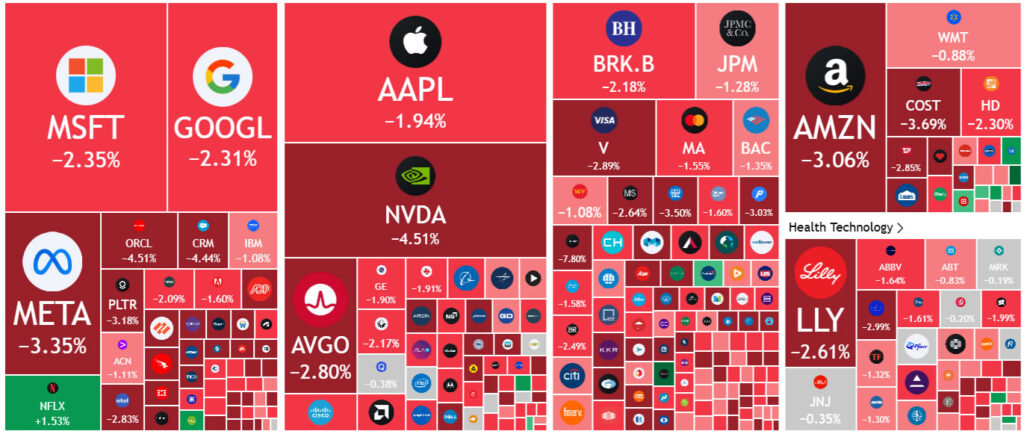

The cryptocurrency market held steady despite the latest salvo sparked by US President Donald Trump’s latest criticism of Federal Reserve Chair Jerome Powell. While the US stock market dipped and the dollar continued to weaken due to growing uncertainty. Stock markets in the United States closed lower on Apr. 21. The S&P 500 fell by 2.4%, the tech-heavy Nasdaq was down 2.5%, and the Dow Jones lost 2.5%, which is almost a 1,000-point decline, according to Google Finance.

The S&P 500 has now dropped over 12% since the start of the year, while the Nasdaq has fallen nearly 18%, reflecting a major pullback in US tech stocks. The stock slide decline follows rising tensions between Donald Trump and Jerome Powell and growing concerns over the effects of trade tariffs. Trump wrote on his social media platform Truth Social, on Apr. 21.

With Energy Costs way down, food prices […] substantially lower, and most other ‘things’ trending down, there is virtually No Inflation.

US Dollar devaluation continues amid Fed uncertainty

Trump has once again pushed for lowering interest rates, criticizing Powell for keeping them high at 4.5%. The POTUS has called Powell “Mr. Too Late” and a “major loser” over his decisions. Last week, Powell criticized Trump’s trade tariffs, saying that they could lead to a risky economic situation with rising prices and slowing growth, what some call “stagflation.”

Trump quickly fired back, suggesting Powell should be removed from his position, saying that his “termination can’t come fast enough. The Fed is likely to maintain its wait-and-see approach at the meeting on May. 7. According to CME FedWatch, there’s only a 13% chance of a rate cut.

The US Dollar Index (DXY), which tracks the dollar’s strength against a group of major currencies, has dropped over 10% this year. As of Apr. 21, it hit a three-year low, falling below 98, according to TradingView.