The crypto market last week was hit hard, as investors reacted to stronger-than-expected economic data from the United States, which now makes it less likely that there will be a 50 basis point interest rate cut.

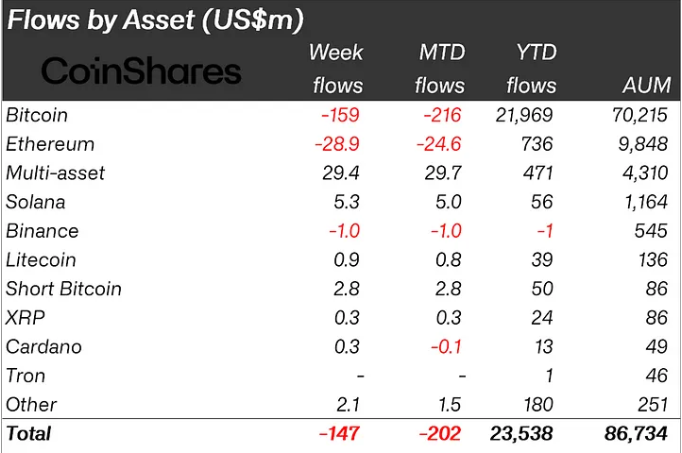

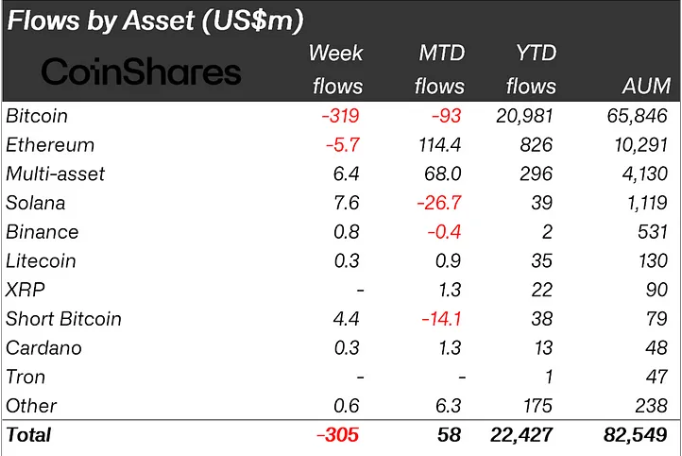

As per the Coinshares Digital Asset Fund Flows Weekly Report released on Sep. 2, digital asset investment products experienced outflows of a total of $305 million. The report mentions “widespread negative sentiment” as the reason for this among providers and regions.

The U.S. market accounted for the largest outflows, with $318 million leaving the crypto ecosystem. Other providers include Germany and Sweden, which also reported smaller outflows of $7.3 million and $4.3 million, respectively. In contrast, Switzerland and Canada saw minor inflows of $5.5 million and $13 million, respectively.

Mixed sentiment in crypto market: BTC outflows vs. SOL inflows

Despite Bitcoin market in general being positive, the negative BTC sentiment attracts over $319 million outflows. Nevertheless, decreasing Bitcoin short investment products, which a two-week period of inflows up to $4.4 million is the longest since March.

ETH also lost funds of $5.7 million. While trading volumes remained at only 15% of the levels recorded during the U.S. ETF launch week, which was similar to the pre-launch volume levels. In contrast, Solana got back $7.6 million in inflows. Remarkably, the blockchain equities in particular, those Bitcoin miner focused investments, inoculated $11 million into the overall negative sentiment.

The report indicates that the cryptocurrency market is becoming more reactive to the interest rate expectations as the Federal Reserve is getting closer to the possibility of changing its monetary policy.

The delicate balance of taming inflation and supporting economic growth is being navigated by the Federal Reserve, and as such, the crypto market is expected toremain volatile with investors closely monitoring the central bank’s decisions and their impact on the broader financial landscape.

Related | SEC warns on FTX creditor payments