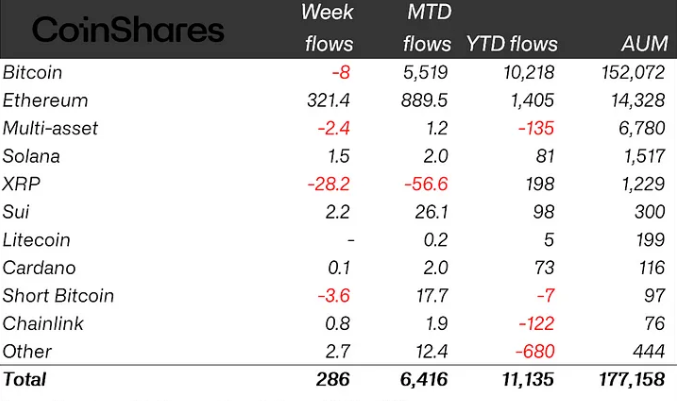

Crypto investment products maintained attracting funds last week despite significant selling pressure caused by Bitcoin’s drop to $103,000. Global crypto exchange-traded products (ETPs) saw $286 million in inflows during the week ending May. 30. This brings total inflows over the past seven weeks to $10.9 billion, according to a June 2 report from CoinShares.

Despite the inflows, total assets under management (AUM) fell from a record high of $187 billion to $177 billion by the weekend, as market volatility driven by uncertainty over U.S. tariffs, said James Butterfill, head of research at CoinShares.

Bitcoin saw a drop of around 6%. It dropped from $110,000 last Monday to a low of $103,400 by May. 30, according to CoinGecko.

Ether ETPs dominate with $321M inflows

Ether ETPs led crypto ETP buying last week with $321 million in inflows, marking the strongest run since late Dec. 2024 and showing a clear boost in investor sentiment.

Butterfill said that Bitcoin ETPs saw $8 million in outflows after a major shift following a New York court ruling that declared US tariffs illegal. XRP investment products saw the biggest withdrawals last week, totaling $28 million.

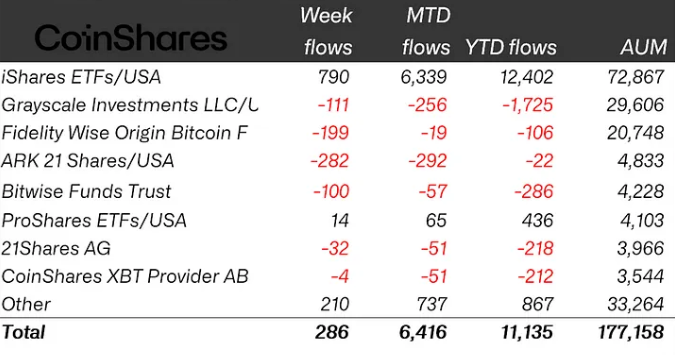

The outflows marked the second consecutive week of XRP losses. BlackRock’s iShares ETFs saw the biggest inflows among issuers last week, despite large outflows from Bitcoin ETFs at the week’s end.

iShares tops ETF inflows despite BTC ETPs outflows

According to CoinShares, iShares ETFs received $790 million in new investments. The investments pushed the total inflows this year up to $12.4 billion. Meanwhile, iShares’ assets under management dropped from $74.8 billion the previous week to $72.9 billion last week, due to a decline in Bitcoin ETFs.

ARK Invest and 21Shares’ crypto investment products faced the largest losses among issuers last week. It fell by $282 million resulting in a total outflow of $22 million year-to-date.

The flow reversal in Bitcoin ETPs follows six weeks of strong inflows, with the recent losses linked to various factors that contributed to last week’s overall crypto market decline.