According to warnings from the Bank for International Settlements (BIS) regarding crypto and decentralized finance (DeFi), a critical point has been reached. The BIS released its Apr. 15 report showing that financial stability risks have risen, and the market gap has grown while many investors enter digital asset markets. The situation needs immediate regulatory intervention because safe and equitable markets require it.

Stablecoins demand stricter oversight

Stablecoins function as the main instruments in the crypto ecosystem by digitally connecting their value to fiat currencies. According to the BIS, regulators need to establish clear guidelines for reserve management and redemption procedures. When the market is unstable, user confidence may break, generating a massive panic.

Governments are beginning to respond. On Apr. 2, the STABLE Act received House Financial Services Committee approval to boost stablecoin transparency alongside consumer security measures. The Senate Banking Committee supported the GENIUS Act through its approval on Mar. 13, which specified stability requirements for stablecoin issuers.

DeFi and Wealth gaps pose long-term threats

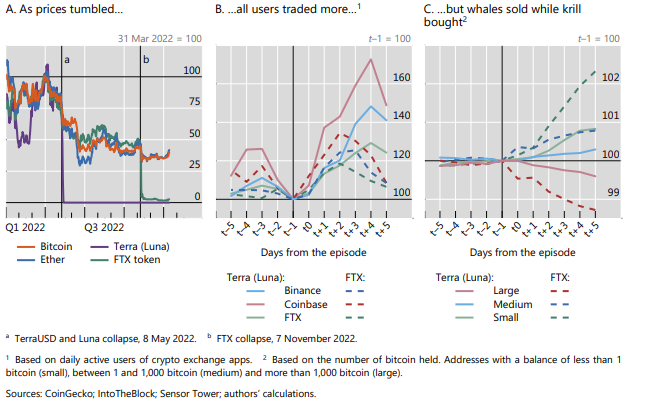

The BIS report predicts that crypto markets will contribute to a poorer distribution of wealth between different social classes. Whales among large investors tend to profit through their power over retail traders. Every day, investors remained invested in FTX assets throughout 2022 while whales took advantage of early sell-offs during the collapse.

The challenge becomes more complex through the introduction of DeFi. The combination of traditional financial characteristics with smart contracts and high network connections creates fresh security loopholes for this system. Failure propagation in the system becomes explosive when oversight functions are absent because platform vulnerabilities spread rapidly.

Crypto’s recent surge presents combined chances for benefits along with threats. According to the BIS, proper regulation must not trail behind technological development. Stablecoins need strict standards. DeFi needs smarter oversight. Retail investors need to acquire safeguards from expanding financial inequality. Regulators globally need to cooperate urgently through decisive measures that prevent upcoming systematic disruptions from becoming out of control.