Crypto market has witnessed a breathtaking losses from hacks and scams in street 2024, as per the latest report of blockchain security firm Immunefi. A 15.5% rise in the figures for the same period last year has led to fear that digital assets are not safe.

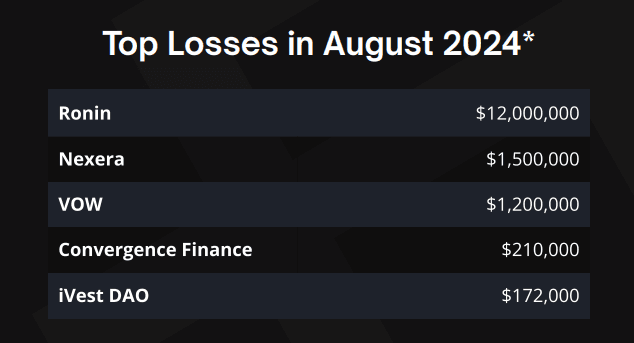

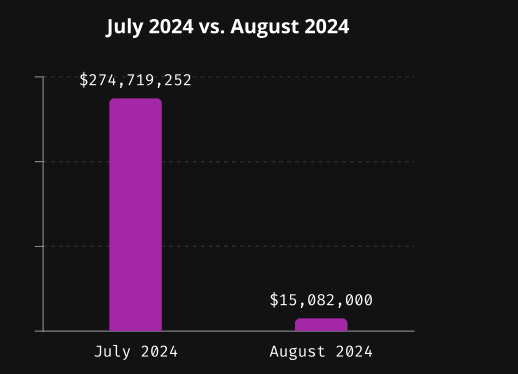

As per the report, August saw a reprieve as the total losses amounted to $15 million from five cases. It was the lowest monthly figure for this year. Two projects were the main targets of the attacks. First, a gaming-focused Ronin Network lost $12 million, other DeFi protocol Nexera lost $1.5 million.

The report brings out the point that the change in criminal goals specifically highlights that the prime target is now DeFi platforms. All five of the August attacks were directed at the DeFi projects, thus, contributing to 100% of the month’s losses. Such a trend indicates the increasing intelligence of cybercriminals in taking advantage of the vulnerabilities in smart contracts and decentralized protocols.

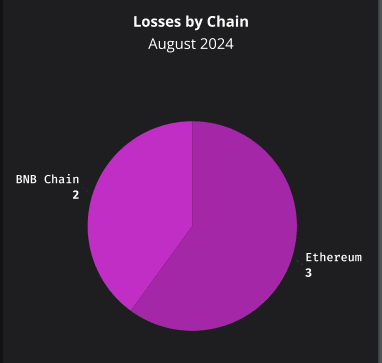

Ethereum and BNB Chain were the two most vulnerable crypto networks. 60% of the attacks in August was on Ethereum and the remaining 40% on BNB Chain. The fact that a lot of these attacks come from the same chains means that the hackers are going for the platforms that have the most money locked.

Year-to-date losses highlight the vulnerability of crypto assets

Though the loss of $15 million in August is clearly a huge decrease from the loss of $274 million in July, the year-to-date total of $1.2 billion across 154 incidents yields a rather grim picture. May remains the costliest month with over $358 million stolen.

large-scale attacks hypnosis not only questions but also the readiness of the crypto industry for mainstream adoption. As finance and big tech firms aim at blockchain integration, the security of the digital assets still remains the main challenge.

Experts say that the tech itself is solid, but the human being makes mistakes and the code is not well checked which often causes vulnerabilities. The response from the industry is the above-mentioned security audits as well as the bug bounty programs, but the cat-and-mouse game between developers and hackers continues.

Even though there are many challenges confronting it, the blockchain supporters argue that the transparent nature of the blockchain along with the financial inclusion are the advantages of the blockchain technology.

Nevertheless, the forthcoming months will probably be the time of heightened actions for the ensuring safety measures, the industry is looking for a way to combine innovation and the user’s rights protection to gain wider acceptance.

Related | Ethereum ETFs see $5.84M inflows; Bitcoin funds struggle