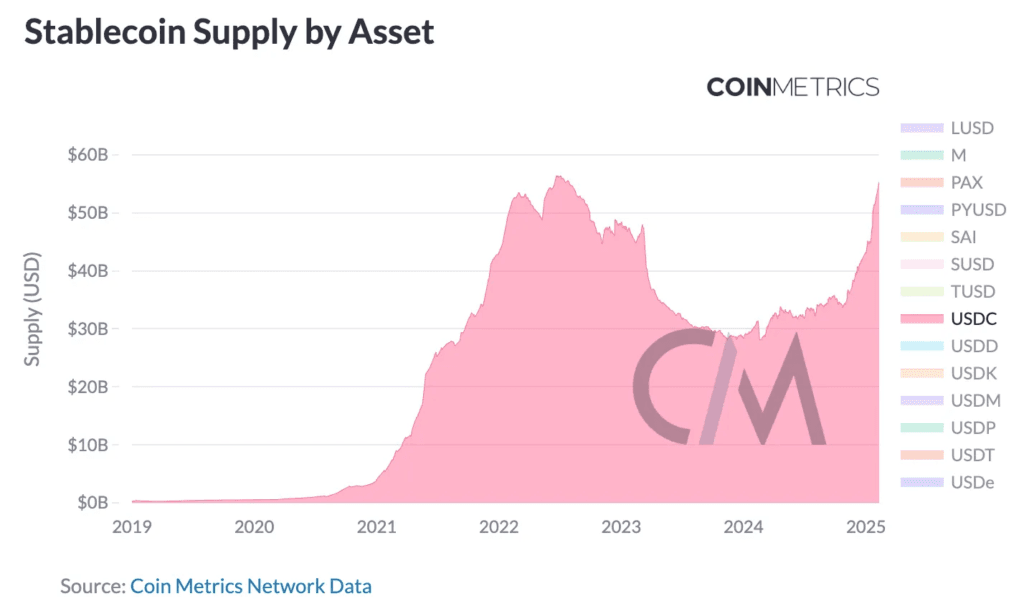

Subscriptions and services revenue is also holding steady, with stablecoin revenue and blockchain rewards playing a significant part. USDC supply grew by 23% in Q4, which bumped up Coinbase’s revenue from interest income. Custodial fee revenue is also growing as a result of Bitcoin ETF adoption and the rise in asset balances.

Nevertheless, Coinbase is hitting its stride. With multiple sources of revenue and a dominant market position, the firm is positioned for long-term expansion. Crypto adoption is expanding, and Coinbase is at the forefront, driving the industry forward.