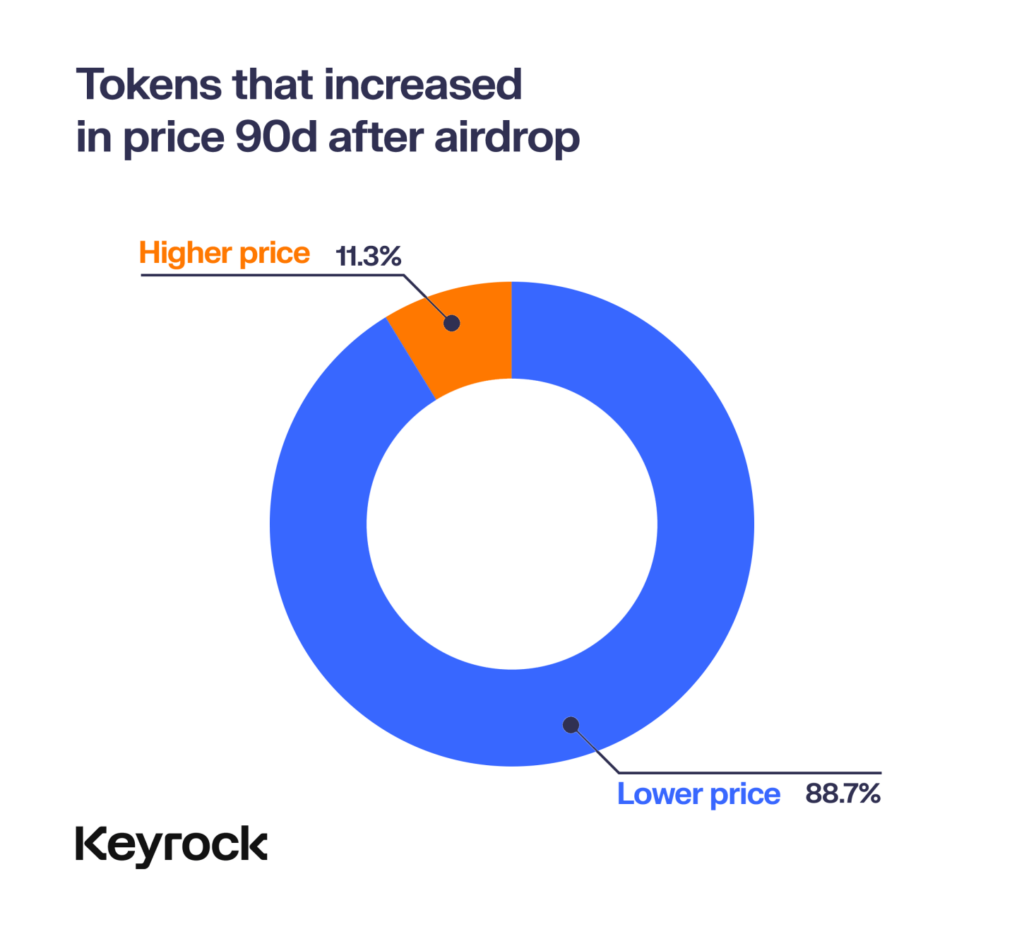

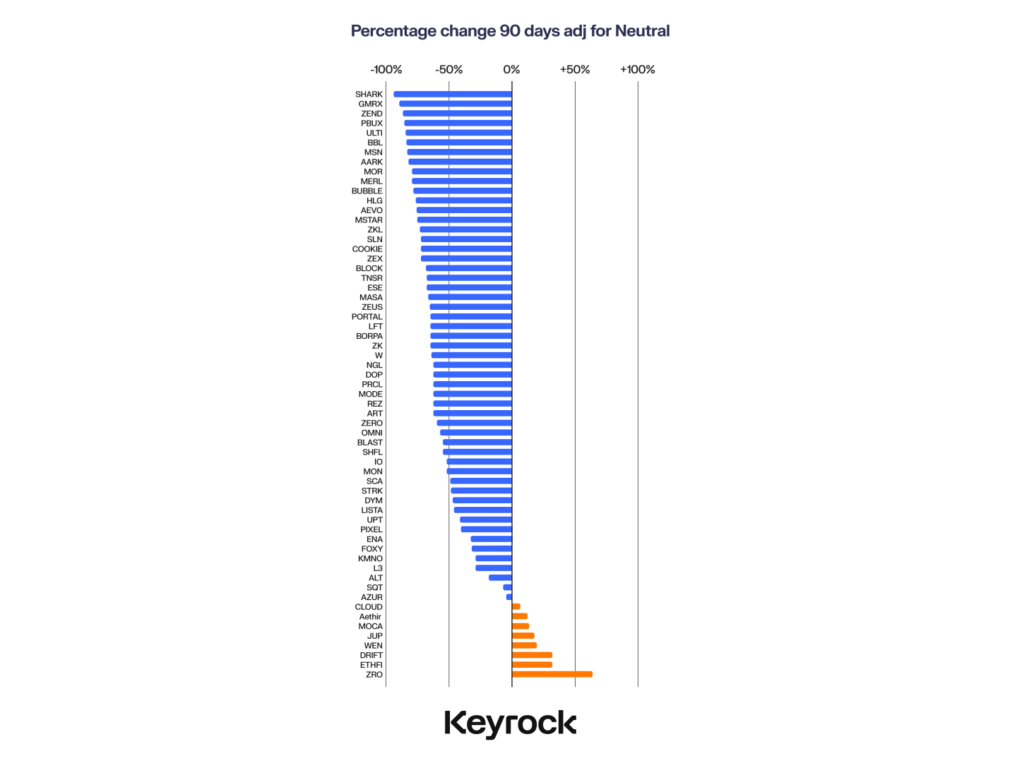

According to a new analysis by Keyrock, crypto airdrop performance in 2024 has largely disappointed. Out of 62 airdrops evaluated, only 8 showed positive returns after 90 days.

Tokens launched with high Fully Diluted Valuation (FDV) suffered the worst price declines. It indicates a trend where inflated valuations and inadequate liquidity make it challenging for new projects to succeed.

Among many, Drift came out to be one of the few winners launched with a mere $56 million FDV. On the other hand, ZKLend declines 95%, due to the risks of overhype with no type of liquidity or user retention strategies put in place.

This is because the airdrop has been put in circulation since 2017 to stir interest in a new project. Still, due to market saturation in the crypto world by 2024, that tends not to be so successful now.

While airdrops still generate early excitement, most have struggled with user retention. The initial hype tends to result in sell-offs, leaving many projects abandoned shortly after launch.

Crypto market conditions pose challenges for airdrops.

Keyrock also underlines in the report that though successful airdrops are possible if treated properly. However, the current crypto market environment is substantially adverse to this.

Among the 62 analyzed airdrops, Ethereum and Solana emerged as the only blockchains with notable successes, each hosting four tokens with positive returns. In regard to performance consistency, Solana owes this to a strong retail base, while other chains like BNB and Arbitrum had no standout projects.

The report also pointed to the strategies of token distribution as a key success factor. Smaller airdrops often tend to perform better in the short run, while larger distributions help create better post-listing performance.

Overly generous token allocations tend to draw in more engaged participants. Meanwhile, projects with greatly inflated FDVs are most likely to face harsh price drops due to a lack of liquidity and sell pressure.

Related | SEC appeals Ripple court decision